Crypto: When Politics and Economy Clash, Who Pays the Bill?

November 2025 will be remembered for an explosive trio: an indecisive Fed, a President Trump at war with Jerome Powell, and crypto markets searching for benchmarks. Between interest rates, presidential insults, and digital asset resilience, the balance remains fragile.

In brief

- The Fed is hesitating over a rate cut in December, torn between inflationary risks and economic slowdown, plunging markets into uncertainty.

- Trump intensifies his attacks against Powell, calling him “mentally ill” and demanding his dismissal, adding unprecedented political pressure.

- Crypto, sensitive to these tensions, oscillates between short-term stress and signs of maturation in the face of traditional macroeconomic dynamics.

The Fed in wait-and-see mode: between internal division and demand for economic evidence

The Federal Reserve is going through a period of deep indecision. Indeed, after the 0.25% rate cut in October 2025, persistent disagreements remain among its members. A majority demands additional economic data before considering another rate cut in December, while a minority fears inflation still too high, close to 3%.

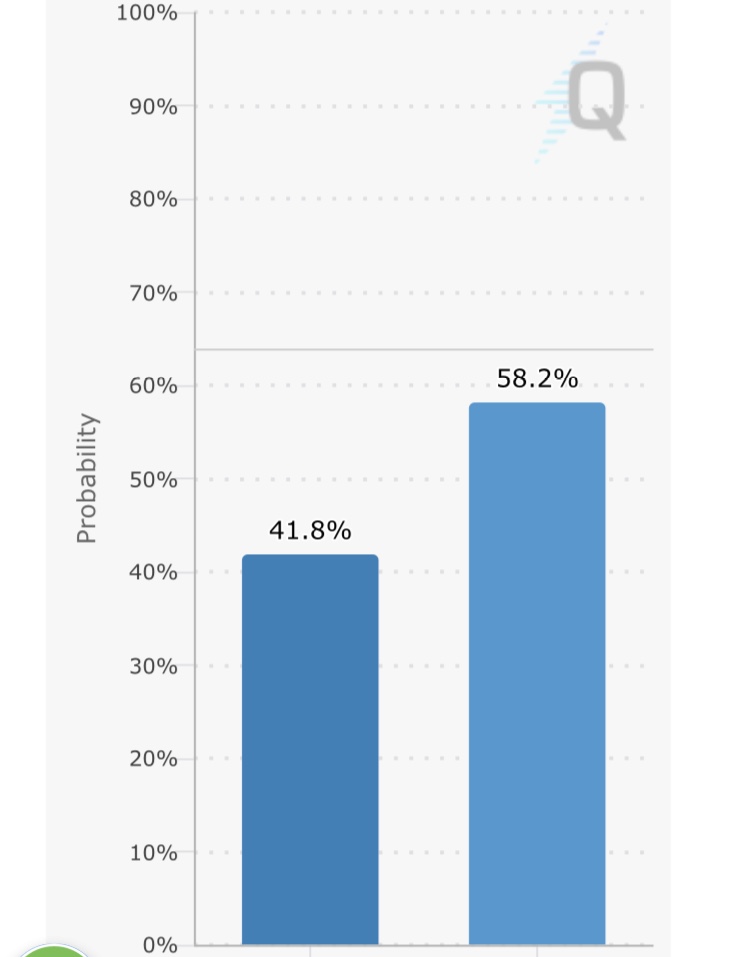

Jerome Powell clearly indicated that a rate cut in December is not guaranteed! A cautious stance that contrasts sharply with financial and crypto market expectations. As a result, the probabilities of monetary easing, once estimated at 95%, have now dropped to 41%, as shown in the chart below.

Moreover, the government shutdown has worsened the situation by delaying the release of key employment reports. Without these indicators, the Fed would be navigating blindly, reinforcing its wait-and-see approach. Some officials advocate a prolonged pause, others quick action in case of confirmed slowdown, creating an unprecedented climate of uncertainty.

Trump harshly insults Jerome Powell and fuels volatility

Donald Trump has renewed his attacks on Jerome Powell, this time accusing him of suffering from “real mental problems” during an economic forum in Riyadh. “He should be fired“, he declared, adopting aggressive rhetoric aimed at discrediting the Fed chair for years.

These remarks form part of a clear strategy: Trump wants a more accommodative Fed, with low rates to boost the economy before the next elections. He openly criticizes Powell’s management, which he deems too cautious, and even threatens to replace him with a candidate more aligned with his views. This move adds stress to already nervous investors, amplifying crypto market volatility.

Crypto: resilience tested in the macroeconomic storm

The crypto market tries to stabilize in a chaotic macroeconomic environment. As Gracy Chen, CEO of Bitget, points out:

The marked decline in market expectations for a Fed rate cut in December, now estimated between 33 and 50% […] highlights increased macroeconomic uncertainty. At the same time, it reflects how much crypto has integrated into traditional finance, with digital assets now responding to the same data gaps and policy delays that influence stocks and bonds. In the long term, this convergence is a positive sign of crypto’s maturation into the mainstream.

In this context, the crypto market tries to stabilize despite an unstable macroeconomic environment. After a sharp drop in October, Bitcoin shows signs of recovery but remains below critical technical thresholds.

ETF flows illustrate this duality: net inflows for Bitcoin, but prolonged outflows for Ethereum.

The Fed, Trump, and cryptos form a volatile mix at the end of 2025. Between monetary uncertainties and presidential outbursts, digital markets must cope with an unstable environment. In your opinion, will the Fed manage to reassure, or is 2026 shaping up to be another turbulent year for crypto?

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

The world is evolving and adaptation is the best weapon to survive in this undulating universe. Originally a crypto community manager, I am interested in anything that is directly or indirectly related to blockchain and its derivatives. To share my experience and promote a field that I am passionate about, nothing is better than writing informative and relaxed articles.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.