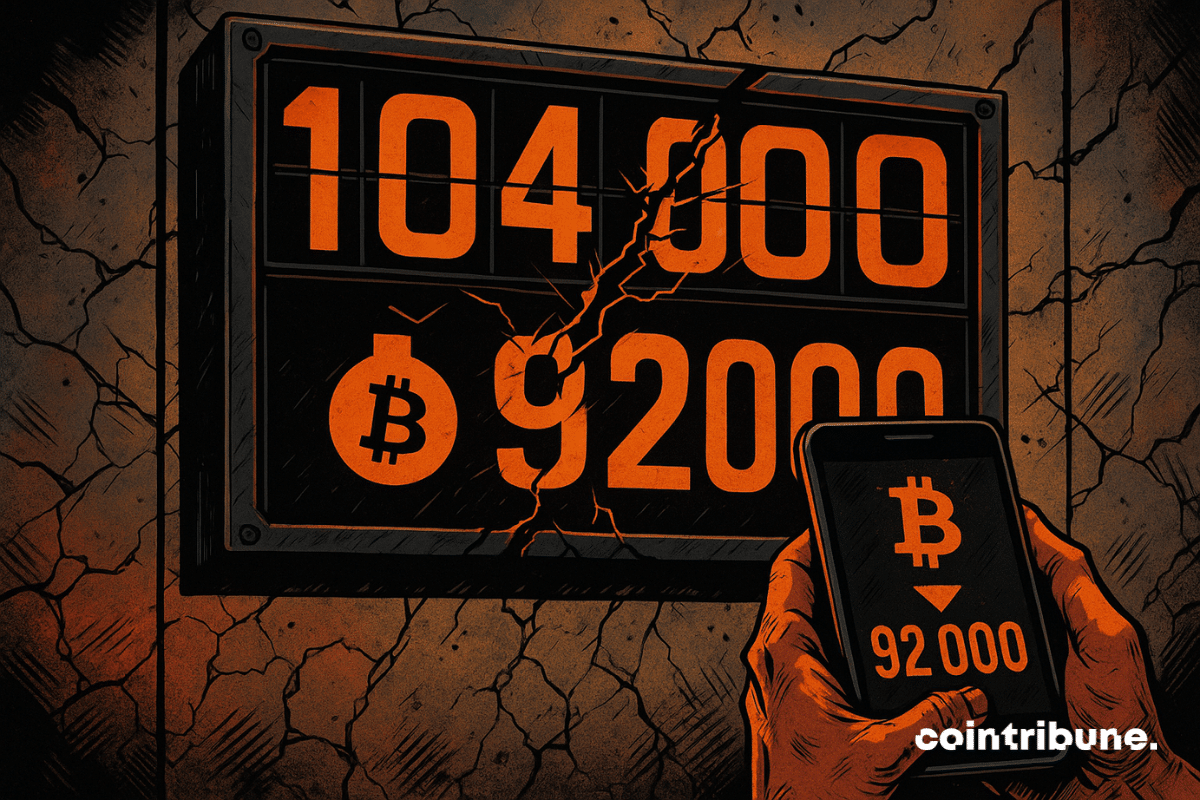

Bitcoin has just fallen back below $100,000, reviving doubts about the strength of its upward trend. Behind this symbolic threshold lies a weakened market, caught between weakening demand and macroeconomic tensions. For CryptoQuant, the threat is clear. If this support does not hold, BTC could plunge to $72,000 within two months. A scenario that worries, as technical and fundamental signals turn red.

Crypto News

While traditional markets waver under the weight of macroeconomic uncertainties, the crypto ecosystem goes through an unprecedented turbulence zone. Bitcoin falls below $104,000, dragging all other assets along with it. However, this correction goes beyond the usual volatility. Investor sentiment collapses, switching from optimism to extreme fear in a few days. This sudden reversal marks a major trend break, which could well redefine the market balance in the short term.

Institutional traders have just reached a historic milestone: 80% of Bitget's volume now belongs to them. A revolution that redefines crypto markets, with record flows and unmatched liquidity. Why does this dominance change everything for investors?

In a rebuilding sector, Ripple takes a strategic step by launching its primary spot brokerage service aimed at American institutions. This turning point, made official at the Swell 2025 conference in New York, relies on the acquisition of Hidden Road, finalized in October. By betting on an integrated infrastructure, Ripple intends to capture a growing demand for professional asset trading services, at a time when market standards are being redefined.

