France's Debt Interest Rates Are Skyrocketing: Crisis Looms?

Interest rates are worrying. François Bayrou warns that pensions and debt will need to be renegotiated. The new generations would do well to turn to bitcoin…

In brief

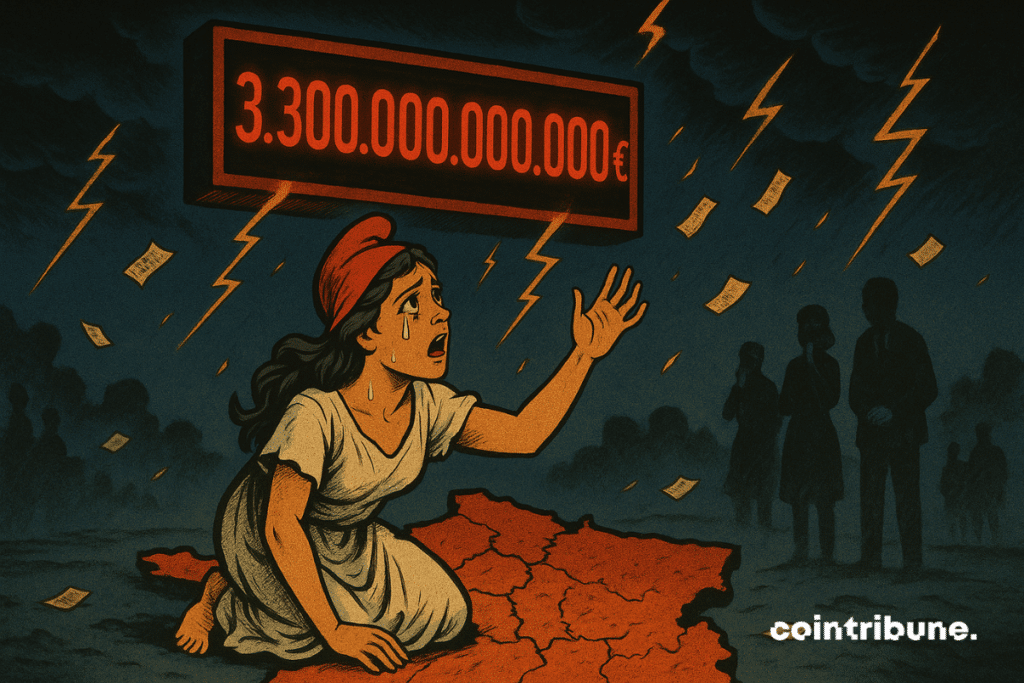

- The French debt amounts to 3,300 billion euros, or 113% of GDP. Interest payments are expected to soar to 108 billion euros per year by 2029.

- With a budget deficit of 170 billion euros and limited growth prospects threatening pension payments.

- In view of inevitable inflation, the new generations would do well to secure their own retirement in bitcoins.

The wear and tear of the system

Beyond its high level (113% of GDP), the French public debt is especially worrying because of the interest.

According to Bercy’s forecasts, the debt burden will explode over the coming years. It is expected to rise from 58 billion euros per year (2024) to 75 billion in 2027 and 108 billion in 2029.

Last year, tax revenues and public spending were respectively 1,500 billion euros and 1,670 billion euros, resulting in a deficit of 170 billion euros, of which 58 billion went to pay interest.

Yes, we borrow to pay the interest. This is called “rolling over the debt”. These interests are referred to as “debt service” or “debt charge” in jargon.

This charge is already the fourth largest public spending item, well ahead of the security or ecology budget, but behind national education and defense.

For Pierre Moscovici, “We have, in recent years, especially 2023 and 2024, lost control of our public finances.”

“The debt service was 25 billion euros in 2021. Today, it’s 67 billion. It’s more than the Defense budget. It will be more than the National Education budget next year”, he worried.

“The slip-ups that accumulate create debt; and the debt, our children pay for it”, he had the honesty to point out. In other words, perhaps it’s time to trim boomers’ pensions, isn’t it?

François Bayrou will he have the courage, he who must unveil by July 14 a budget plan that will require “an effort from all French people, without exception”? And the State? A CSA survey underlines that 92% of French people believe the State must reduce its spending.

No energy, no retirement

On pension reform and ongoing discussions, the Prime Minister asserts “there are no taboos”, including on the retirement age.

We are spending 10% more than what is coming into the coffers.

François Bayrou

The size of the debt and the weak growth prospects (scarcity of cheap-to-extract oil) unfortunately suggest that new generations will have little or no retirement.

It must be well understood that pensions are financed by workers’ salaries. And for salaries to exist, there must be productive entities that create wealth. Cereals, meat, gasoline, clothing, smartphones, cars, houses, etc.

And this wealth is produced by machines. Everything is made and (above all) transported by machines that would not operate without energy. A factory is a large park of machines. A cafe has a coffee machine. A garage has many electric tools. A bakery, an oven, etc.

So future wealth that will allow, or not, paying pensions depends heavily on the quantity of available energy. But in fact, it has been declining sharply in Europe for 15 years. Now, without energy growth, it’s hard to produce more for everyone.

This is problematic for the modern monetary system which is a Ponzi scheme based on perpetual growth and growing debt, under penalty of defaults or inflation.

Unfortunately, the energy decline suggests that millennials, Generation Z, and those after will retire after 70 years old.

Artificial intelligence will certainly boost productivity, but ultimately, trucks fueled by gasoline supply our supermarkets.

Bitcoin, the smart retirement savings plan

Bitcoin cannot affect energy scarcity. It takes tens of millions of years to create oil, and nothing will change this physical reality. There is no uranium, lithium, nickel, or cobalt in the blockchain…

To believe that having a currency with an absolutely fixed quantity changes anything about this reality is denial. Standard of living, abundance, depend on our ability to produce, and therefore mainly on the quantity of available energy and the cost of extraction.

Another certainty is that national currencies will depreciate as energy becomes problematic. Keeping in mind that oil is THE limiting factor for GDP. The reason being that it powers 95% of global transport.

Moreover, it should be reminded that 30% of the oil Europe consumes passes through the Strait of Hormuz. The euro’s value would collapse rapidly in the event of a world war.

In the face of galloping inflation and the deterioration of public accounts, new generations would be wise to prepare their own retirement.

You must save yourself for your old age, and what better than the best store of value ever created: bitcoin. It is the first currency existing in an absolutely finite quantity and which the United States are about to make their reserve currency.

Don’t miss our article on the subject: Bitcoin Is a Much Stronger Investment Today Than It Was a Decade Ago.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Bitcoin, geopolitical, economic and energy journalist.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.