Is Bitcoin Finally Ready to Bounce Back? What the Signals Say

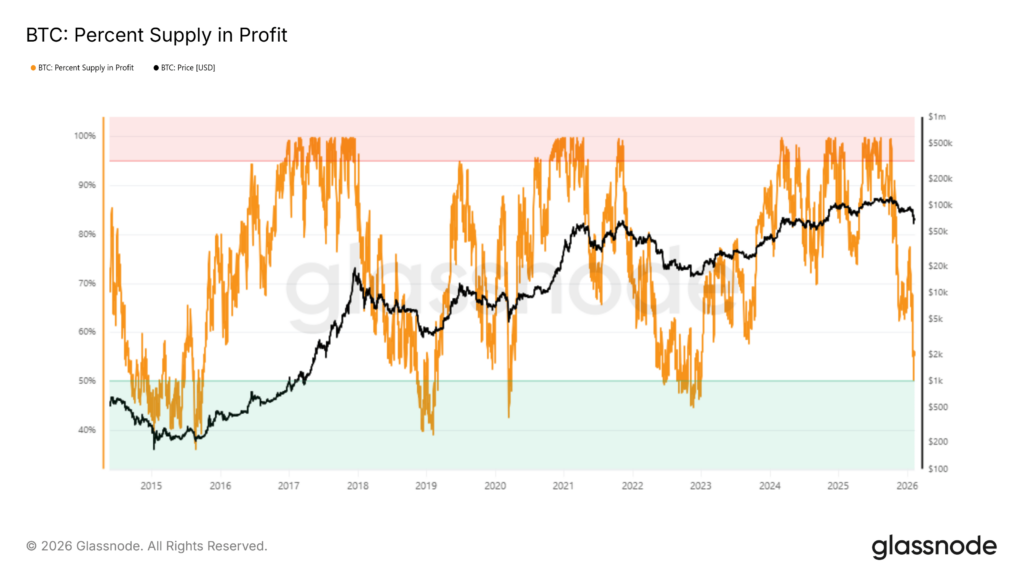

For the first time since 2022, bitcoin is sending a bottom signal, a rare technical indicator that is attracting investors’ interest. This phenomenon, confirmed by the drop of the profitable supply to 50%, could mark a turning point after months of volatility. What are the key levels to watch and what strategies to adopt?

In brief

- Bitcoin shows a rare bottom signal in 3 years, with profitable supply falling to 50%, a threshold historically linked to recoveries.

- Key levels to watch for BTC include support at $63,007 and major resistance at $71,672.

- Long-term buying opportunities for investors, short-term risk management and caution regarding persistent volatility.

What is a bottom signal and why is it significant for bitcoin?

A bottom signal, or “bottom signal”, indicates that an asset has reached a floor after a prolonged period of decline. For bitcoin, this signal is particularly relevant since it coincides with profitable supply dropping to 50%! A threshold historically linked to bear market phases. This phenomenon suggests that BTC holders are less inclined to sell, thus reducing selling pressure.

