Crypto: Is Now the Time to Buy XRP Ahead of a Surprise ETF Announcement?

XRP is weathering turbulence but remains in the sights of investors. Between clarified legal framework and speculation around an ETF, Ripple is regaining solid support. As institutional adoption accelerates, the token could well make a notable comeback in the crypto spotlight.

In Brief

- An XRP ETF, still uncertain, could become a major catalyst, similar to the effect observed on Ethereum.

- XRP withstands crypto volatility thanks to a strengthened legal framework and increasing prospects of institutional adoption.

- Despite a massive transfer by Chris Larsen, crypto analysts remain optimistic about a sustainable recovery of XRP.

Crypto: XRP falls, but analysts bet on a rebound to $5

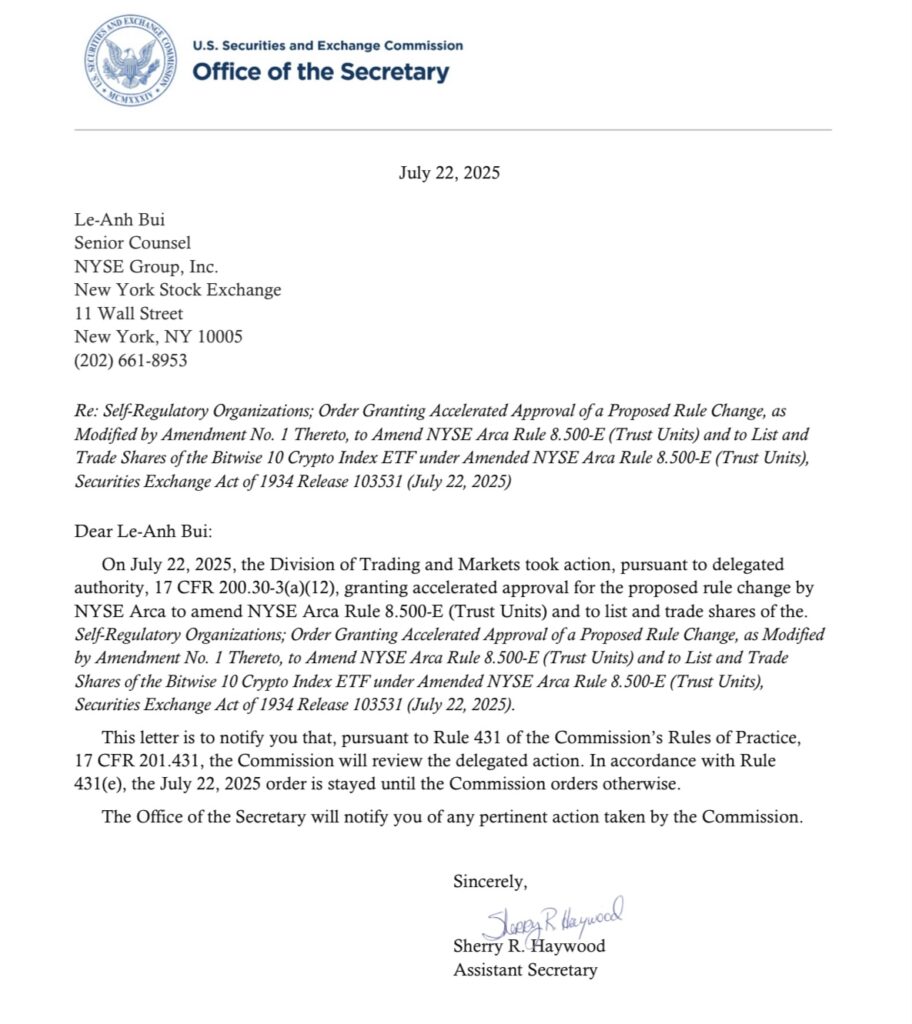

On July 25, XRP recorded a notable drop, falling nearly 7%. This decline was partly attributed to uncertainty surrounding the conversion into a Bitwise 10 Crypto Index Fund ETF, which holds exposure to XRP. Although the SEC initially approved this conversion, it immediately suspended its own decision via a review order based on Rule 431, leaving the project on hold. This reversal rekindled doubts about the timetable for institutional integration of crypto assets.

Despite this unexpected freeze by the SEC, several analysts maintain a positive outlook on Ripple’s trajectory. Ryan Lee, Chief Analyst at Bitget Research, recently pointed out that institutional adoption, combined with a favorable market sentiment, could push XRP to 5 dollars by the end of 2025. Remarks that, although made before the ETF suspension, reflect a bullish conviction in the medium term.

Ripple gains legitimacy against the SEC and attracts funds

Since the 2023 ruling between Ripple and the SEC, XRP benefits from a clearer legal framework than most other crypto assets. This distinction is now seen as a competitive advantage. Indeed, Ripple obtained recognition of its token not being a security in over-the-counter transactions, which significantly reduces legal risk.

At a time when the American regulator is multiplying lawsuits against other crypto projects, this clarity allows investors to treat XRP as a compliant asset. This paves the way for broader adoption by financial institutions and fund managers.

XRP ETF: the secret weapon to boost token liquidity?

The prospect of an XRP-backed ETF remains speculative but is already attracting attention. Despite volatility, analysts continue to anticipate a rally for XRP, driven by hopes for an ETF. If such a crypto product were launched, it would transform Ripple (XRP) into an investment vehicle for traditional capital! Thus multiplying its visibility and liquidity.

Like Ethereum’s journey, the mere anticipation of an XRP ETF could be enough to fuel a gradual bullish momentum, with an amplified effect upon actual approval.

XRP is moving forward on firmer foundations than ever before, between favorable regulation and concrete use cases. If the ETF materializes, it could trigger a new bullish phase. However, the recent 175 million dollar XRP transfer by Chris Larsen, Ripple’s co-founder, raises questions about possible selling pressure. Does a crypto’s trajectory really depend on a financial product, or on its ability to establish itself outside traditional markets?

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

The world is evolving and adaptation is the best weapon to survive in this undulating universe. Originally a crypto community manager, I am interested in anything that is directly or indirectly related to blockchain and its derivatives. To share my experience and promote a field that I am passionate about, nothing is better than writing informative and relaxed articles.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.