Behind the apparent rise of XRP, the technical signals turn red. While Ripple's crypto shows a sustained price, the on-chain data reveal a worrying fragility: a large share of recent investors are at a loss, exposing the market to potentially explosive selling pressure.

Crypto News

While traditional markets are wavering in anticipation of Nvidia's results, bitcoin surprises by rebounding 4% on Tuesday. In a tense atmosphere, the crypto escapes the declining US stock indices and intrigues investors. Is this surge a sign of a new bullish momentum or merely a speculative spike? The timing, on the eve of a key verdict on AI, makes this move all the more strategic.

The crypto market is wobbling. Bitcoin lost more than 10% in a few days and struggles to regain momentum. Arthur Hayes, a prominent figure in the ecosystem, points to an unexpected culprit: the contraction of dollar liquidity. His thesis challenges conventional analyses and opens a debate on the real drivers of the market.

Trump tightens the screws: after flirting with crypto, he is now ready to unleash the IRS on digital havens... Soon audits on wallets hidden in the Bahamas?

Growing U.S. interest in tightening oversight of offshore digital assets is gaining traction in Washington. Momentum is building as a proposed rule allowing the IRS to access data on Americans’ foreign crypto accounts moves into White House review. Signaling a stronger push to align U.S. tax policy with global reporting standards, the step places cooperation with foreign regulators closer to reality.

The SEC omits crypto from its 2026 priorities. Towards looser regulation and recognition of the sector? Full analysis here!

Global cryptocurrency markets are under heavy pressure after a sharp decline in Bitcoin's value damaged sentiment across the sector. Prices are now giving back most of the gains made earlier in the year, while smaller tokens are falling to multi-year lows. Investors are reassessing risk, trading volumes are shrinking, and several analysts warn that further declines remain possible.

Tom Lee says Ethereum is entering the same supercycle that propelled Bitcoin’s historic surge, noting the move will require holding through market ups and downs.

Strategy has just reached a new milestone in its bitcoin accumulation strategy. Michael Saylor's company acquired 8,178 BTC for 835 million dollars, marking a spectacular acceleration of its investments. This operation occurs in a context of high volatility, where the bitcoin price lost 11% in seven days.

Bitcoin, in slide mode, flirts with the precipice of the CME Gap while whales do their shopping. Bounce to come or final plunge? Suspense guaranteed.

Ethereum faces steady ETF outflows, with investors viewing it as riskier than Bitcoin, signaling caution in the market.

Bitcoin facing the law: Nick Szabo reveals a worrying vulnerability that even developers underestimate. Details here!

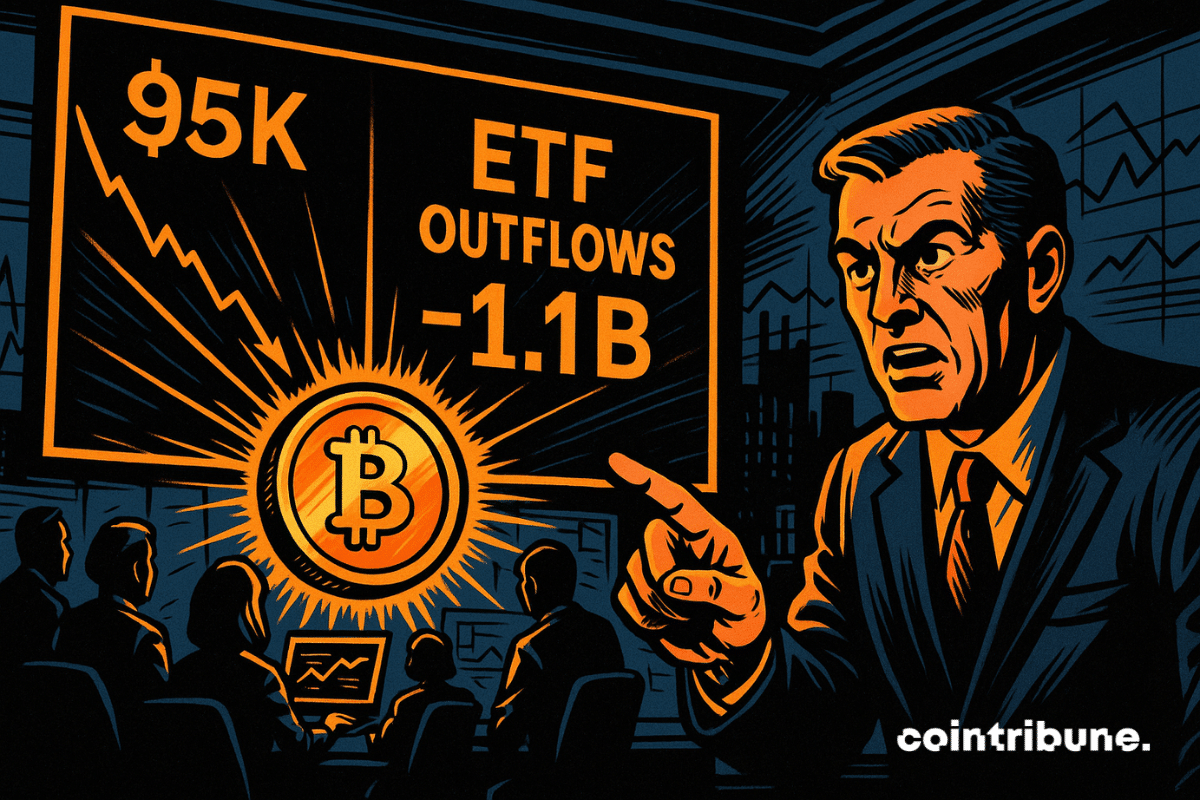

U.S. Bitcoin ETFs faced another difficult week as steady capital outflows added strain to an already uneasy market. Investor caution increased as withdrawals accelerated, pushing Bitcoin further below the $100,000 mark and signaling a broader loss of confidence in digital assets.

