Digital Euro: The EU Approves Two Versions, Including One Focused on Privacy

Europe is accelerating its monetary revolution with the official validation of two versions of the Digital Euro: one online and one offline, the latter emphasizing privacy. Supported by the ECB and the EU Council, this project aims to modernize payments while meeting users’ expectations regarding privacy.

In Brief

- The EU approves two versions of the Digital Euro: one online (traceable) and one offline (private, without internet).

- The private version of the Digital Euro targets crypto users, but its adoption will depend on its simplicity and credibility against stablecoins.

- The Digital Euro aims to reduce dependence on the dollar, but its success will depend on international adoption and market trust.

Digital Euro: 2 Versions to Meet All Needs

The EU Council and the ECB have agreed on the development of two distinct versions of the Digital Euro.

The Online Version of the Digital Euro:

Connected and traceable, it will allow transactions compliant with anti-money laundering (AML) and know your customer (KYC) regulations. It will also integrate with existing banking infrastructures, facilitating adoption by financial institutions and merchants.

The Offline Version of the Digital Euro:

It stands out for its privacy-focused approach. Indeed, it will operate without an internet connection, via certified devices such as smartphones or smart cards. Transactions will be local and anonymous, similar to cash but with enhanced security.

According to official documents, this version could be favored for small daily payments, with a holding limit capped at 3,000 euros per wallet. A direct response to growing data protection concerns. Christine Lagarde, ECB president, emphasized that this duality aims to reconcile innovation and respect for privacy, a crucial balance to win Europeans’ trust.

Digital Euro: Which Version Will Attract Crypto Users in Europe?

The offline version of the Digital Euro could particularly attract crypto users, accustomed to pseudonymous and decentralized transactions. Its main asset? Enhanced privacy, close to that offered by assets like Monero or Zcash. Private keys, stored on secure devices, will limit surveillance or censorship risks, a strong argument for blockchain purists.

However, several barriers persist. Technical complexity, particularly key management, could discourage newcomers. Moreover, stablecoins, already widely adopted, offer a simpler and more flexible alternative. Finally, part of the crypto community, attached to decentralization, could reject a currency issued by a central institution, even if private.

Will Europe Finally Free Itself from the Dollar?

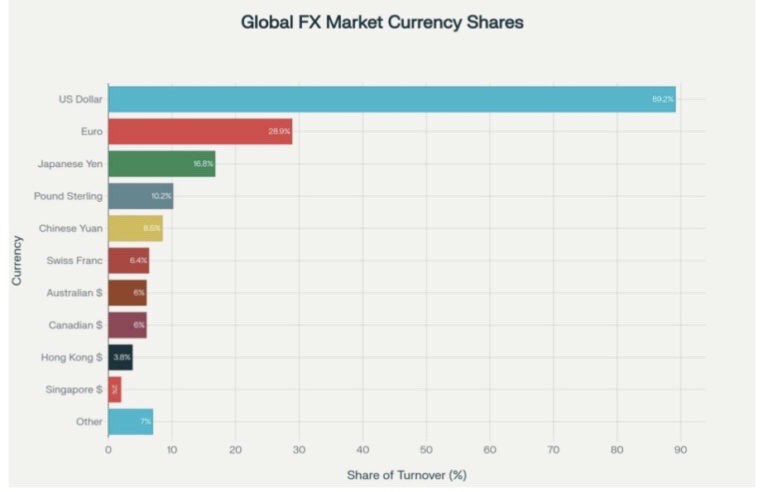

The EU’s approval of the two versions of the Digital Euro represents a historic opportunity for Europe to reduce its dependence on the dollar, which largely dominates global trade with 89.2% of transactions, far ahead of the euro (28.9%). Thanks to instant and low-cost transactions, it could then facilitate intra-European trade. Additionally, backed by the euro’s stability, it also avoids crypto volatility, an asset for businesses and states.

Yet, the challenges are immense. International adoption will require convincing actors outside the EU, in a context where the digital yuan and other CBDCs are emerging. Trust in European regulation and the system’s technical robustness will be decisive. According to projections, the Digital Euro could capture 10 to 15% of international transactions by 2030, provided an ambitious strategy.

The Digital Euro, with its two versions, marks a decisive step for Europe, combining modernity and respect for privacy. Its success will depend on its adoption by the public and its ability to assert itself against the dollar… A promise from the ECB for a stronger European economy. In your opinion, will it manage to reconcile innovation, economic sovereignty, and data protection?

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

The world is evolving and adaptation is the best weapon to survive in this undulating universe. Originally a crypto community manager, I am interested in anything that is directly or indirectly related to blockchain and its derivatives. To share my experience and promote a field that I am passionate about, nothing is better than writing informative and relaxed articles.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.