Institutions Return To Bitcoin ETF In Post-Crash Rebound

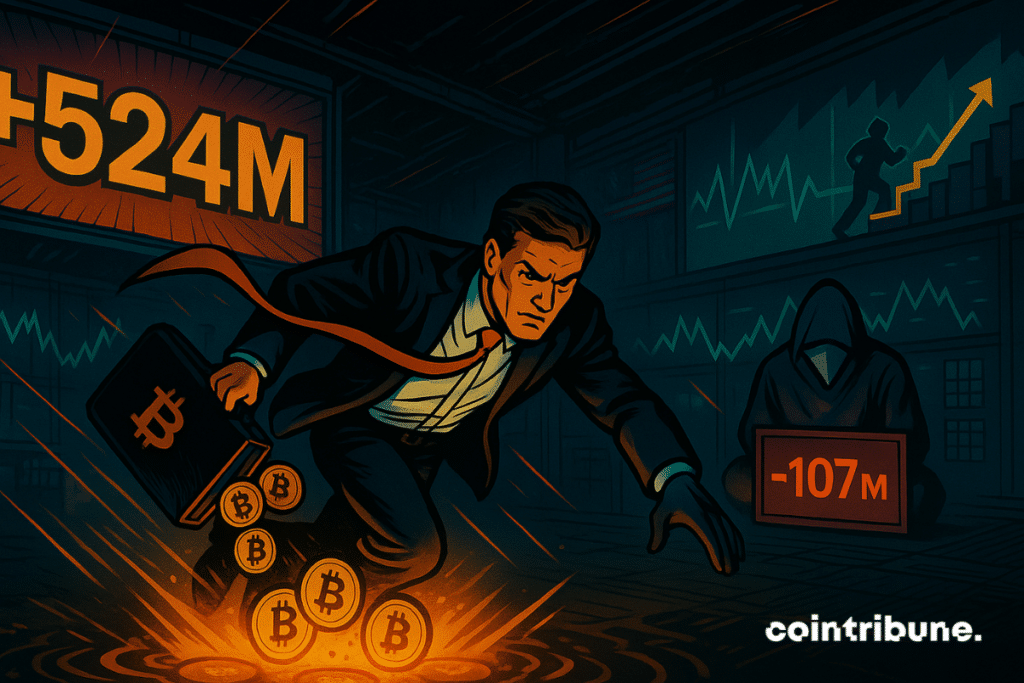

Bitcoin ETFs mark their best day since the October crash. The data indeed reports $524 million in net inflows. A rebound that could well signal the end of the institutional de-risking phase. More details in the following paragraphs !

In brief

- Bitcoin ETFs record $524 million in net inflows, signaling a marked institutional return.

- Solana also attracts positive flows, while Ethereum continues to undergo massive and repeated outflows.

Bitcoin regains favor with ETFs

On Tuesday, November 11, the Bitcoin ETFs listed in the United States recorded $524 million in net inflows. A record since October 7 ! BlackRock (IBIT) captured $224.2 million, Fidelity (FBTC) $165.9 million, and ARK Invest (ARKB) $102.5 million.

These flows mark a turning point after a month of outflows. Many investors fled crypto products exposed to bitcoin. They also reflect a post-crash deleveraging context.

This notably refers to the K33 Research indicator which displays a decline of -29,008 BTC over 30 days. This is an unprecedented outflow sequence since March. For crypto analysts, this phase reflects a temporary reduction of risk exposure (without questioning the bullish cycle).

Not all crypto ETFs benefit from the current enthusiasm

Ethereum ETFs suffered $107 million in withdrawals on the same day. They thus continue a negative streak exceeding $615 million this month. Meanwhile, Solana attracts with $8 million in inflows. Enough to confirm a long-term trend. Since their launch, Solana ETFs have accumulated $350.5 million.

The crypto market awaits the November 13 CPI, which is decisive to confirm monetary easing. Moderate inflation could indeed extend the recovery phase. If ETFs continue to attract capital, the technical threshold of $108,000 on bitcoin could break. But without a strong catalyst, consolidation around $100,000 remains likely.

The momentum of Bitcoin ETFs in any case reignites debates on the role of institutional funds in the next market phase. As macro signals evolve, one question remains: how far will these flows be able to push adoption and above all, who will remain on board at the next turning point?

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

My name is Ariela, and I am 31 years old. I have been working in the field of web writing for 7 years now. I only discovered trading and cryptocurrency a few years ago, but it is a universe that greatly interests me. The topics covered on the platform allow me to learn more. A singer in my spare time, I also cultivate a great passion for music and reading (and animals!)

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.