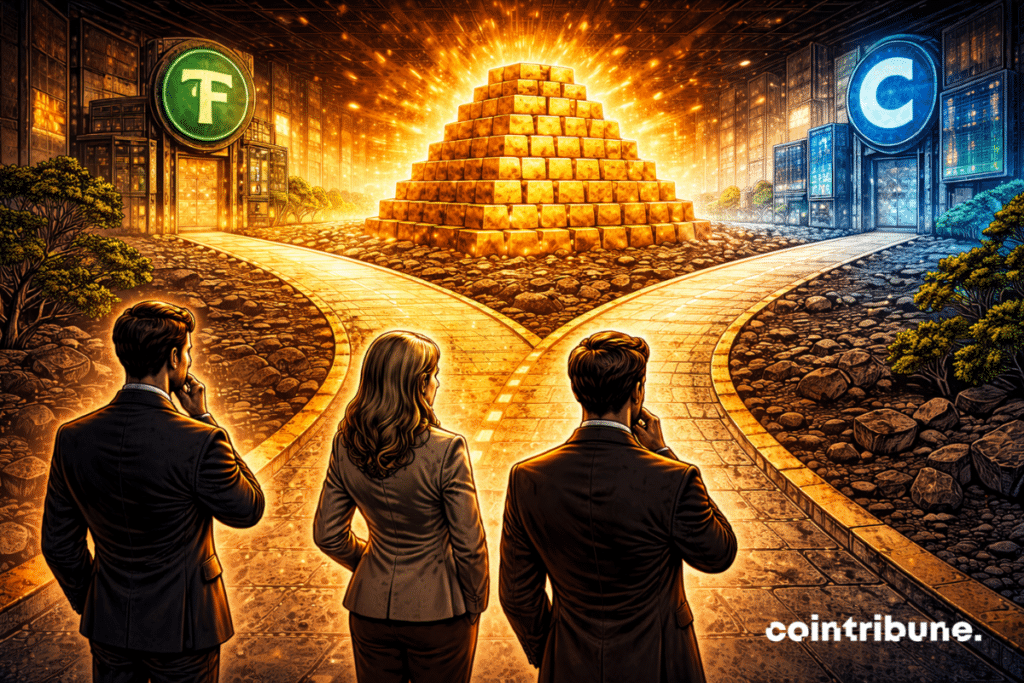

Gold At $5,311 : Tether And Coinbase Diverge On Strategy

Gold has just crossed 5,311 dollars an ounce, sparking a race to the safe haven. Facing this historic high, two crypto giants adopt opposite strategies. Tether bets on physical gold, Coinbase on derivatives. This divergence is no coincidence. It reveals two visions of the financial future : grounded in the tangible for one, focused on markets for the other. Such a strategic turning point could redefine the balance of power in the crypto ecosystem.

In brief

- Gold has reached a record level of 5,311 dollars an ounce, confirming its status as a safe haven amid economic uncertainty.

- Tether massively strengthens its physical gold reserves, reaching 130 tons, including 16.2 dedicated to the stablecoin XAUT.

- Coinbase takes an opposite approach by betting on futures contracts on precious metals, without physical holdings.

- This strategic divergence illustrates two opposing visions of stability : tangible backing versus financial flexibility.

Tether dreams of becoming the central bank of gold

While the price of gold crossed 5,311 dollars an ounce, Tether confirmed its growing role in accumulating the precious metal.

The issuer of the USDt stablecoin now holds 130 tons of physical gold, valued at approximately 22 billion dollars. Added to this are 16.2 tons specifically allocated to its gold-backed stablecoin, XAUT, for a total of 520,089 troy ounces.

“We are soon becoming, in a way, one of the largest central banks of gold in the world”, declared Paolo Ardoino, CEO of Tether, during an interview with Bloomberg. According to the latest data from the World Gold Council, this reserve places Tether at the level of central banks of countries like Mexico, Sweden, or South Africa.

The company specified that the gold reserves linked to the XAUT token are separate from the rest of the assets, and that each token can be physically delivered on demand. The strategy adopted by Tether thus rests on a logic of tangible backing, based on real assets, breaking away from a certain financial abstraction in the sector. This accumulation aims to :

- Strengthen the credibility of XAUT in an uncertain economic context ;

- Diversify Tether’s reserves by adding a historically stable asset ;

- Compete with traditional institutions in the field of strategic reserves ;

- Offer crypto investors a direct and deliverable exposure to gold.

This atypical positioning among stablecoin issuers reflects a clear intention: to anchor cryptos in tangible fundamentals to attract a new category of investors and ensure longevity.

Coinbase bets on futures contracts

In response to this materialistic offensive, Coinbase has adopted a resolutely financial approach. Rather than accumulating physical gold, the American platform has highlighted its range of derivative products, notably futures contracts on precious metals.

“You can trade precious metals on Coinbase”, reminded Brian Armstrong, CEO of the company, in a post on X. He mentioned gold, silver, copper, and platinum among the available options, specifying that these instruments do not involve any physical delivery.

This strategy has provoked mixed reactions in the crypto community. Some commentators saw it as a “top signal”, interpreting the emphasis on these products as a sign of an imminent peak in gold markets. Unlike Tether, Coinbase does not seem to aim to capitalize on the intrinsic safe haven value of the yellow metal, but rather to offer flexible trading instruments to its users, in a market-driven, primarily speculative logic.

In a context of economic tensions, the strategies of Tether and Coinbase outline two irreconcilable visions. While tokenized gold skyrockets, the question is no longer whether to be exposed to it, but how. Physical or derivatives, the outcome of this divergence could well redraw the future of safe havens in the crypto sphere.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Diplômé de Sciences Po Toulouse et titulaire d'une certification consultant blockchain délivrée par Alyra, j'ai rejoint l'aventure Cointribune en 2019. Convaincu du potentiel de la blockchain pour transformer de nombreux secteurs de l'économie, j'ai pris l'engagement de sensibiliser et d'informer le grand public sur cet écosystème en constante évolution. Mon objectif est de permettre à chacun de mieux comprendre la blockchain et de saisir les opportunités qu'elle offre. Je m'efforce chaque jour de fournir une analyse objective de l'actualité, de décrypter les tendances du marché, de relayer les dernières innovations technologiques et de mettre en perspective les enjeux économiques et sociétaux de cette révolution en marche.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.