The stablecoin market has just passed another historic milestone with a total capitalization of 273 billion dollars. Tether consolidates its overwhelming dominance with 165 billion dollars, more than 60% of this booming sector.

Crypto News

What if bitcoin exploded to $280,000 by the end of 2025? This is not just another rumor, but the projection of a respected trading veteran in traditional circles. Peter Brandt, a prominent figure in financial markets for over 40 years, supports a chart model that is making a big noise in the crypto sphere. Built on the analysis of historical cycles, this scenario anticipates a new peak for bitcoin… well beyond current expectations. A forecast that reignites debates as a key market moment approaches.

Nearly 94% of XRP investors are now in the green, a level rarely reached in crypto history. Driven by a surge up to $3.11, the fourth largest crypto by market capitalization triggers as much euphoria as concern. Indeed, previous instances where XRP reached such profitability were followed by sharp corrections, in 2018 as in 2021. This time, is it a new bull cycle... or a precursor sign of a brutal reversal?

Jack Dorsey revives Satoshi Nakamoto's vision: making bitcoin a universal currency for exchange. Faced with speculation and financial markets, can it become everyday money?

Ethereum is soaring, ETFs are rushing in, but beware of overflow: exchange platforms are filling up and ether heats up faster than an insomniac trader's coffee.

Bitcoin is showing signs of slowing momentum. BTC trading volume fell by 28% this week, even as the price climbed modestly to around $117,582. Is capital quietly rotating into altcoins?

Bitcoin wavers below 117,000 dollars as the "Ghost Month" threatens to lead to a drop to 100,000. Between sustained demand in the United States and Korea, and seasonal pressures, the market plays a decisive game.

The crypto market is coming out of its lethargy: the open interest on Bitcoin futures has just exceeded $82.4 billion, an unprecedented level since speculative euphoria phases. While BTC's price remains stable, derivatives are experiencing a clear resurgence in activity. This dynamic, driven by institutional investors and rising leverage, could mark a turning point. Rising futures, options in frenzy: signals are multiplying, and the market seems to be preparing for a new cycle.

Could XRP initiate a decisive turning point? A rarely observed technical signal attracts analysts' attention: Bollinger Bands draw a setup favorable to a trend reversal. While the market remains volatile and volumes decline, the asset shows signs of resilience above a critical threshold. Enough to revive the interest of seasoned investors, on the lookout for a strategic entry point. Is this movement the prelude to a new bullish cycle or just a simple technical rebound?

XRP, long held back by its judicial battle with the SEC, returns to the forefront. While institutional investors quietly strengthen their positions, a series of massive liquidations shakes the market. Between unstable technical signals and behind-the-scenes accumulation strategies, crypto is going through a zone of high instability. Should this be seen as a simple correction or the beginning of a strategic repositioning?

The bullish momentum of bitcoin seems to be fading. After reaching a peak above $124,000, the leading cryptocurrency shows signs of fatigue. Meanwhile, retail investor interest is shifting towards altcoins and Ethereum. Could this capital rotation signal a new phase in the crypto cycle?

Since touching a daily high of $24.74 on August 13, Chainlink’s (LINK) northward price movement has cooled, pushing the asset a few levels lower. Despite LINK’s upward trend stalling, large holders are still accumulating the coin. Generally, these whale buyers view this slip as a “buy the dip” window for a potential next leg higher. So, what are the current bets regarding LINK’s future trend?

A new proposal in the New York State Assembly aims to impose a small tax on cryptocurrency sales and transfers. Assemblymember Phil Steck has introduced legislation seeking a 0.2% excise tax on digital asset transactions, including cryptocurrencies and non-fungible tokens (NFTs). The bill, if passed, could reshape the way the state approaches digital finance while channeling revenue into school-based substance abuse prevention programs.

The crypto market is going through a major redistribution phase. While Ethereum attracts the majority of capital and focuses investors' attention, memecoins are losing ground, seeing their dominance crumble. Dogecoin, Shiba Inu, and Pepe struggle to keep pace. Should this be seen as an end of cycle or just a lull before a new explosive rally?

Gemini, the exchange founded by the Winklevoss brothers, has officially filed its S-1 with the SEC for a Nasdaq IPO. In a context marked by the multiplication of crypto IPOs, this initiative raises as much enthusiasm as questions. The platform's repeated losses and the market's persistent volatility indeed call for a thorough analysis. Will Gemini manage to attract Wall Street despite disappointing financial results?

After several years of heightened caution, the US Federal Reserve changes course regarding banks' crypto activities. The institution ends its specific monitoring program. It believes, indeed, that the risks linked to digital assets are now better understood and manageable within the traditional supervisory framework.

Less than 48 hours after hovering near a peak at 124,000 dollars, bitcoin falls below 117,000 while ether drops to 4,400. This brutal but seemingly classic correction exposed a weak link in the ecosystem: publicly traded companies exposed to cryptos. Thus, this segment long supported by bullish euphoria takes the reversal full on. The market, meanwhile, reminds that it never rewards excess for long.

On August 14, ambiguous remarks by Secretary Scott Bessent triggered a mini-crash, wiping out tens of billions of dollars in capitalization within minutes. While investors feared an official renouncement of any BTC acquisition, a backpedal published on the X platform a few hours later sowed even more confusion about the real strategy of the United States.

This week, the cryptocurrency market was marked by new records and the spectacular rise of certain assets. ADA, the native token of the Cardano blockchain, stood out with a notable performance, exceeding the dollar threshold for the first time in five months.

