Ethereum Is Going Crazy With 17 Days Of Record Inflows Into Its ETFs

Ethereum ETFs record 17 consecutive days of net inflows. An unprecedented streak reflecting renewed institutional appetite for the asset. In the background, BlackRock’s iShares ETF stands out as the main catalyst, while demand far exceeds the native supply of the crypto ecosystem.

In Brief

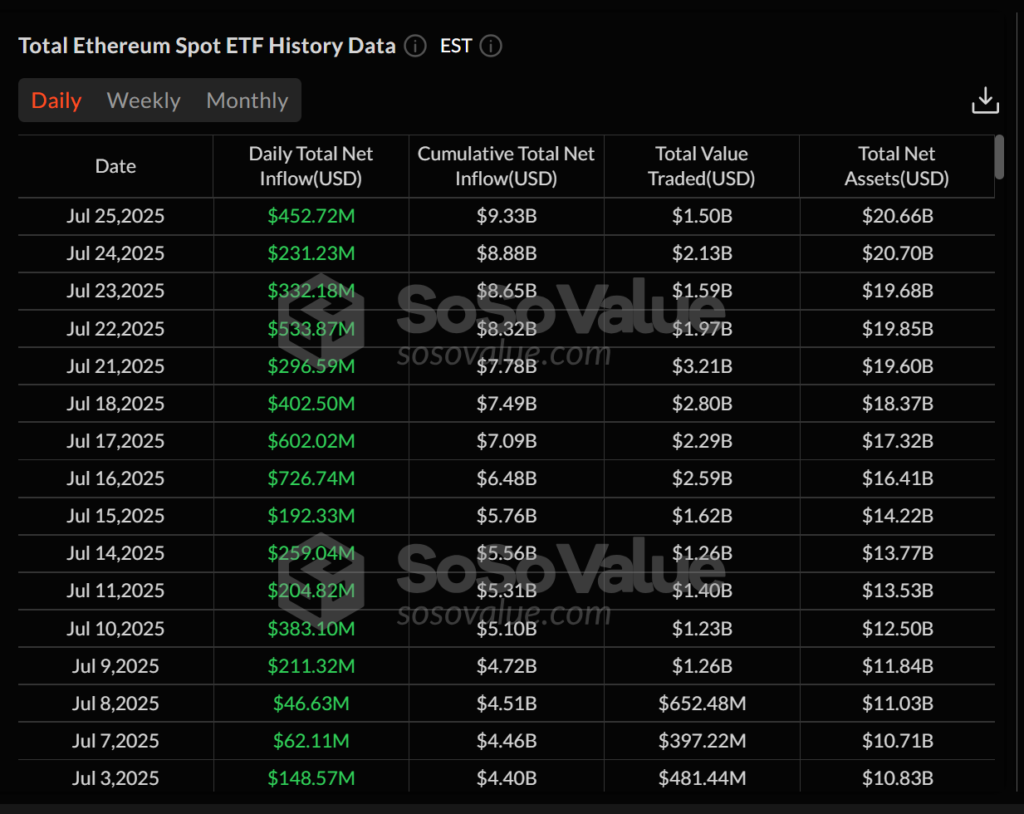

- From July 9 to 25, 2025, Ethereum ETFs experienced 17 consecutive days of net inflows.

- BlackRock’s ETHA ETF leads Ethereum ETFs with $440.10 million in a single day.

- ETF demand could reach 5.3 million ETH per year, against only 0.8 million created, signaling upward pressure on Ethereum.

When Ethereum ETFs Become the Pros’ Favorite Asset

Between July 9 and 25, 2025, Ethereum ETFs recorded 17 consecutive days of net inflows, a historic record for a crypto asset. The trend was marked by:

- A start at $211 million on July 9;

- A peak of $726.74 million on July 16 (more than 200,000 ETH);

- A new high of $452.72 million on July 25.

These volumes far exceed the daily issuance of the crypto network. Driven by Ethereum at over $3,400, this dynamic has strengthened institutional interest in Ethereum, triggering a strong bullish flow amid a strategic rotation toward tokenized assets.

BlackRock Captures Half of the Ethereum ETF Market

Most of the recorded flows come from BlackRock’s iShares Ethereum Trust (ETHA) ETF. Among the $453 million inflows into Ethereum ETFs on July 25, this crypto product alone captures $440.10 million, bringing its assets under management to $10.69 billion. With a 45.5% market share, ETHA now stands as the pillar of this institutional wave.

In contrast, historically dominant Grayscale ETHE continues its outflows with $23.49 million in withdrawals. Since its conversion to an ETF, Grayscale has recorded over $4.29 billion in outflows, indicating a profound reshuffling of institutional preferences. Other crypto ETF issuers like Bitwise and Fidelity also benefit from this trend, albeit to a lesser extent.

One ETH Bought, Seven Demanded: Pressure Rises on Ethereum

According to Matt Hougan, CIO of Bitwise, cumulative flows could reach $20 billion over one year. This would represent 5.3 million Ethereum purchased via ETFs, while only 0.8 million ETH are created annually through the staking mechanism.

This imbalance suggests structural tension between exponential demand and limited supply, which could ultimately heavily weigh on the price of the crypto asset. Especially since Ethereum, since its shift to proof of stake, tends towards a deflationary dynamic, further limiting the quantity of units available.

21Shares Bets on Solana, but Flows Say Ethereum

While 21Shares envisions a scenario where Solana would surpass Ethereum by the end of 2025, the current trajectory of Ethereum ETFs challenges this projection. With over $9.3 billion in net inflows since launch and an uninterrupted 17-day collection streak, institutional interest in ETH crypto stands massive and durable.

Unlike Solana, still absent from the U.S. crypto ETF market, Ethereum benefits from an already active regulatory infrastructure and consolidated use in DeFi. These factors highlight a structural gap difficult to close in the short term, despite Solana’s technological agility.

After 13 consecutive days in the green and 17 days of record inflows, Ethereum ETFs confirm a major institutional turning point. The scale of injected volumes and the growing imbalance between supply and demand place the crypto asset at the heart of the new finance. It remains to be seen whether this dynamic can withstand the emergence of competitors like Solana.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

The world is evolving and adaptation is the best weapon to survive in this undulating universe. Originally a crypto community manager, I am interested in anything that is directly or indirectly related to blockchain and its derivatives. To share my experience and promote a field that I am passionate about, nothing is better than writing informative and relaxed articles.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.