Crypto Cards Beat Banks On Payments Of Less Than €10 In Europe

Crypto cards are now competing with traditional banks for everyday purchases in Europe. With nearly half of transactions under $12, these new payment tools are transforming spending habits. A silent revolution that is redefining the future of European payments.

In Brief

- 45% of crypto card transactions in Europe are under 10 € according to CEX.IO.

- Online payments via crypto card occur twice as often as those by banks.

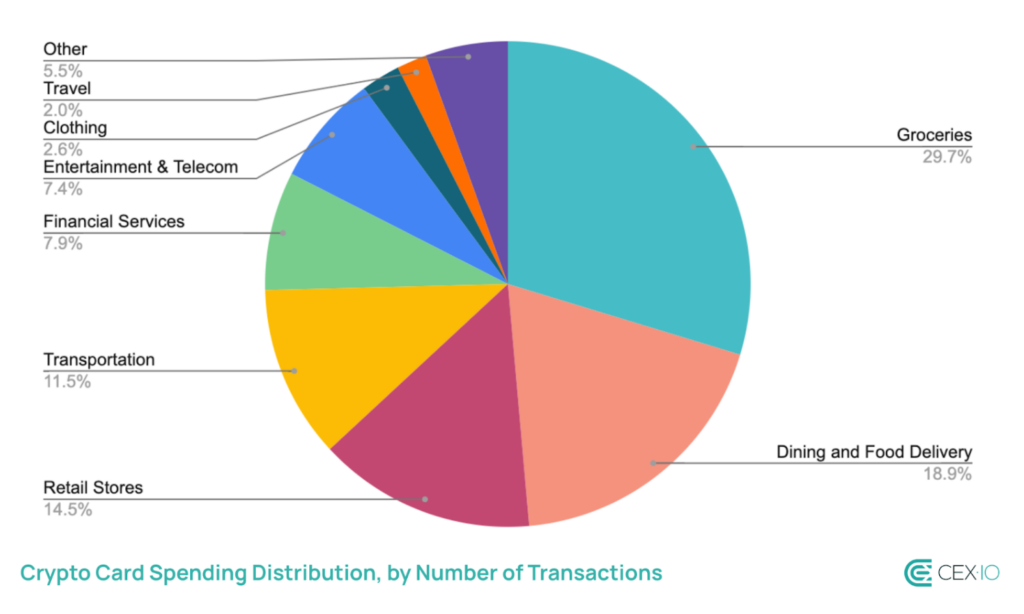

- Daily usage is booming: grocery (59%), dining (19%), transport, etc.

- Stablecoins dominate with 73% of transactions, but bitcoin, ETH, and SOL remain well represented.

Crypto cards establish themselves in everyday spending in Europe

Europe is witnessing a major transformation in its payment habits. According to an exclusive report from CEX.IO shared with Cointelegraph, crypto cards are now establishing themselves as serious competitors to traditional banks for small daily purchases. This evolution marks a decisive turning point in the European financial ecosystem.

Moreover, the figures speak for themselves: 45% of crypto card transactions are under 10 euros, a category historically dominated by cash.

This remarkable performance demonstrates that Europeans no longer hesitate to use their digital assets for their smallest purchases, whether it is a coffee, a newspaper, or a transit ticket.

The enthusiasm is also measured by the spectacular growth in new subscriptions. CEX.IO records a 15% increase in crypto card orders across Europe in 2025, signaling a growing interest in this payment technology.

This trend reveals a profound change in the perception of cryptos.

What we observe in Europe is that crypto card users are not just experimenting with new technologies: they are showing us what daily spending might look like in a truly cashless future.

Alexandr Kerya, Vice President of Product Management at CEX.IO

Spending habits that challenge banking standards

Crypto card holders are also revolutionizing online purchases. While the European Central Bank counts 21% of card payments made online in the euro zone, crypto card users already conduct 40% of their transactions online. This statistic perfectly illustrates the pioneering spirit of this user community.

Spending analysis reveals fascinating behaviors. Indeed, grocery products account for 59% of purchases with crypto cards, a figure close to the ECB reference of 54%.

Moreover, restaurants and bars capture 19% of transactions, surpassing the traditional average of in-store dining expenses. These data confirm that crypto cards naturally integrate into European consumption habits.

The blockchain technology underlying these cards offers an unprecedented diversity of payment methods. Stablecoins dominate with 73% of transactions, ensuring a value stability appreciated by consumers.

Bitcoin, Ethereum, Litecoin, and Solana complete this array, allowing users to spend their crypto investments directly on groceries, meals, or transportation.

This flexibility contrasts with restrictions imposed by some traditional banks. Barclays has just announced the ban on crypto transactions on its Barclaycard credit cards, citing risks related to market volatility and lack of investor protection.

This defensive stance illustrates the growing gap between European crypto innovation and traditional banking resistance.

In short, Europe is writing a new chapter in its financial history with the rise of crypto cards. This micro-payment revolution goes beyond a mere technological gadget to become a genuine societal phenomenon. While traditional banks still hesitate, Europeans are already charting the path towards a future of decentralized and digital finance.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Passionné par le Bitcoin, j'aime explorer les méandres de la blockchain et des cryptos et je partage mes découvertes avec la communauté. Mon rêve est de vivre dans un monde où la vie privée et la liberté financière sont garanties pour tous, et je crois fermement que Bitcoin est l'outil qui peut rendre cela possible.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.