Crypto markets are hot right now, with Bitcoin recently breaking all-time highs. But 2023 wasn’t half bad either! Read our latest blog for a breakdown of our estimates for crypto investors’ gains in 2023, both in total and broken down by country. https://t.co/HfD1MuGiA7

— Chainalysis (@chainalysis) March 14, 2024

A

A

Crypto: The United States and Asian countries lead the way

Fri 15 Mar 2024 ▪

4

min read ▪ by

Getting informed

▪

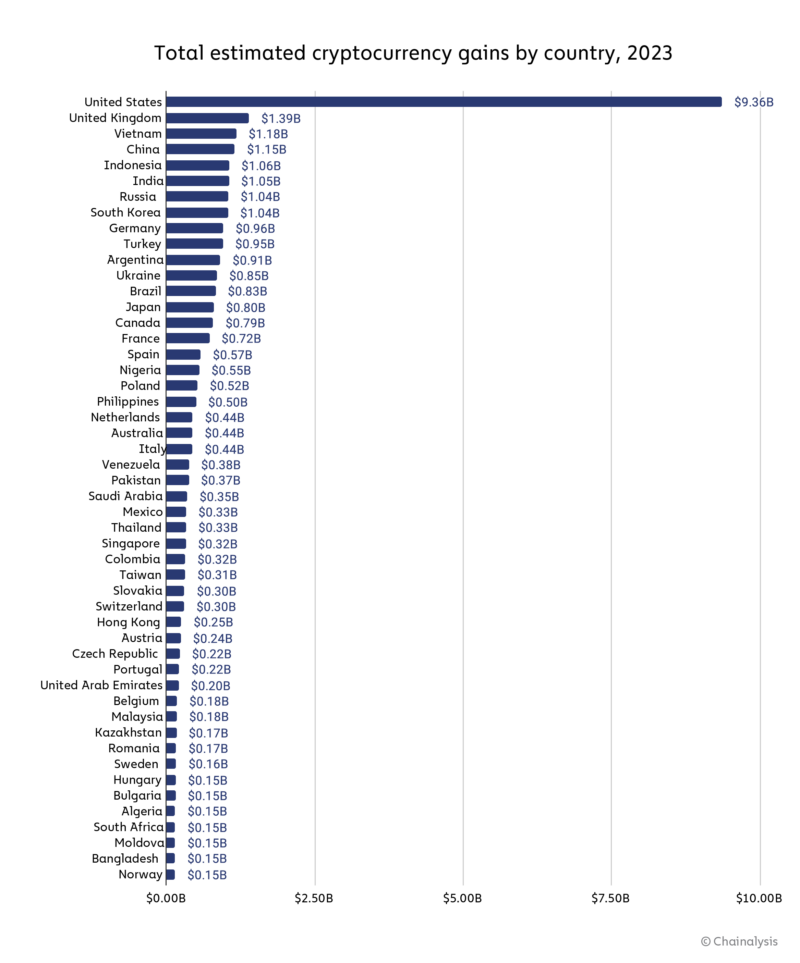

2023, a terrible year for cryptos? Not so fast! While many are dubbing it the dark year for crypto investors, Chainalysis data suggests that 2022 was worse. In 2022, the market lost $127.1 billion, whereas in 2023, it generated profits of $37.6 billion. Ironically, even in the United States, where bitcoin is not yet legalized, crypto profits are piling up.

The United States tames the crypto market: a telling record

Despite its progress with spot Bitcoin ETFs, the United States still lags in crypto regulations. The potential return of Donald Trump to the White House could be a game-changer, as he appears ready to legalize BTC or let it coexist with the dollar.

After a tumultuous 2022, the cryptocurrency market has regained its vigor in 2023, according to the latest Chainalysis report. Investors have made substantial gains, totaling $37.6 billion globally. A ray of hope in a market once faltering.

The United States stands out with impressive gains of $9.3 billion, followed by the United Kingdom with $1.39 billion. But even more remarkable is the performance of upper-middle and lower-middle-income countries in Asia. Vietnam, China, Indonesia, and India all recorded gains exceeding a billion dollars, demonstrating massive crypto adoption despite the challenges.

This positive momentum is fueled by investor optimism, although the gains remain below the peak of $159.7 billion reached in 2021. However, the reluctance of investors to withdraw their assets suggests growing confidence in the continuous growth of the crypto market. The gradual rise observed throughout the year, with a particular boost in November and December, indicates anticipation of a year-end rally and strengthens confidence in the future of the cryptocurrency market.

The method behind crypto gains: A proven formula

Chainalysis’ approach is based on the analysis of crypto asset movements and conversions into fiat currency. By examining on-chain flows, the company assesses the collective gains on each asset by measuring the differences between withdrawal and deposit values.

While this method is not perfect, it provides a solid estimate of the gains on assets traded on major centralized exchanges (DEX). Then, these gains are distributed among countries based on their share of web traffic on the tracked service platforms. This approach, used for Chainalysis’ annual Global Cryptocurrency Adoption Index, ensures a reliable estimation of the gains by country.

The horizon of 2024: The path to growth?

As 2023 gives way to 2024, favorable trends continue, driving crypto assets like bitcoin to all-time highs. The approval of bitcoin ETFs and the growing adoption by institutions fuel this ascent. With an increase of 65.4% for bitcoin and 70.2% for ether up to March 13, this year promises gains close to those of 2021.

This persistence reflects the robustness of the market, supported by increasing institutional adoption and clearer regulations. The expectation of continued growth, evidenced by the reluctance to realize gains, could signal the start of a prolonged expansion.

A widespread growth, observed across various countries and income levels, attests to the enduring momentum of the cryptocurrency market.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

A

A

La révolution blockchain et crypto est en marche ! Et le jour où les impacts se feront ressentir sur l’économie la plus vulnérable de ce Monde, contre toute espérance, je dirai que j’y étais pour quelque chose

DISCLAIMER

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.