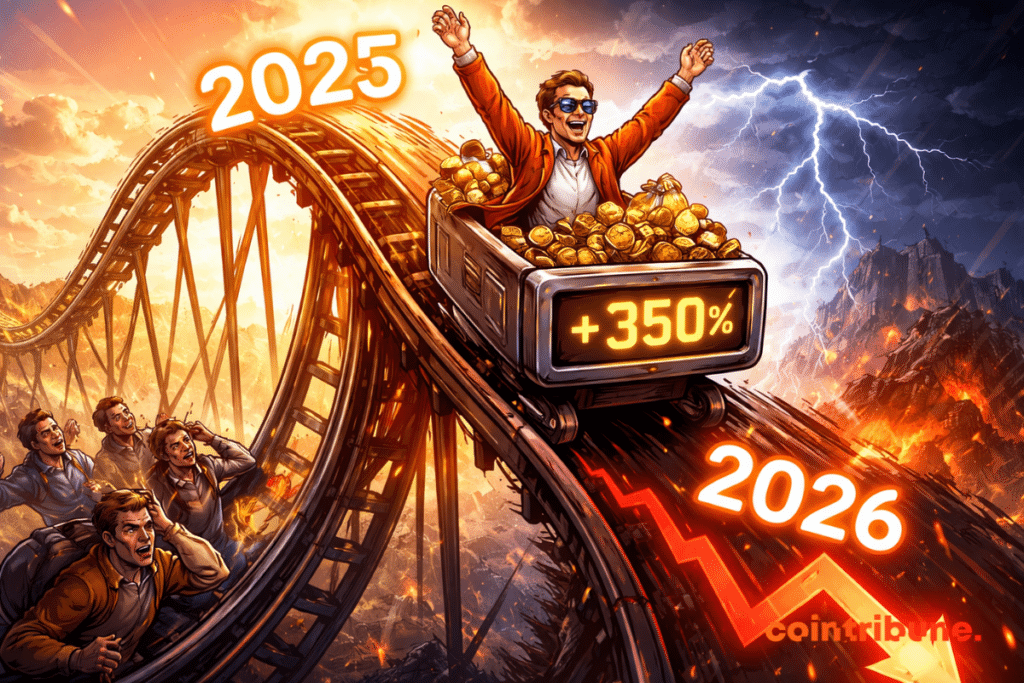

Crypto: CTAs Surge in 2025, Risk a Collapse in 2026

We have seen louder trends pass by, but rarely such a corporate trend. In 2025, the CTAs, those companies that put Bitcoin or other crypto-assets at the heart of their treasury, multiplied at an almost suspicious speed. And already, some crypto sector leaders talk about 2026 as a narrow corridor where many will not pass.

In Brief

- CTAs exploded in 2025 by turning Bitcoin into a treasury showcase, but the model already shows its flaws as soon as the price wobbles.

- In 2026, many risk being ousted at the first real drawdown, especially those accumulating without strategy or discipline.

- To survive, CTAs will have to move from storytelling to yield and professional infrastructure, while facing competition from crypto ETFs.

The Rush to Crypto Treasury, Corporate Version

The figure is brutal and tells everything. According to Ryan Chow from Solv Protocol, we went from about 70 companies buying and holding Bitcoin in early 2025 to more than 130 by mid-year. A growth resembling a frenzy, not cautious adoption.

Why this frenzy? Because a balance sheet boosted by Bitcoin is alluring. It grabs attention. It simplifies storytelling. “We accumulate,” period. Except a narrative, no matter how well-packaged, does not replace a treasury strategy.

And that’s precisely where the crack appears. The cited leaders describe a mechanism under pressure. When the price wobbles, the actions of these players sway, and the crypto model becomes more fragile than it appears.

The Market Does Not Forgive Showcase Treasuries

Altan Tutar sums up the atmosphere without poetry. 2026 looks bleak. On-the-ground translation: if you are just a safe hoping BTC will go up forever, you’re flipping a coin with your company.

Ryan Chow puts it differently, but the essence is the same. A Bitcoin treasury is not a magic solution for infinite dollar growth. And many would be unlikely to survive the next real drawdown.

We got a glimpse in December. Bitcoin briefly fell to around 84,398 dollars, and volatility revived the topic of these valuation rollercoasters, complicating financing and trust. At that time, those who turned accumulation into marketing operations sometimes found themselves selling, just to cover costs. This is the most common scenario. And the most toxic.

Yield, Discipline, and the Showdown Against ETFs

The interesting point is that the execs don’t say: everything will collapse. They say: the model must evolve. The winners, according to Tutar, will be those who add real value beyond the stock. Products. Mechanisms generating regular returns and redistributing part to stakeholders.

Vincent Chok points to the silent enemy: crypto ETFs. For many investors, they offer regulated, simple, and increasingly competitive exposure. Conclusion: if CTAs want to compete, they must speak TradFi language. Transparency, auditability, compliance, professional infrastructure.

Chow pushes the logic further. Treat Bitcoin as a digital active capital, integrated into a yield strategy. He mentions using on-chain instruments to produce more sustainable yield, or collateralized assets to access liquidity when the market retreats. In short: stop putting BTC on a shelf and call it finance.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Fascinated by Bitcoin since 2017, Evariste has continuously researched the subject. While his initial interest was in trading, he now actively seeks to understand all advances centered on cryptocurrencies. As an editor, he strives to consistently deliver high-quality work that reflects the state of the sector as a whole.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.