Increased Volatility And Complex Context: A Critical Week For Bitcoin

Bitcoin starts the week flirting with 107,000 dollars, but caution remains essential. Between recent liquidations, macroeconomic uncertainties, and technical signals, here are 5 key points to watch to anticipate movements and seize opportunities in this booming market.

In brief

- Bitcoin reached a new weekly closing record of about 106,500 dollars.

- A massive 673 million dollar liquidation in 24 hours amplified volatility.

- The macroeconomic context remains complex with a low probability of rate cuts and a decline of the dollar.

- The correlation between bitcoin and stock markets varies, affecting mixed investment strategies.

- Spot volumes on Binance show a resurgence of buying, but a too rapid rise may announce a local peak and correction.

5 key factors on bitcoin this week

Bitcoin plunges to 102,000 dollars on May 19 and caution is more important than ever. Here are the 5 essential factors you absolutely need to know this week to avoid making bad choices.

Bitcoin: a new weekly closing record

Earlier that day, bitcoin reached a record weekly close of about 106,500 dollars, an unprecedented level that demonstrates the market’s strength despite significant volatility. This close validates the ongoing bullish momentum and shows that investors remain confident.

This historic peak marks a key milestone in BTC’s recovery since its April low. It is also a strong technical signal that could attract more buyers in the medium term. However, this level remains fragile and requires confirmation through support around 100,000 dollars.

The liquidation phenomenon: increased volatility

Bitcoin approaching 107,000 dollars triggered a classic massive liquidation phenomenon, amplifying volatility. This movement:

- Forced many short-position traders out via a “short squeeze“;

- Trapped late buyers, causing a rapid price reversal;

- Generated over 673 million dollars in liquidations in 24 hours.

These liquidations are frequent when testing peaks, where the search for liquidity creates strong oscillations. They reflect a market in an unstable balance between optimism and caution.

The macroeconomic context as a backdrop

Bitcoin operates in a complex macroeconomic environment, impacted by:

- Moody’s downgrade of the US credit rating, causing a 1% drop in stock indices;

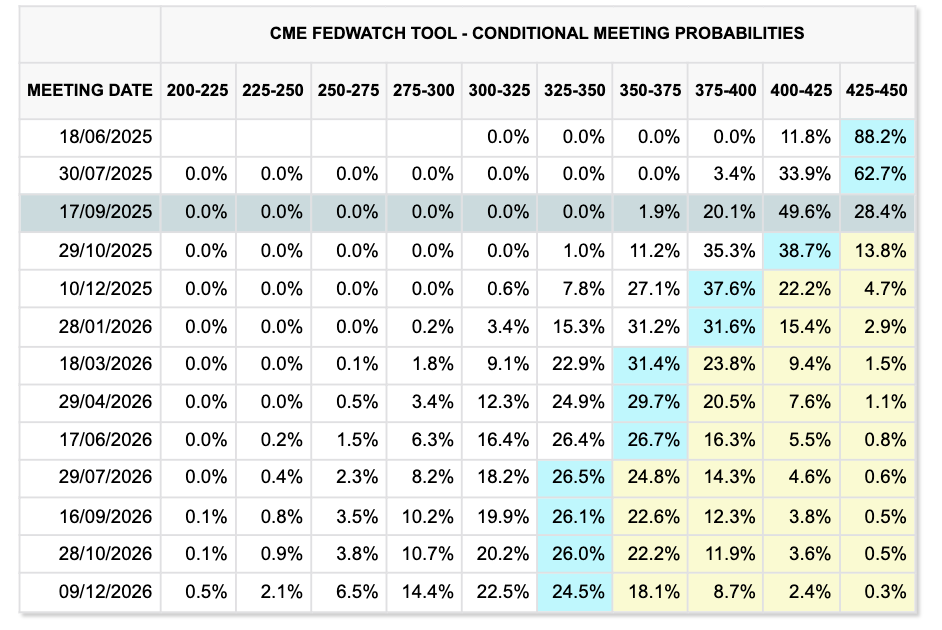

- The low probability of a Fed rate cut in June, estimated at only 12%;

- The US dollar (DXY) declining about 2% since early May.