Bitcoin slips, whales abandon, small holders capitulate... what if the famous $92,000 gap became the new stopover? Bearish mood guaranteed.

The Ethereum Foundation changes the game: no more random grants, instead an ultra-targeted strategy to boost innovation. Wishlist, RFPs and impacts on ETH... Decoding a revolution that could redefine the future of crypto and make prices explode.

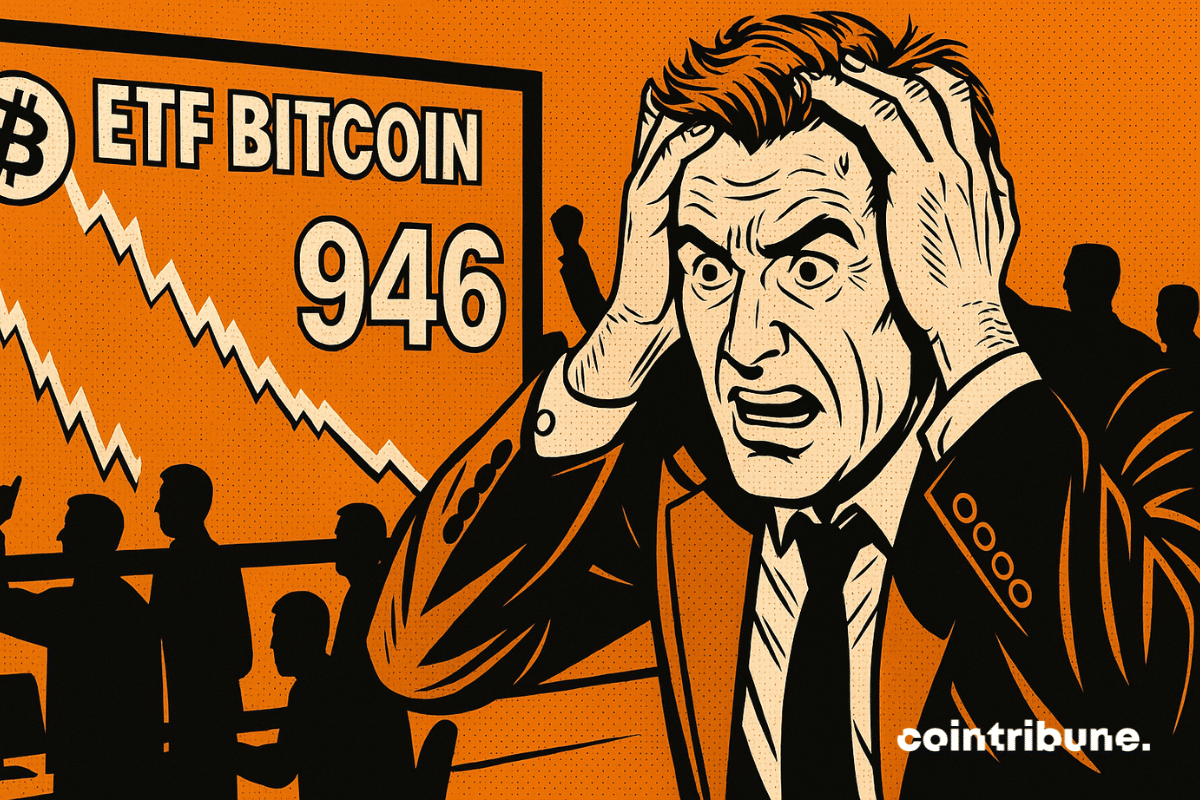

American Bitcoin ETFs experienced a massive outflow of capital last week. Institutional investors turned away after Jerome Powell dashed hopes of a rate cut in December. Contrary to this, Solana ETFs stand out with record inflows.

The crypto market experienced a sharp decline at the start of the week. While US stocks remained in the green, Bitcoin, Ethereum, and Dogecoin collapsed, triggering over $1.1 billion in liquidations within 24 hours. A sudden drop, without a clear catalyst, revealing the weaknesses of an ecosystem still unstable and vulnerable to panic movements. This massive setback rekindles doubts about the market's strength and investors’ resilience amid an ever unpredictable volatility.

Michael Saylor replenishes his Bitcoin treasury, but at a less frantic pace: simple strategy or market warning? Analysis.