The debate between gold and bitcoin takes a new turn. Peter Schiff accuses Michael Saylor of steering Strategy according to a "fraudulent" model based on promises of illusory returns. He proposes a public debate during Binance Blockchain Week in Dubai, in December. In a volatile market, this confrontation crystallizes tensions around the integration of bitcoin into business strategies.

As tension rises in the market, Bitcoin is about to cross a critical technical threshold: the "death cross." This signal, feared by traders, occurs at a pivotal moment, at the intersection of a 25% correction and an uncertain macroeconomic climate. While some see it as a classic bearish indicator, others recall it coincided with market lows. In this context, certainties waver, and each candlestick becomes a test for investor morale.

A sharp shift in sentiment has taken hold across digital assets after a week of sell-offs, weaker macro signals, and thinning liquidity. Markets now sit in a cautious posture, with fear climbing as large-cap tokens retreat toward multi-month lows.

Growing interest in digital assets is prompting investors to reassess which tokens deserve long-term attention. Recent shifts in sentiment around Solana, XRP, and other major networks reflect a market still trying to determine its next set of leaders.

Crypto on promo, X turns a blind eye, Spain pulls out the fine book. Musk aimed for the stars but ends up with his feet in regulatory mud. Cryptos cost.

Chainlink takes the lead in the RWA sector just as the crypto market corrects. Development data on GitHub shows a clear gap with Hedera, Avalanche and others, confirming that Chainlink establishes itself as the technical benchmark of the segment. For institutional investors, this code dominance, despite the price drop, becomes a signal hard to ignore.

CMC messes up, CZ takes a risk, Aster takes off... and the curious watch the screen. When an altcoin creates a rebound while the crypto universe collapses, should you believe it or flee?

At each ETF launch, the crypto market anticipates a price jump. For XRP, backed by the new XRPC fund from Canary Capital, the expected effect did not occur. Despite solid opening volume, the price remained frozen before dropping by 7%. A striking contrast with previous surges triggered by similar announcements. Why hasn’t XRP, despite being in the spotlight, benefited from this institutional momentum?

While the crypto market seeks a new balance, an analysis by Glassnode reveals a major strategic divergence: bitcoin holders hold, Ethereum holders mobilize. Beyond community rivalries, these data reveal two opposing visions of crypto value. One is based on reserve, the other on use. This behavioral gap, often neglected, could well redefine the power balance within a rapidly evolving ecosystem.

Market pressure spiked on Friday as cryptocurrencies dropped sharply, pushing Bitcoin below $94,000 for the first time in six months. The slide stirred fresh concern across trading circles, where rumors spread that Michael Saylor’s firm, Strategy, was unloading part of its massive Bitcoin holdings. However, Saylor quickly stepped in to dismiss the claims, confirming that Strategy hadn’t sold any BTC and had actually increased its position during the week.

Harvard made major moves in its investment portfolio by sharply increasing its Bitcoin and gold ETF holdings.

The crypto market is wavering again, and the same question arises: has bitcoin finally hit rock bottom? While analysts are getting carried away and predictions are proliferating, the Santiment platform calls for caution. According to it, the real market bottoms never occur when everyone is expecting them. Behind collective optimism, it sees a formidable emotional trap, where overconfidence could precede a new downturn. What if the worst is not over yet?

While ETFs backed by SOL have recorded steady inflows for nearly two weeks, its price is plunging, reaching a five-month low. This striking paradox between institutional enthusiasm and spot market weakness raises the question: why does such a supported asset fall so sharply? Away from classic patterns, Solana reveals the deep, sometimes contradictory tensions currently affecting the crypto ecosystem.

As Beijing tightens the grip on stablecoins, Alibaba chooses another path: that of the deposit token backed by banks. This is not a technical detail, it is a full-scale test of the limits of the Chinese model: zero tolerance for private onshore stablecoins, but calculated openness for regulated tokens, useful for exports.

The crypto market is going through a period of intense turbulence. While Bitcoin dangerously slips below the symbolic threshold of 100,000 dollars, gold and silver shine brightly. Investors are turning away from digital assets to seek refuge in commodities. But what explains such a turnaround?

U.S. spot Bitcoin ETFs saw over $860 million withdrawn on Thursday, marking the second-largest outflow ever and adding pressure on Bitcoin’s price.

XRPC, Canary Capital’s new XRP ETF, opened with record inflows as the crypto market weakened and the token dropped 6%.