Crypto funds record capital outflows for the fourth consecutive week

Crypto markets are going through a turbulence zone. For the fourth consecutive week, specialized funds record massive withdrawals. Bitcoin stumbles and falls below the symbolic 70,000 dollars mark.

In brief

- Crypto investment products suffered $173 million outflows last week, bringing the total to $3.8 billion over four weeks.

- Bitcoin leads withdrawals with $133.3 million in outflows, while assets under management drop to their lowest level since April 2025.

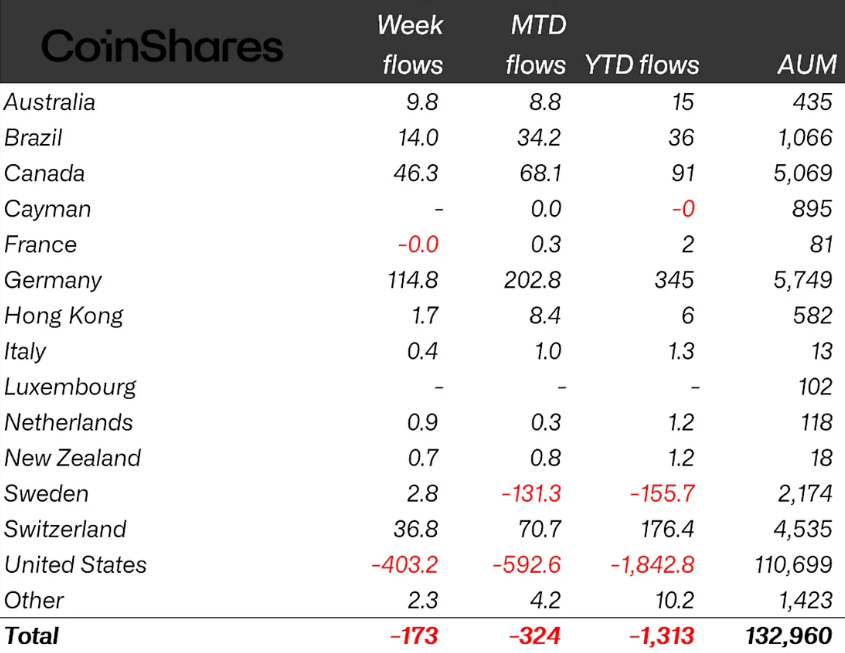

- The US accounts for most of the pessimism with $403 million outflows, contrasting with $230 million inflows in the rest of the world.

- XRP and Solana resist the downtrend with respective inflows of $33.4 and $31 million.

A wave of outflows that does not weaken

The data published Monday by CoinShares paints a worrying picture. Cryptocurrency exchange-traded products lost $173 million in one week.

This figure is part of a negative trend started nearly a month ago. James Butterfill, head of research at CoinShares, points to the prevailing gloom and the persistent weakness of prices.

Bitcoin, which traded around $70,000 at the start of the week, briefly dropped to $65,000 on Thursday before stabilizing around $68,900.

The downward spiral particularly affects Bitcoin funds. They account for $133.3 million in weekly withdrawals. US spot Bitcoin ETFs show an even gloomier balance with nearly $360 million in outflows over the same period, according to SoSoValue data.

This mistrust is accompanied by a contraction in assets under management, now established at about $106 billion for Bitcoin alone. The sector’s total stands at $133 billion, a level not seen since April 2025.

Ether is not exempt from this dynamic. Funds linked to the second largest crypto recorded $85 million in outflows. However, a note of optimism remains on the side of US spot Ether ETFs, which show modest inflows of $10 million. This divergence illustrates the complexity of current investor sentiment, torn between caution and selective opportunism.

Geography of capital and unexpected resistances

Geographical analysis reveals a striking contrast. American products suffered massive outflows of $403 million, while all other regions combined attracted $230 million.

Germany leads the charge with $115 million inflows, followed by Canada with $46 million and Switzerland with $37 million. This divergence suggests that American pessimism does not necessarily reflect global sentiment. European and Canadian investors seem to see it as a window of opportunity rather than a flight signal.

In this mostly gloomy landscape, two assets stand out. XRP and Solana show remarkable performances with respective inflows of $33.4 and $31 million.

Standard Chartered analysts have officially revised their Bitcoin forecasts downwards. Their target for 2026 drops from $150,000 to $100,000. They even anticipate a possible drop to $50,000 before a rebound.

This target correction reflects a recalibration of expectations in a changing macroeconomic context, notably marked by a slowdown in US inflation that weakens Bitcoin’s argument as a hedge against monetary erosion.

The crypto market enters a decisive phase

The last four weeks mark a turning point. The $3.8 billion in cumulative outflows signal a profound reassessment of positions. Investors seem to be reconsidering their exposure as macroeconomic conditions evolve.

Volatility remains high and the feeling of “extreme fear” dominates, as indicated by the Fear & Greed index falling to historically low levels. This period of turbulence could nevertheless create opportunities for those who bet on the long term and believe in the fundamental resilience of cryptocurrencies.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Passionné par le Bitcoin, j'aime explorer les méandres de la blockchain et des cryptos et je partage mes découvertes avec la communauté. Mon rêve est de vivre dans un monde où la vie privée et la liberté financière sont garanties pour tous, et je crois fermement que Bitcoin est l'outil qui peut rendre cela possible.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.