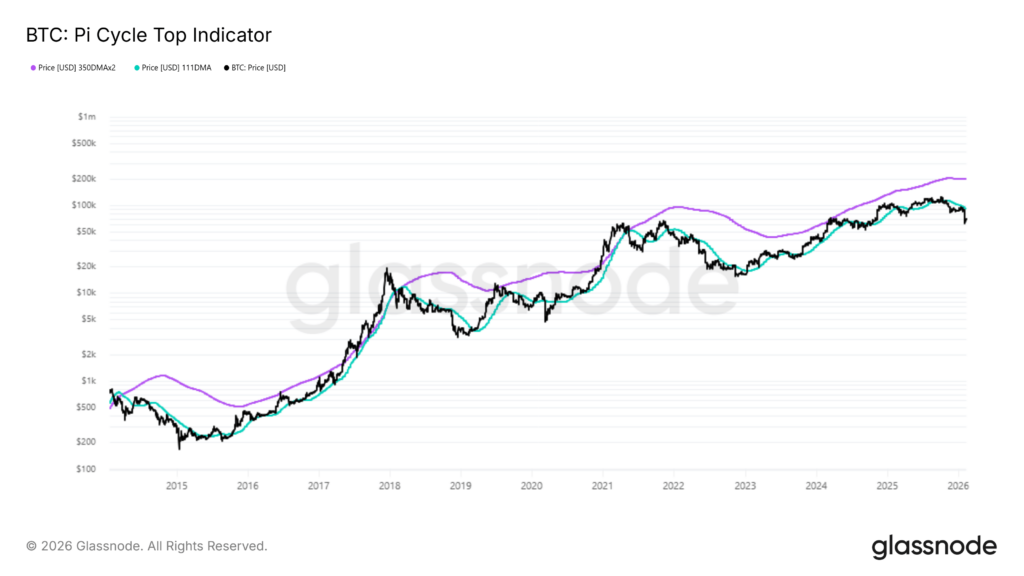

Previous cycles, like those of 2018, 2020, and 2022, show that this type of signal often preceded significant recoveries. For example, after the 2022 signal, bitcoin experienced a gradual rise despite an uncertain macroeconomic context. Additionally, indicators like the Pi Cycle Top Indicator confirm that the market is not overheated, thus reinforcing the idea of consolidation.

Bitcoin: here are the price levels to watch today

Currently, bitcoin is holding above the immediate support at $63,007, a level corresponding to the 23.6% Fibonacci retracement. However, the key short-term resistance is at $71,672. If this level is overcome, BTC could target $78,676! Then $85,680 to confirm sustained recovery, triggering a real bull rally.

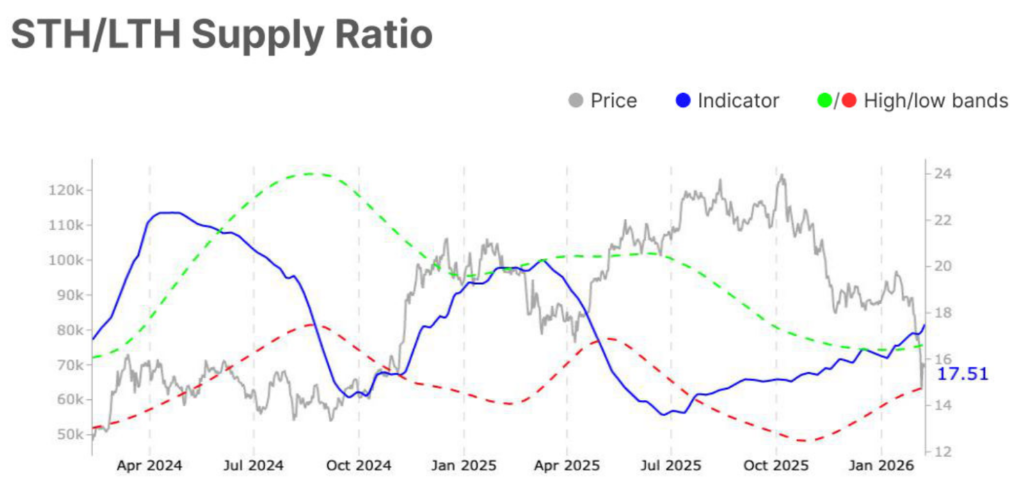

Conversely, if bitcoin fails to surpass $71,672, a return to $63,000 remains likely, temporarily invalidating the bullish thesis. The STH/LTH ratio (Short-Term Holder / Long-Term Holder) also plays a crucial role. Currently high, it reflects increased participation from short-term holders, often synonymous with volatility.

Investment Strategies on BTC

For long-term investors, this bottom signal represents a potential opportunity. Historically, buying during such signals has often been rewarded with significant gains once the market resumed upward. However, it is essential to diversify your portfolio to limit risks related to bitcoin’s persistent volatility.

Short-term traders, on the other hand, must adopt a cautious approach. Indeed, increased volatility and critical resistance levels require rigorous risk management. Especially since external catalysts, such as regulations, institutional adoption, or technological innovations, could influence the market in the coming months.

The bitcoin bottom signal in 2026 opens interesting prospects but also challenges for investors. Between buying opportunities and risks of volatility for BTC, caution remains essential. By monitoring key levels and adapting your strategies, you will maximize your chances of benefiting from this market phase.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

The world is evolving and adaptation is the best weapon to survive in this undulating universe. Originally a crypto community manager, I am interested in anything that is directly or indirectly related to blockchain and its derivatives. To share my experience and promote a field that I am passionate about, nothing is better than writing informative and relaxed articles.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.