Bitcoin falters in November 2025: between technical drops, investor withdrawals, and macroeconomic tensions, the crypto defies its historical trends. Why does this "cautious calm" hide major risks? Exclusive analysis of the 5 signals to watch to anticipate the next wave of volatility.

Are cryptos on their way to becoming a burden for French investors? A recently adopted amendment in the National Assembly could change the game. Bitcoin, Ethereum, and other digital assets would soon be taxed as "unproductive wealth," on the same level as yachts and hoarded gold.

Ethereum stablecoin activity hit $2.82 trillion in October, exceeding September’s volume with USDC leading the market.

Tom Lee, an iconic figure of crypto optimism, just unveiled a projection that is a bombshell in the ecosystem. According to him, Bitcoin could reach between 1.6 and 2 million dollars by 2030. But that's not all: he even mentions a 3 million scenario. How does he justify such ambition?

XRP has just experienced a historic boom: a 100% explosion of new users in just a few days. Transaction records, rising volumes and price under pressure — what's behind this sudden frenzy around Ripple's crypto (XRP)? Dive into the analysis of the numbers and stakes.

In seven days, the asset's realized capitalization jumped by 8 billion dollars, marking a spike in on-chain activity rarely seen outside periods of extreme tension. This indicator, which measures investments actually committed, suggests a possible bullish return. Yet, despite this structural effervescence, the spot price of bitcoin remains frozen. A dissonance arises between internal network movement and the inertia of external flows.

Bitcoin and Ethereum are subject to massive withdrawals of several billion dollars from exchanges, a rare phenomenon that intrigues investors. While gold collapses, these cryptos resist. Is it a sign of a historic rebound or mere caution? Dive into the on-chain data analysis and trends that could change everything.

Coinbase faced questions over its contributions to a Trump-linked White House ballroom, with the company defending its donations and political involvement.

Long overshadowed by regulatory constraints and the rise of centralized platforms, Zcash makes an unexpected comeback to the forefront of the crypto scene. Driven by a spectacular rise in its price and growing adoption of its privacy features, the project regains momentum. At a time when demand for private transactions is exploding, Electric Coin Company unveils an ambitious roadmap to assert Zcash's central role in the ecosystem.

Christine Lagarde presents the digital euro as a symbol of trust and unity, promising to revolutionize payments in Europe. But this ambitious project also raises passionate debates: financial sovereignty or risk of increased surveillance? Discover the issues and controversies behind this innovation and the hidden role of bitcoin.

Faruk Fatih Özer, former CEO of the crypto exchange Thodex, was found dead in his cell in Tekirdağ. Turkish authorities are conducting an investigation and currently favor the hypothesis of suicide. Thodex collapsed in 2021 after the withdrawal freeze, before Özer's flight and then his extradition in 2022. In 2023, he was sentenced to a cumulative 11,196 years for fraud and related offenses.

Solana ETFs have just achieved a historic feat: nearly 200 million dollars raised in only four days. Yet, the price of SOL drops by 1.5%. A paradox that raises questions: will these new financial products finally propel the Solana crypto to new heights?

Crypto explosion: Zcash emerges from an 8-year bearish cycle and climbs to the top. We tell you more in this article.

Bitcoin just experienced a red October, a first since 2018. November, historically a bullish month for BTC, could it change everything? Between hoped-for rebound and risks of decline, here is what experts predict and strategies to adopt to not miss the movement.

