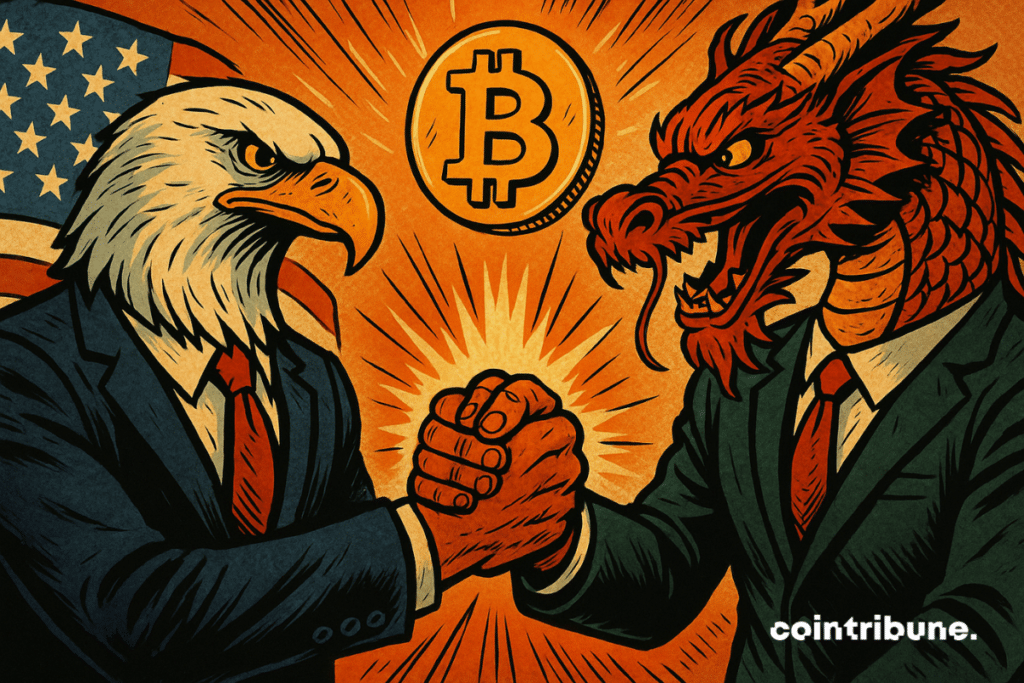

Crypto Market Optimism Sparked by U.S. and China Trade Agreement

After months of trade tension, the United States and China have agreed to a 90-day pause in their trade war, following a two-day meeting in Geneva. The prolonged conflict has already impacted financial markets, including crypto.

In Brief

- US and China agree to pause trade war for 90 days and cut tariffs.

- Bitcoin rockets past $104K as crypto bulls charge in.

- Crypto sentiment soars with Fear and Greed Index at 70.

The United States will lower tariffs on Chinese imports from 145% to 30%. This follows a decision to suspend current tariffs for 90 days, based on an agreement reached by both parties. In a joint statement, the two countries said they want to build a strong, long-term trade partnership.

China has also agreed to reduce its tariffs on American goods, bringing them down from 125% to 10%. It will also remove additional tariffs imposed earlier this year. This temporary reduction is a sign of progress in easing trade tensions. China also agreed to suspend the countermeasures it had implemented in retaliation to the increased tariffs. It stated:

Adopt all necessary administrative measures to suspend or remove the non-tariff countermeasures taken against the United States since April 2, 2025.

A system will also be set up to continue discussions about their economic and trade relations. These discussions will be led by representatives from both sides: He Lifeng, Vice Premier of China, will represent China; Scott Bessent, the U.S. Secretary of the Treasury, and Jamieson Greer, the U.S. Trade Representative, will represent the United States.

The meetings will take place either in China, the U.S., or a third country, depending on mutual agreement. They wrote:

After taking the aforementioned actions, the Parties will establish a mechanism to continue discussions about economic and trade relations. The representative from the Chinese side for these discussions will be He Lifeng, Vice Premier of the State Council, and the representatives from the U.S. side will be Scott Bessent, Secretary of the Treasury, and Jamieson Greer, United States Trade Representative. These discussions may be conducted alternately in China and the United States, or a third country upon agreement of the Parties. As required, the two sides may conduct working-level consultations on relevant economic and trade issues.

Many see this reduction in tariffs as a welcome development. Trade wars are often linked to tariff decisions, and this pause raises hopes that trade could flow more smoothly between the two nations.

Could the Trade Truce Fuel Crypto Growth and Ease Inflation?

The crypto market has reacted positively to this latest development. Bitcoin surged above $104,000, marking its highest price in months, while Ethereum climbed back above $2,500. Dogecoin also saw a 10% gain in the last 24 hours.

The Kobeissi Letter, a market commentary publication, noted that Nasdaq futures rose by 3% in response to the news.

Trade peace is often good news for crypto. Easing tariffs could slow inflation, which might lead the Federal Reserve to consider cutting interest rates. And lower rates usually drive more interest in riskier assets like Bitcoin. This could set the stage for BTC to hit and even surpass its all-time high of $109,000, triggering a ripple effect across other altcoins.

Meanwhile, the Crypto Fear and Greed Index has climbed to 70%, showing a surge in investor optimism and rising FOMO (Fear of Missing Out). This could push crypto sentiment even higher and keep the market in bullish territory.

According to a weekly report released by Bybit, the last time Bitcoin crossed $100,000 for the first time since February was influenced by the US-UK trade deal. This suggests that a solid agreement with China could have an even greater impact on the crypto market.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Ifeoluwa specializes in Web3 writing and marketing, with over 5 years of experience creating insightful and strategic content. Beyond this, he trades crypto and is skilled at conducting technical, fundamental, and on-chain analyses.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.