Crypto: Bittensor Jumps 10% After Grayscale Launches GTAO

The crypto market is experiencing a new rebound with the launch of the Grayscale Bittensor Trust (GTAO), propelling the Bittensor TAO token to a spectacular 10% increase. This event marks a turning point for decentralized AI, attracting the attention of institutional investors.

In brief

- Grayscale launches the Grayscale Bittensor Trust (GTAO), offering regulated exposure to TAO and boosting its credibility with institutions.

- TAO jumps 10% thanks to the GTAO and halving, with a market cap exceeding 2.8 billion dollars.

- Bittensor stands out from Bitcoin by betting on decentralized AI, a rapidly expanding sector.

The Grayscale Bittensor Trust (GTAO): a first institutional step for decentralized AI

A few days after filing an S-1 form with the SEC for a Bittensor ETF, Grayscale officially launched the Grayscale Bittensor Trust (GTAO) on the OTC markets on January 6, 2026. Under the ticker GTAO, this product allows investors to obtain regulated exposure to the TAO crypto token without having to hold the asset directly. With 0.0192 TAO per share and an expense ratio of 2.5%, the Trust has a net asset value of 7.96 dollars per share.

This initiative is part of a strategy aimed at attracting institutional investors by offering them a secure and familiar structure, similar to existing Grayscale products like GBTC. A step that could pave the way for broader adoption of decentralized technologies, especially in artificial intelligence. For Grayscale, the goal is to democratize access to innovative crypto assets like TAO while meeting regulatory requirements.

Crypto: 10% rise of Bittensor (TAO) driven by Grayscale

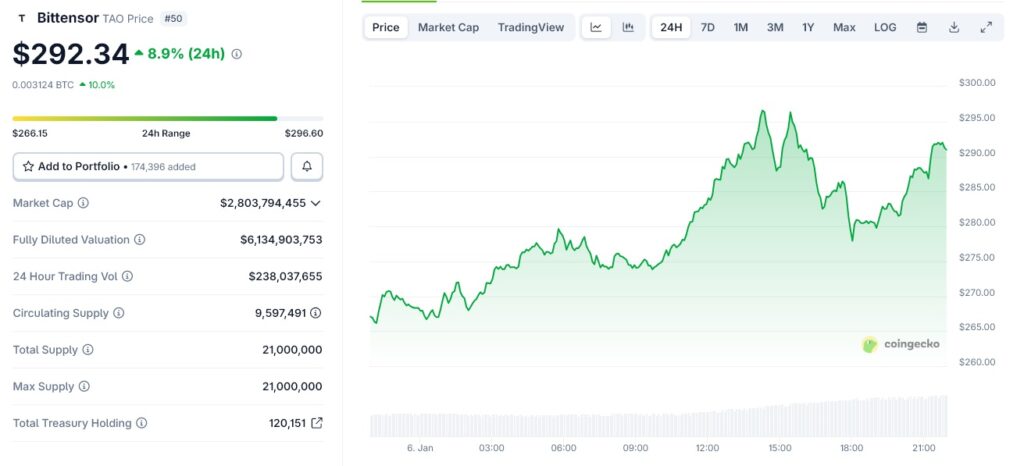

On January 6, 2026, the Bittensor TAO token recorded a nearly 10% increase, surpassing 290 dollars, with a 24-hour trading volume exceeding 230 million dollars. This performance is largely explained by the announcement of the GTAO launch, which stimulated institutional demand. Moreover, TAO’s market capitalization now stands at about 2.8 billion dollars with a circulating supply of 9.5 million tokens.

Another key factor in this rise is the Bittensor halving that occurred in December 2025, which cut daily TAO emissions in half, from 7,200 to 3,600 tokens per day. This supply reduction increased the crypto’s scarcity, a mechanism inspired by Bitcoin, and helped support its price. Additionally, Bittensor subnets, like Targon, play a crucial role by generating significant annual revenues, demonstrating the network’s concrete utility.

Bittensor vs Bitcoin: two disruptive crypto models

Bittensor and Bitcoin share similarities, such as their halving mechanisms to control inflation and create scarcity. However, their ambitions differ radically. Bitcoin is primarily a decentralized store of value, while TAO is a utility crypto token at the heart of a collaborative AI ecosystem. In the latter, contributors are rewarded in TAO for services like computing or validating AI models.

Thus, analysts believe that TAO, currently undervalued, could reach 1,000 dollars in the long term. This outlook attracts more and more investors, who see in Bittensor a promising alternative to centralized AI giants. The combined effect of Grayscale and the halving creates a favorable environment for growth while reinforcing market participants’ confidence in this crypto project’s potential.

The launch of the GTAO and the 10% rise of TAO confirm the growing interest in cryptos related to AI. However, challenges remain, especially on regulatory and technological fronts. One question remains: will these innovations manage to compete with traditional giants?

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

The world is evolving and adaptation is the best weapon to survive in this undulating universe. Originally a crypto community manager, I am interested in anything that is directly or indirectly related to blockchain and its derivatives. To share my experience and promote a field that I am passionate about, nothing is better than writing informative and relaxed articles.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.