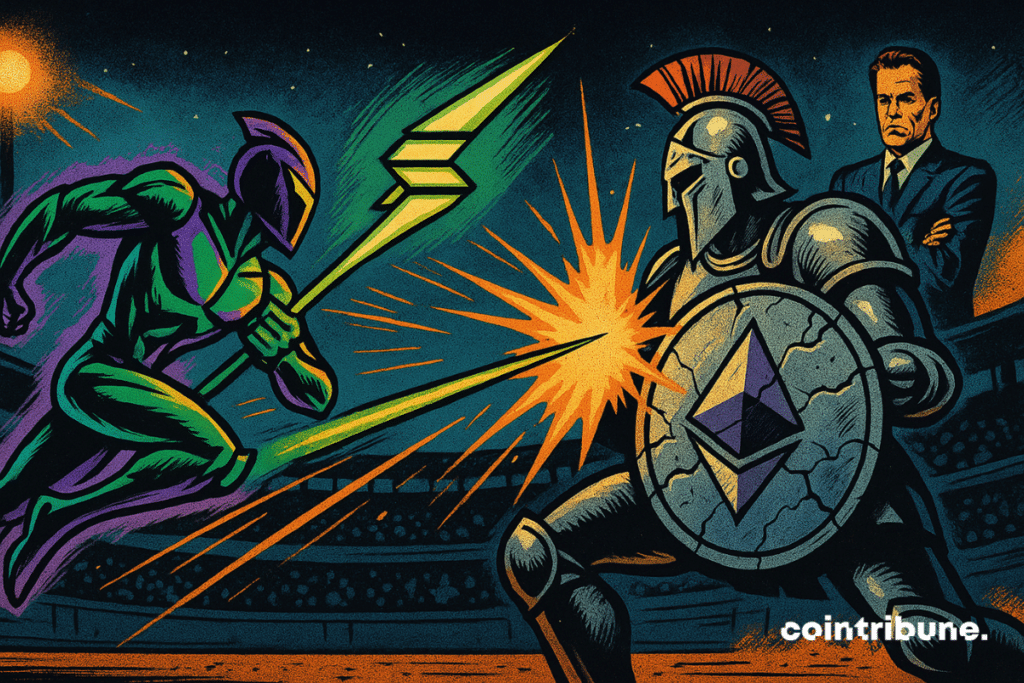

Crypto: Solana Will Surpass Ethereum, According To Anthony Scaramucci

While the crypto ecosystem remains dominated by the heavyweights Bitcoin and Ethereum, a bold statement from Anthony Scaramucci, founder of SkyBridge Capital, is shaking up the hierarchy. At the DigiAssets 2025 conference, the investor claimed that Solana will overtake Ethereum, while admitting he does not have a strong opinion on the latter. A comment that reignites a heated debate: can Solana really establish itself as the new standard of blockchains?

In Brief

- Anthony Scaramucci predicts Solana will surpass Ethereum.

- SkyBridge Capital holds hundreds of millions in crypto, including a lot of SOL.

- Despite much smaller market cap, Solana appeals with its speed and low fees.

Scaramucci bets big on Solana: poker move or clear vision?

Scaramucci is not a first-hour crypto evangelist. His entry into the arena dates back to 2020, at a time when Ethereum reigned uncontested over smart contracts. Yet, his disinterest in ETH is not tinged with rejection but rather with stronger adherence to another story: that of Solana. He claims to understand its story a bit better, an understatement that says much about his conviction.

SkyBridge Capital, his investment vehicle, now holds “a nine-figure balance in bitcoin and Solana,” and about 40% of its digital assets are concentrated in a few cryptos including SOL.

This is therefore not a mere speculative bet but a massive strategic allocation that also includes names like Avalanche and Polkadot. We are talking about 300 million dollars in a diversified crypto fund but clearly oriented towards blockchains with high adoption potential.

Solana vs Ethereum: numbers telling a different crypto story

In terms of price, the duel remains uncertain. In January 2025, Sol crypto flirted with 293 dollars before dropping back to 145 $. A decrease of 23.2% in a few months, comparable to that of Ethereum which lost 24.75% in the same period. But where the comparison becomes more intriguing is at the market capitalization level: Solana weighs 76 billion dollars, far behind Ethereum’s 304 billion.

In other words, if Solana really wants to overthrow Ethereum, it will have to almost quadruple its current value. A feat that will depend neither on a simple stroke of luck nor a passing craze. This will require structural advances: adoption by developers, network robustness, technical innovations, and above all, resilience against flaws like those observed in the past (notably network outages).

A battle of opinions

It should be noted that Scaramucci’s prediction is not consensual. On the institutional side, the bank Standard Chartered, in a recent note, states that the crypto Sol will underperform ETH during the next two to three years. Their analysis is based on solid fundamentals: the depth of the Ethereum ecosystem, its advances in the L2 (Layer 2) domain, and the solidity of its decentralized smart contracts.

However, these arguments do not seem to shake Scaramucci. And while his prognosis may seem provocative, it resonates with a feeling increasingly shared in the community: Ethereum is slow, expensive, and its move to proof-of-stake has not (yet) solved all its problems. Conversely, Solana, with its fast and inexpensive transactions, attracts dApp developers, NFT projects, and Web3 games.

Will Solana really be able to dethrone Ethereum? The story remains to be written. In 2025, while the old father bitcoin advances undisturbed against inflation and geopolitical storms, his heirs stir. What if one of them, Solana, stepped out of the sandbox to shake up the established order?

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Fascinated by Bitcoin since 2017, Evariste has continuously researched the subject. While his initial interest was in trading, he now actively seeks to understand all advances centered on cryptocurrencies. As an editor, he strives to consistently deliver high-quality work that reflects the state of the sector as a whole.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.