World Liberty Financial (WLFI), the crypto venture co-founded by Eric Trump and Donald Trump Jr., has taken a major leap into the spotlight. On Wednesday, the brothers joined a Nasdaq bell-ringing ceremony in Times Square, celebrating a $1.5 billion token arrangement that could push their firm into the upper ranks of decentralized finance.

Citigroup bank, once hesitant, now wants to keep your crypto like you keep gold bars: stablecoins in the vault, ETFs in the pocket, all under Washington's watchful eye.

Cardano posted one of its strongest single-day performances of 2025, jumping more than 17% in 24 hours as speculation swirled over a possible Cardano-focused ETF from Grayscale Investments. The rally left Bitcoin and Ethereum trailing and pushed ADA to the number two spot among the day’s top gainers in the crypto market.

Coinbase strikes hard by buying Deribit, leader in crypto options, establishing itself as a central player in derivatives products. This strategic acquisition unifies spot, futures, perpetuals, and options, attracting institutions and experienced traders. In a competitive market, it strengthens Coinbase's appeal and marks a key step towards a global crypto empire.

Ethereum spot ETFs saw heavy inflows this week, led by BlackRock and Fidelity, as investor demand for the asset grows.

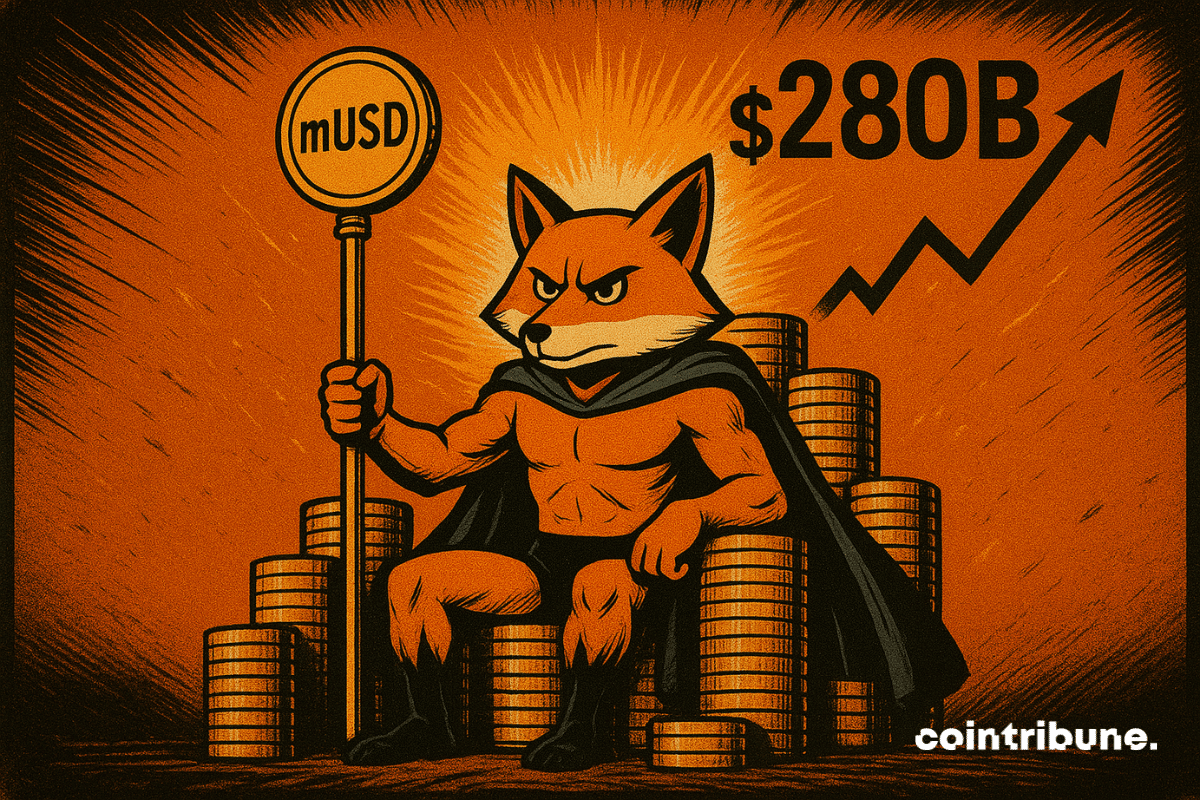

While the market watches ETFs and bitcoin monopolizes headlines, another dynamic, less noisy but more structuring, is underway: the rise of stablecoins. Backed by fiat currencies, these long secondary assets are becoming the backbone of the new digital finance. And at the heart of this transformation, one player stands out: Ethereum. The network is on track to become the central infrastructure of the tokenized monetary system.

Bitcoin reached a historic peak before dropping sharply. Is this the beginning of the end for BTC or just a temporary correction? Discover the reasons behind this downward trajectory and what investors should watch for.

Bitcoin drops below $120,000 following Scott Bessent's statements. What should be expected from the market in the coming days?

Ethereum has rebounded from its end-of-July drop, trading just a few levels shy of its all-time high (ATH), as buyers flood its current price level. Amid this notable trend, market observation tools have spotted an interesting on-chain activity: Ether net outflows have skyrocketed in the past month. This data suggests that crypto participants may be positioning for potential profit-taking.

Grayscale eyes a Cardano ETF, prices soar, and traders speculate. But will ADA be able to maintain its top position or will it fall victim to its own crypto success?

MetaMask is set to dip its toes into an increasingly hot stablecoin market by launching its own U.S. dollar-pegged token, mUSD. The Ethereum wallet provider may announce the plan as early as Thursday, with a complete rollout by the end of the month. The decision represents a wider change toward MetaMask being a crypto gateway to a full-scale financial platform.