JPMorgan closes the accounts of Strike CEO: Crypto debanking relaunched?

A tweet was enough to reveal a deep rift between traditional finance and the crypto universe. Jack Mallers, CEO of Strike, announced that JPMorgan Chase had closed his accounts without clear explanation. This incident raises a crucial question: why are traditional banks pushing crypto actors out?

In brief

- JPMorgan closes the accounts of Jack Mallers, CEO of Strike, without providing a clear explanation.

- This case is part of a growing trend of debanking crypto actors by traditional banks.

- The opacity of this decision raises questions about the relationship between traditional finance and the crypto ecosystem.

JPMorgan VS Jack Mallers: a bank exclusion with unclear boundaries

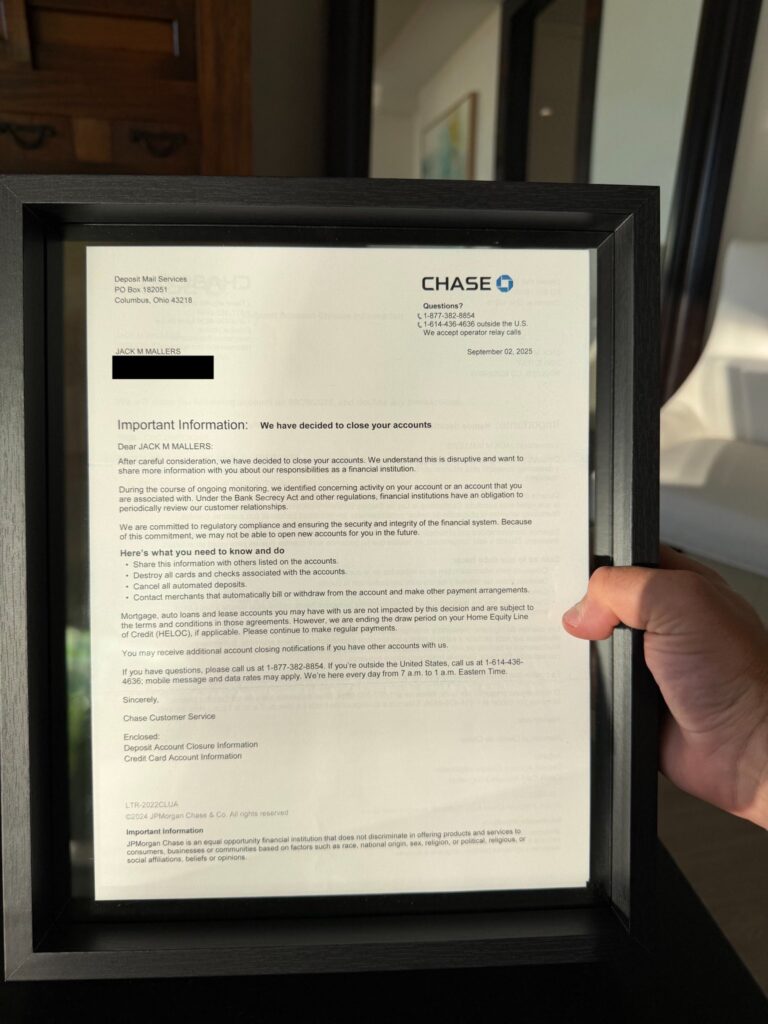

On November 23, 2025, Jack Mallers, founder of Strike, a Bitcoin payment platform, shared explosive information on X: JPMorgan Chase had closed his personal accounts. According to Mallers, this decision, described as “strange“, occurred without transparent justification, despite his repeated requests. Worse, his father, a client of the bank for over 30 years, could not obtain any explanation.

The letter from JPMorgan, dated September 2, 2025, mentions “concerning activities” and legal obligations, including the Bank Secrecy Act. However, no concrete details are provided, leaving doubt about the bank’s true motivations. Is this a simple rigid application of rules, or targeted mistrust towards crypto actors?

After the closure of Jack Mallers’ bank account by JPMorgan, reactions were quick. The crypto community expressed support for Jack Mallers, denouncing JPMorgan’s opacity. Some see it as an attempt to muzzle innovators, while others highlight the hypocrisy of a bank that, while exploring blockchain, excludes those building it. Still, others, more extreme, call for a boycott of JPMorgan.

Crypto debanking: a rising phenomenon

The case of Jack Mallers is not incidental. For several years, participants in the crypto sector have experienced what is called “debanking”: the arbitrary closure of their bank accounts. Binance, Kraken, and even independent developers have been affected. Banks often invoke compliance reasons, such as anti-money laundering or counter-terrorism financing.

Yet, this practice raises questions. Why are crypto actors disproportionately targeted? Traditional banks, which manage financial flows much larger and sometimes opaque on a daily basis, seem to apply stricter rules to the cryptocurrency ecosystem. The consequences are severe: difficulties paying salaries, managing cash flow, or even opening new accounts.

Bitcoin, a response to banking censorship?

Faced with exclusion from traditional banks, bitcoin appears as an obvious solution. Designed to resist censorship, it allows users to transfer value without relying on an intermediary. For Jack Mallers and many others, this incident strengthens the argument that BTC is not just a speculative asset, but a tool for financial sovereignty.

The impact on the crypto market could be significant. Bank account closures push users to adopt non-custodial wallets! Also, solutions like the Lightning Network, which facilitate fast and low-cost transactions. Some analysts even suggest these events could support Bitcoin’s (BTC) price by increasing demand for an asset perceived as a refuge against arbitrary banking.

The Jack Mallers vs JPMorgan case illustrates growing tensions between traditional banks and the crypto ecosystem. Denounced by Donald Trump, debanking could well accelerate the adoption of bitcoin and decentralized solutions. In your opinion, will this rift lead to peaceful coexistence, or a definitive split between two financial worlds?

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

The world is evolving and adaptation is the best weapon to survive in this undulating universe. Originally a crypto community manager, I am interested in anything that is directly or indirectly related to blockchain and its derivatives. To share my experience and promote a field that I am passionate about, nothing is better than writing informative and relaxed articles.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.