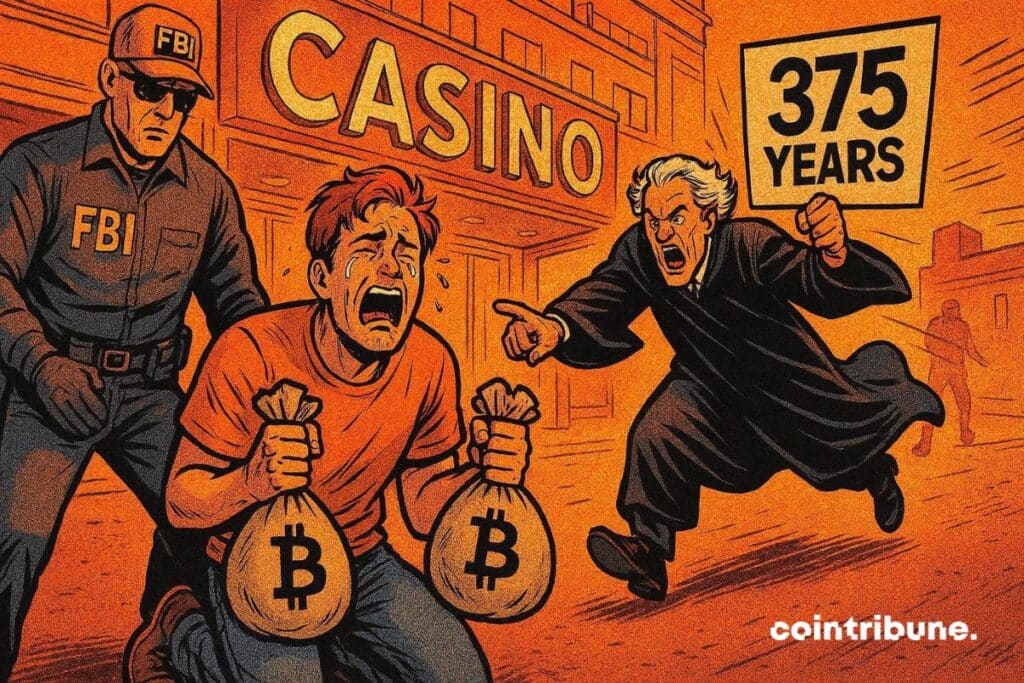

He embezzles 1 million $ in crypto and risks 375 years in prison

Nearly 1 million dollars embezzled, promises of incredible returns, and a 24-year-old man who risks 375 years in prison for crypto fraud… The Elmin Redzepagic case reveals the little-known dangers of an ecosystem where trust too often rhymes with vulnerability.

In brief

- A 24-year-old man embezzled nearly 1 million $ claiming to invest in cryptos, but in reality he bet everything on an online casino.

- He risks 375 years in prison for fraud, money laundering and false tax declarations after deceiving dozens of victims.

- This case reveals the dangers of too enticing promises in crypto and the importance of verifying intermediaries’ legitimacy.

This young man risks 375 years in prison for crypto fraud

Elmin Redzepagic, a Connecticut resident, presented himself as a savvy crypto investor, promising exceptional returns to his clients. Under the guise of working for a mysterious guru known as “The Chef,” he convinced dozens of victims to entrust him with their savings. Yet, instead of investing these funds, he embezzled them to Stake, a controversial online casino.

His scheme was simple:

- Collect the money;

- Bet online;

- Justify payment delays by gas fees or technical issues.

The victims, believing in the legitimacy of his crypto operations, saw their savings evaporate. With more than 950,000 dollars embezzled, federal authorities finally intervened, revealing the extent of the fraud. Redzepagic, charged with electronic fraud, money laundering, and false declarations to the IRS, now faces up to 375 years in prison.

Cryptocurrency: why are investors so vulnerable?

Bitcoin and cryptos generally, with their promises of decentralization and rapid returns, attract as much investors as fraudsters. However, the lack of regulation and the relative anonymity of transactions make it an ideal playground for scammers. In Redzepagic’s case, victims’ trust was exploited through promises of high gains and a professional appearance.

Investors, often rushed by fear of missing out, sometimes fail to verify intermediaries’ legitimacy. Crypto fraudsters take advantage of this haste to create complex schemes, like Redzepagic’s, where funds are diverted to online betting platforms instead of real investments.

How to protect yourself from crypto scams in 2026?

Facing the resurgence of crypto frauds, adopting rigorous practices is essential. First, always verify the legitimacy of intermediaries. Look for tangible proofs of their success, such as independent audits or verified testimonials. Beware of promises of excessively high returns, often a sign of a scam.

Next, secure your funds by using reputable crypto wallets and avoid entrusting your assets to third parties. Favor regulated and transparent platforms that offer better protection against fraud. Finally, if in doubt, report any suspicious activity to the competent authorities.

The Redzepagic case starkly reminds us of the danger of cryptos, where trust and vulnerability coexist. As frauds and scams multiply, investors must be extra cautious. Should we wait for stricter regulation, or will distrust eventually slow innovation in this promising sector?

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

The world is evolving and adaptation is the best weapon to survive in this undulating universe. Originally a crypto community manager, I am interested in anything that is directly or indirectly related to blockchain and its derivatives. To share my experience and promote a field that I am passionate about, nothing is better than writing informative and relaxed articles.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.