Memecoins Power Crypto Market Rebound as Sector Surges After Flash Crash

After one of the steepest sell-offs in crypto history, digital assets have begun to recover. A renewed wave of buying has lifted both memecoins and major tokens, driven by easing tensions between the U.S. and China and a rebound in overall market sentiment.

In brief

- Memecoin market cap jumps to $68.8B, with Dogecoin, WIF, and PENGU leading double-digit gains.

- Bitcoin recovers to $115,227 after flash crash; major altcoins like ETH and SOL also rally.

- Arjun Vijay calls the crash a “temporary glitch,” driven by cascading liquidations and leverage.

- Analysts say the correction cleared excess leverage, setting the stage for a stronger market rebound.

Top Memecoins Surge as Crypto Market Recovers from Massive Selloff

Memecoins staged a sharp recovery on Monday as crypto markets bounced back from one of the worst liquidation events in recent history. The sector’s total market capitalization climbed to $68.8 billion, up 12.6% on the day, according to market data.

Here’s how the top memecoins performed during the session:

- Dogecoin (DOGE) jumped 11.9% to trade at $0.21, leading the memecoin rebound.

- Dogwifhat (WIF) posted the strongest gain, soaring 18.4% in 24 hours.

- Pudgy Penguins (PENGU) followed closely with a 17.5% surge as traders returned to riskier assets.

- Pepe (PEPE) also advanced, climbing 13.2% amid renewed market momentum.

- Bonk (BONK) rose 15.3%, extending its strong performance from last week.

- Shiba Inu (SHIB) added 9.4%, rounding out the memecoin sector’s broad recovery.

The strong performance across memecoins reflected a renewed appetite for risk following last week’s market turmoil.

Friday’s selloff wiped out nearly $20 billion in digital asset positions, with Bitcoin (BTC) plunging from $121,000 to as low as $109,000 in a single day. By Monday morning, BTC had recovered to $115,227, up 2.9%, while major altcoins also rallied—Ethereum (ETH) rose 8.4%, BNB (BNB) gained 12.2%, and Solana (SOL) added 8.7%.

Arjun Vijay Calls Flash Crash a ‘Temporary Glitch’ as Memecoins Lead the Comeback

Arjun Vijay, the founder of the crypto exchange Giottus, said the rebound was expected following the recent “flash crash.” He explained that cascading liquidations drove the previous drop and that high-risk assets, such as memecoins, typically recover the fastest during market rebounds.

The flash crash was a temporary glitch and was caused by the cascading liquidations, and everyone was expecting a rebound. During the rebound, the riskiest assets and those that crashed the most are expected to rebound the maximum. So it is no surprise that people are betting on memecoins, and this is leading to a virtuous cycle.

Arjun Vijay

The crash was triggered by President Donald Trump’s announcement of a “massive increase” in tariffs on Chinese imports, as well as the cancellation of a planned meeting with President Xi Jinping.

Predictably, the move sparked fears of renewed trade tensions, sending global markets lower and fueling liquidations across crypto exchanges. However, sentiment improved over the weekend.

Crypto Correction Clears Excessive Leverage, Paving Way for Stronger Market

A spokesperson for China’s Ministry of Commerce accused the United States of unfair trade actions and excessive export controls. Later, Trump struck a more conciliatory tone on Truth Social, saying the U.S. aims to support rather than harm China.

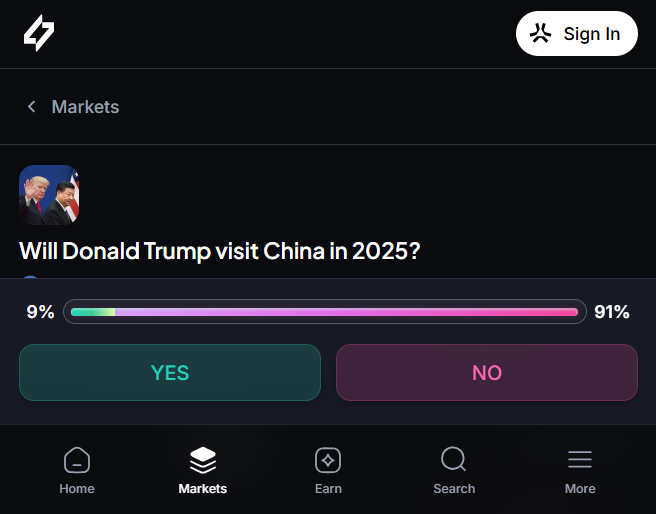

Prediction markets on Myriad still assign only a 9% chance of Trump visiting China before the end of the year, reflecting lingering uncertainty.

Despite the volatility, market participants say the correction could ultimately strengthen the crypto ecosystem. Charmaine Tam, head of OTC sales and trading at Hex Trust, called the event “a healthy reset.”

Tam noted that the recent market drop helped clear excessive leverage from the system, describing it as a constructive correction that could strengthen the market over time. She added that institutional infrastructure remained stable throughout the volatility. With Bitcoin’s dominance staying below 60.5%, altcoins may now be positioned to lead as liquidity returns.

As risk appetite improves and geopolitical concerns ease, memecoins appear to be at the forefront of the recovery—once again proving their ability to capture momentum when markets turn.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

James Godstime is a crypto journalist and market analyst with over three years of experience in crypto, Web3, and finance. He simplifies complex and technical ideas to engage readers. Outside of work, he enjoys football and tennis, which he follows passionately.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.