Ethereum Surpasses Bitcoin in Spot Trading Volume Amid Institutional Surge

After trailing Bitcoin for most part of a decade, Ethereum has toppled the OG crypto in monthly and weekly spot trading volume on centralized exchanges. Market data ties this dominance flip to recent trends, including increased institutional adoption of Ether, as well as capital rotation from BTC to ETH.

In brief

- Ethereum hit $480B in August CEX trades, topping Bitcoin for the first time in seven years of market dominance.

- Spot ETH ETFs drew $3.87B in inflows, while Bitcoin products posted a $751M investment loss in August.

- ETH reached a $4,950 ATH , outperforming 93% of the top 100 digital assets.

- Bitcoin still holds strong with a $124K ATH and 50% positive trading days last month.

Ethereum Surpasses Bitcoin in August Spot Trading Volume

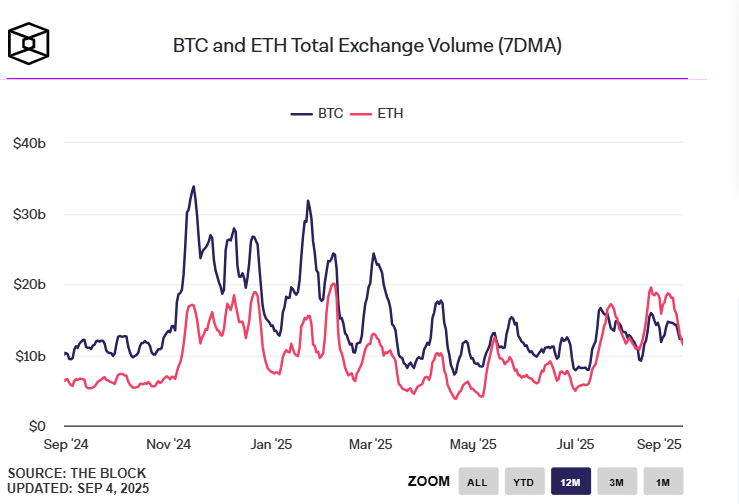

Following a seven-year wait, Ethereum topped BTC in weekly CEX spot volume for the month of August. Effectively, this rare shift in momentum ended BTC’s year-on-year dominance in global spot volumes. Data from The Block shows that centralized platforms pulled in $480 billion in Ether trades over the past month—$79 billion more than Bitcoin.

Ethereum’s strong run is powered by several positive market trends, one of which is the heavy exposure through U.S. spot ETH ETFs and corporate treasury accumulations. Last month, SharpLink Gaming launched a $1.5 billion Ether accumulation program to boost its ETH stash.

Corporate Ethereum holder, BitMine Immersion, went on a one-week buying spree in mid-August, accumulating 373,110 ETH in the process.

Spot ETFs See Record Inflows and Whale Rotations Fuel Market Shift

Apart from the massive corporate buys, Ether financial vehicles also recorded strong demand from market participants. According to SoSoValue, spot ETH ETFs raked in $3.87 billion in investments during the month of August. Bitcoin spot products saw a red outing during the same timeframe, posting an investment loss of $751.12 million.

Adding to the impressive trends, Ether has also outpaced BTC in year-to-date (YTD) gains. Since the start of the year, ETH has surged 30%, compared to Bitcoin’s 20% rally during the same period.

Bitcoin whales have also recently been involved in heavy BTC-to-Ether swaps, which resulted in a flash crash. Paul Howard, senior director at Wincent, explained that the market could witness more of this trend as institutions pivot to ETH as a higher-risk, higher-reward alternative.

It would be worth keeping eyes on the Bitcoin whale wallets who have been switching to ETH this quarter, as that looks to be where I expect more of the ‘blue-chip’ price action into Q4.

Paul Howard

He further mentioned that the crypto market could be in for an impressive end to the year if the dovish rate cut outlook comes into play.

Bitcoin and Ethereum Cool Off After August Highs but Maintain Bullish Momentum

Following a remarkable August outing, which saw both assets touch new levels, Bitcoin and Ether’s price movement have cooled in recent weeks. At the time of writing, ETH is exchanging hands at $4,403 after trading relatively flat over the past week. On top of that, Ethereum recorded only 14 green trading days in the past four weeks.

Here are other key ETH trends to note:

- Reached an all-time high (ATH) of $4,950.50 on Aug 24, 2025.

- Recorded an 83% price growth in the last year.

- Outperformed 93% of the top 100 crypto assets over the same period.

- Currently trading above the 200-day SMA, signaling a sustained bullish trend.

- High liquidity with a 24h volume-to-market cap ratio of 0.0774.

Bitcoin is currently sitting around $ 112,210 following a modest uptick in the past week. On-chain data also captures the following trends:

- Touched an ATH of $124,171 recorded on Aug 14, 2025.

- Surged by 97% in the past year.

- Outperformed 95% of the top 100 crypto assets, though still lagging behind Ethereum’s performance.

- Sustained bullish sentiment, supported by trading above the 200-day SMA.

- Posted 50% positive trading days in the last month.

- The overall market outlook remains bullish, with technical and sentiment indicators aligned.

Howard believes that many crypto assets, including Bitcoin and Ethereum, could touch new ATHs in the fourth quarter of the year—assuming the Feds initiate rate cuts. As the market awaits this bullish trigger, crypto participants continue to pay close attention to the digital asset sector.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

James Godstime is a crypto journalist and market analyst with over three years of experience in crypto, Web3, and finance. He simplifies complex and technical ideas to engage readers. Outside of work, he enjoys football and tennis, which he follows passionately.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.