All this strengthens the appeal of safe-haven assets like bitcoin, which has gained over 40% since its April low. This situation creates strong uncertainty, with crypto sometimes acting as a hedge against traditional volatility.

Bitcoin: fluctuating correlation with traditional markets

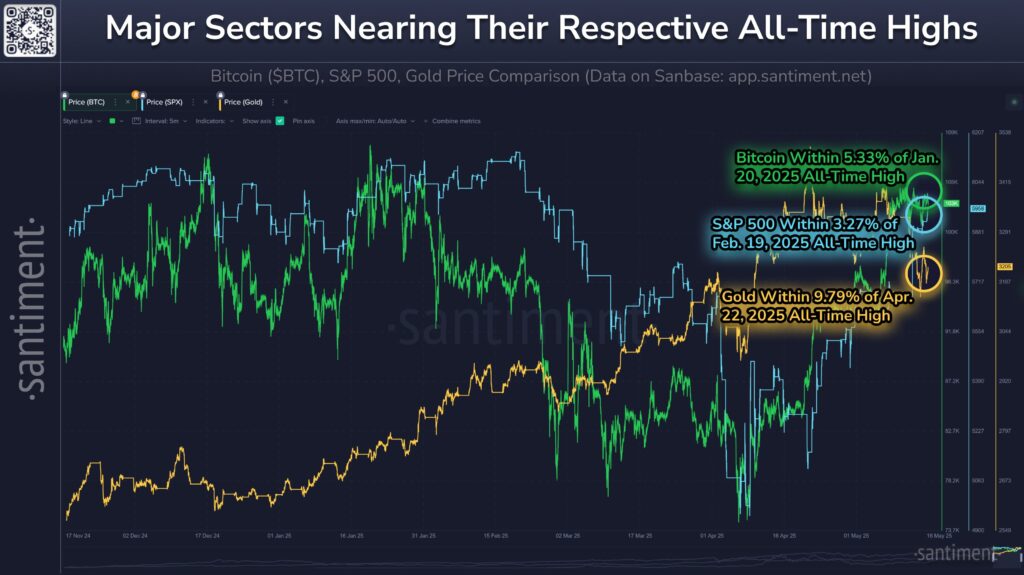

The correlation between Bitcoin and US stock markets varies depending on the time horizon: it is often negative short-term but turns positive over a one-month period. Over the past 30 days, the correlation between BTC and the S&P 500 is around +0.4, whereas it was negative (-0.3) the previous week.

This variability makes movement prediction more complex and impacts investment strategies in mixed crypto-traditional portfolios. Bitcoin also closed two consecutive weeks above a key Fibonacci level, signifying its progressive integration into global financial cycles.

The role of spot volumes in forecasting bitcoin trends

Analysis of spot volumes on Binance reveals renewed sustained buying, with:

- A notable 15% net delta volume increase in one week, indicating more buy orders than sell orders;

- A significant decline in selling pressure, a sign of increased confidence;

- Total liquidations reached 673 million dollars over 24 hours, indicating a rapid market turnaround.

Historically, too rapid increases in spot volumes have often preceded major corrections, as in January and April 2025, signaling a possible local peak. Monitoring these indicators provides a valuable tool to anticipate the durability of BTC price movements and avoid risky entries into an overheated market.

Navigating uncertainty: bitcoin challenges and strategies for the coming week

These five key points reveal a bitcoin market at a crossroads, oscillating between bullish ambition and strategic caution. The extreme volatility linked to liquidations, combined with an uncertain macroeconomic context and fluctuating correlation with traditional markets, underscores the complexity of an evolving environment.

Monitoring onchain indicators like spot volumes becomes essential to avoid pitfalls in a sometimes unpredictable market. This analysis offers investors a framework for navigating wisely in the coming weeks, where decisions will be crucial.

After near touching 105,000 dollars, bitcoin now moves between historic records and increased volatility. This duality raises a major question: is the market ready for a lasting breakout or is it heading towards a new phase of uncertainty? The answer will shape the future of cryptocurrencies.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

The world is evolving and adaptation is the best weapon to survive in this undulating universe. Originally a crypto community manager, I am interested in anything that is directly or indirectly related to blockchain and its derivatives. To share my experience and promote a field that I am passionate about, nothing is better than writing informative and relaxed articles.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.