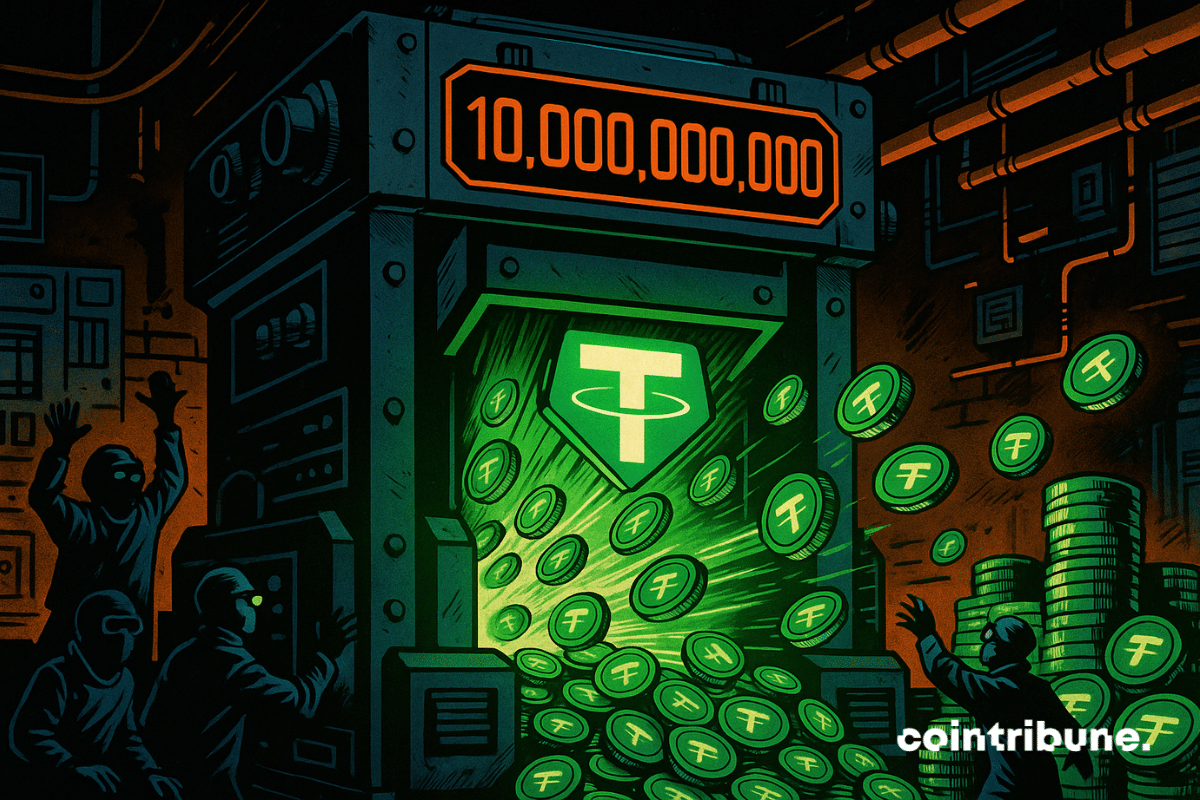

Tether has just crossed a dizzying threshold: more than $10 billion in profit in just nine months. Behind this extraordinary figure lies the rise of a key player in the crypto ecosystem. Issuer of the USDT, the most used stablecoin in the world, Tether impresses as much as it raises questions. This record profitability, revealed in its latest attestation report, triggers as much enthusiasm as concerns, especially in terms of transparency and regulation.

Seventeen years after the publication of the white paper by Satoshi Nakamoto, bitcoin is no longer a niche bet. It is a global asset worth 2 trillion dollars. Yet, on this October 31, the market turns the page on a thwarted "Uptober." October closes in red for the first time since 2018. A signal to be read carefully, without melodrama.

While institutional interest in cryptos is rising again, the decisions of major players capture all the attention. This November 1st, Ripple plans to unlock 1 billion XRP, which is more than 2.4 billion dollars at the current price, from its escrow accounts, as part of a mechanism established in 2017 to regulate the supply. A regular operation, but one that, in the current climate, raises questions about liquidity strategies and market balance.

Despite the paralysis of the federal government, Republican lawmakers are staying the course on their ambitious crypto schedule. Several key senators say they want to pass a landmark digital assets law before the end of the year. But will this promise hold against the budget deadlock blocking Washington?

The Basel Committee's rules on cryptocurrencies could change the game in 2026. Between bank adoption of stablecoins and crypto integration, a financial revolution is underway. Are banks ready to take the leap? The answer could change everything for your investments.

A false information involving Changpeng Zhao in an alleged massive sale of ASTER tokens triggered a real earthquake on the crypto markets. The token of the decentralized platform Aster plummeted sharply, dragging millions of dollars in liquidations behind it. But what really happened?

In October, the Bitcoin market confirmed its vitality despite a sharp price correction. Spot volume exceeded 300 billion dollars, a sign of a return to "cash" trading and a reduction in leverage usage. According to CryptoQuant, this dynamic reflects a healthier market, capable of withstanding volatility without a sudden collapse. In short, despite the drop in BTC, investors, whether retail or institutional, show renewed confidence in the spot market, marking a structural evolution of the market towards greater stability.