Pump.fun Breaks Records as Solana Memecoins Surge

Pump.fun establishes itself as the crypto phenomenon of 2026. With a daily volume exceeding 2 billion dollars, the platform redefines the memecoin ecosystem on Solana. Between opportunities and risks, this frenzy raises questions: sustainable revolution or speculative bubble?

In brief

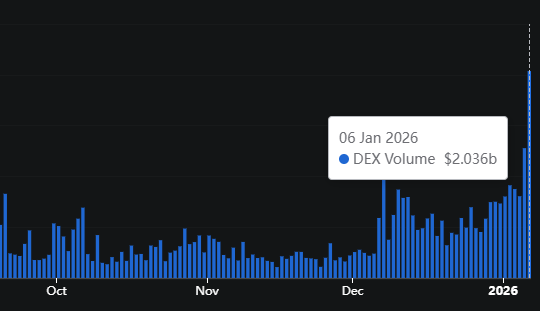

- Pump.fun records a volume record of 2.03 billion dollars on January 6, driven by enthusiasm for memecoins on Solana.

- Pump.Fun faces legal threats (a 500 million $ lawsuit), extreme volatility, and the collapse of memecoins created in a few days.

- Pump.Fun’s future will depend on its ability to diversify its model, reassure regulators, and transform its speculative success into a sustainable crypto ecosystem for Solana.

Pump.Fun: a historic record marking the rise of memecoins on Solana

On January 6, 2026, Pump.fun breaks records by registering 2.03 billion dollars in volume in a single day! That’s a 99% increase in one week. This success is explained by the ease of token creation and the appeal of memecoins, boosted by media events such as crypto tokens inspired by Donald Trump. Solana, with its low fees and speed, has become the blockchain ideal for these volatile assets.

Users flock to launch projects in a few clicks, attracted by potential quick gains. According to CoinMarketCap, the platform now accounts for more than 56% of transactions on Solana DEXs. Crypto experts point out that this dynamic reflects a growing appetite for speculative assets, but also a democratization of token creation.

Yet, behind Pump.fun’s record figures lies a contrasting reality: the majority of created memecoins disappear within a few days. Despite this, the platform generated more than 800 million dollars in revenue, confirming its status as the undisputed leader.

Risks and controversies behind Pump.Fun’s euphoria

Pump.fun’s explosion is not without shadows. Indeed, a 500 million dollar lawsuit threatens the platform, accused of facilitating “rug pulls”. Crypto investors, often novices, are exposed to massive losses, attracted by promises of dazzling returns. Moreover, competition intensifies with rivals like LetsBonk or Bags, who are eating into market shares.

Furthermore, the extreme volatility of memecoins raises questions: how to distinguish serious projects from scams? Regulators are starting to take a close interest in this sector, where the line between innovation and speculation remains blurry. Solana, although benefiting from this activity, sees its image associated with a speculative economy. Some analysts fear that this trend overshadows more serious blockchain use cases, such as DeFi or NFTs.

Crypto: what future for Pump.fun and memecoins?

Pump.fun bets on diversification to sustain its model. The platform is considering partnerships with institutional players and tools to limit fraud. But its future will also depend on its ability to reassure increasingly watchful regulators. For investors, caution remains advised. Memecoins, although profitable in the short term, remain high-risk crypto assets.

To this end, experts recommend prioritizing projects with an active community and verified liquidity. In the long term, Pump.fun could become a key player in the crypto sphere, provided it transforms its speculative success into a sustainable ecosystem. Otherwise, it risks being just a flash in the pan in the history of cryptocurrencies.

Pump.fun marks the beginning of 2026 by bringing Solana memecoins into the spotlight. But between innovation and excess, its model raises questions. Will the platform be able to reconcile growth and regulation? The debate remains open as the crypto industry seeks balance between freedom and security… Especially at a time when a woman was kidnapped in France because of cryptos.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

The world is evolving and adaptation is the best weapon to survive in this undulating universe. Originally a crypto community manager, I am interested in anything that is directly or indirectly related to blockchain and its derivatives. To share my experience and promote a field that I am passionate about, nothing is better than writing informative and relaxed articles.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.