Vitalik Buterin considers the Fusaka upgrade and its PeerDAS technology as a decisive turning point for the future of Ethereum. By revolutionizing blockchain data management, this innovation could well solve the complex equation between scalability and decentralization.

Crypto News

Bitcoin briefly plunged below $109,000, recording a three-week low. Hours before the expiration of $22 billion in options scheduled for this Friday, pressure is mounting among investors. In a context of increased volatility and macroeconomic uncertainties, positions are being urgently readjusted. The crypto market is entering a decisive sequence where each level crossed could amplify upcoming movements.

Facing a tense economic context and persistently high rates, some companies are revising their cash management strategies. The latest is the Chinese company Jiuzi Holdings. Listed on Nasdaq but little known to the general public, the Chinese company has just authorized an investment of up to 1 billion dollars in cryptocurrencies. This is an unexpected shift for an actor outside Web3, who is now betting on Bitcoin.

Nine major European banks join forces for a simple and ambitious bet: a euro stablecoin, tailored for MiCA, designed from the start for on-chain uses. The consortium includes ING, Banca Sella, KBC, Danske Bank, DekaBank, UniCredit, SEB, CaixaBank, and Raiffeisen Bank International. First issuance targeted: second half of 2026.

Ethereum falls below $4,000. Liquidations, ETFs outflows, but record accumulation behind the scenes. Complete analysis of the reversal.

Cryptocurrency activity is growing worldwide, led by the Asia-Pacific region, with Latin America and Africa also seeing notable increases.

After losing its top position to Tron in March, Ethereum has surged back to reclaim its place as the leading network for USDT, with its supply reaching $80 billion. Although both networks maintained high supply levels of roughly $75–$80 billion for most of the year, this reversal signals a key shift in infrastructure preferences.

When Trump roars "I am the boss", the Winklevoss texts remind him that the kings of Bitcoin crypto sometimes pull more strings than a president on stage.

BNB Chain seems ready to write a new chapter in its history. With ultra-low gas fees at 0.05 Gwei, a record perpetual volume of $51.3 billion, and massive developer adoption, Binance's ecosystem is putting all the odds in its favor to reach new heights and compete with Ethereum Layer 2 and Solana.

He posts a "gm" from his cell, the FTT token soars... and traders applaud! Who said crypto wasn't an open-air theater?

In a few days, wallets identified as whales moved several tens of millions of dollars from Hype to Aster, a newly launched token on a DEX supported by Changpeng Zhao. This massive capital movement, observed since September 17, quickly propelled Aster among the 40 largest global cryptos.

What if bitcoin entered a new era, where scarcity would no longer be a speculative narrative but an accounting reality? Michael Saylor, executive chairman of Strategy, warns of a tipping point: institutional demand, driven by ETFs and listed companies, now exceeds supply from mining. As bitcoin oscillates between $111,000 and $118,000, a structural imbalance, but potentially explosive for the price, is settling in.

Bloomberg sources report that Tether Holdings SA is in private discussions to raise roughly $20 billion—a move that could push the USDT stablecoin issuer’s valuation to about $500 billion. If finalized, the deal would position Tether among the world’s most highly valued private companies.

Despite leading global crypto transactions, the majority of U.S. investors remain largely uninvolved, with just 14% holding digital assets.

Ethereum ETFs experience explosive growth as institutional demand reaches unprecedented highs. With 534 million dollars in daily inflows, these financial products now represent 15% of Ethereum's spot volume, compared to only 3% at their launch less than a year ago.

Exit Gensler, here comes Atkins: the SEC shifts from the brake to the accelerator. "Innovation exemption", multi-crypto ETP, stablecoins… Washington finally discovers that blocking costs more than moving forward.

The leverage effect, driver of soaring increases, becomes a formidable trap when the market turns. Solana (SOL) suffers the consequences, with a brutal drop to $213, its lowest level in two weeks. While the Fed briefly rekindled risk appetite, persistent tensions over inflation and employment quickly reversed the trend.

The collapse of FTX has not finished shaking the crypto ecosystem. The FTX Recovery Trust has filed a lawsuit against bitcoin miner Genesis Digital Assets, claiming $1.15 billion. A colossal amount that reminds how much the shadow of FTX continues to hover over the industry.

While the crypto market begins a new phase of pullback, Avalanche surprises. The AVAX token jumped 10% this Tuesday, reaching 33 dollars, at the very moment when major capitalizations showed losses. The crypto thus stands out by an opposite dynamic, built and supported by significant players.

When a central bank teams up with Solana and Mastercard to create a stablecoin, it means crypto is no longer reserved for geeks. Kazakhstan is quietly forging its path.

Europe is stepping up its game on stablecoins. Bullish Europe has just listed USDCV, the new dollar-backed stablecoin launched by Société Générale-Forge. MiCA compliant and supervised by BaFin, this token marks a decisive turning point in Europe’s regulatory battle against American giants in the sector.

Investors pulled back from Bitcoin and Ethereum ETFs on Monday, reflecting caution amid market shifts and pending economic data.

For the first time, Washington speaks with one voice on crypto. After years of partisan deadlocks and ideological battles, Democrats and Republicans are finally breaking their divides to build a common regulatory framework. Twelve Democratic senators have just announced their support for negotiations, accelerating the implementation of a law that could redefine the future of a market worth more than 4 trillion dollars.

Bitcoin consolidates around $112,500 after a bounce on support, but fails to regain clear momentum. Discover the technical outlook for BTC's future evolution.

On Monday, the U.S. and U.K. launched a new joint task force to improve cross-border capital flows into the crypto sector. The special alliance, aimed at strengthening ties between the two nations’ digital asset industries, will include regulators from both countries.

Deutsche Bank predicts Bitcoin could join gold in central bank reserves as markets mature and volatility eases, signalling growing institutional adoption.

Nearly three years after the collapse of FTX, the shadow of the scandal still lingers. Ryan Salame, former co-leader of the platform, is serving a heavy sentence, but his plea deal remains at the center of a legal battle involving his wife, Michelle Bond. The justice system is still trying to unravel the ramifications of an explosive case.

September once again catches up with the crypto market. After a promising start, the trend reversed with a brutality that hits the main capitalizations. Bitcoin, Ethereum, and Dogecoin show a sharp decline, exposing a marked exhaustion of the bullish momentum. As every year at the same time, the specter of a "Red September" reappears, fueled by weakened technical signals and a sharply declining market sentiment. Once again, the scenario of a red month seems to be drawing with insistence.

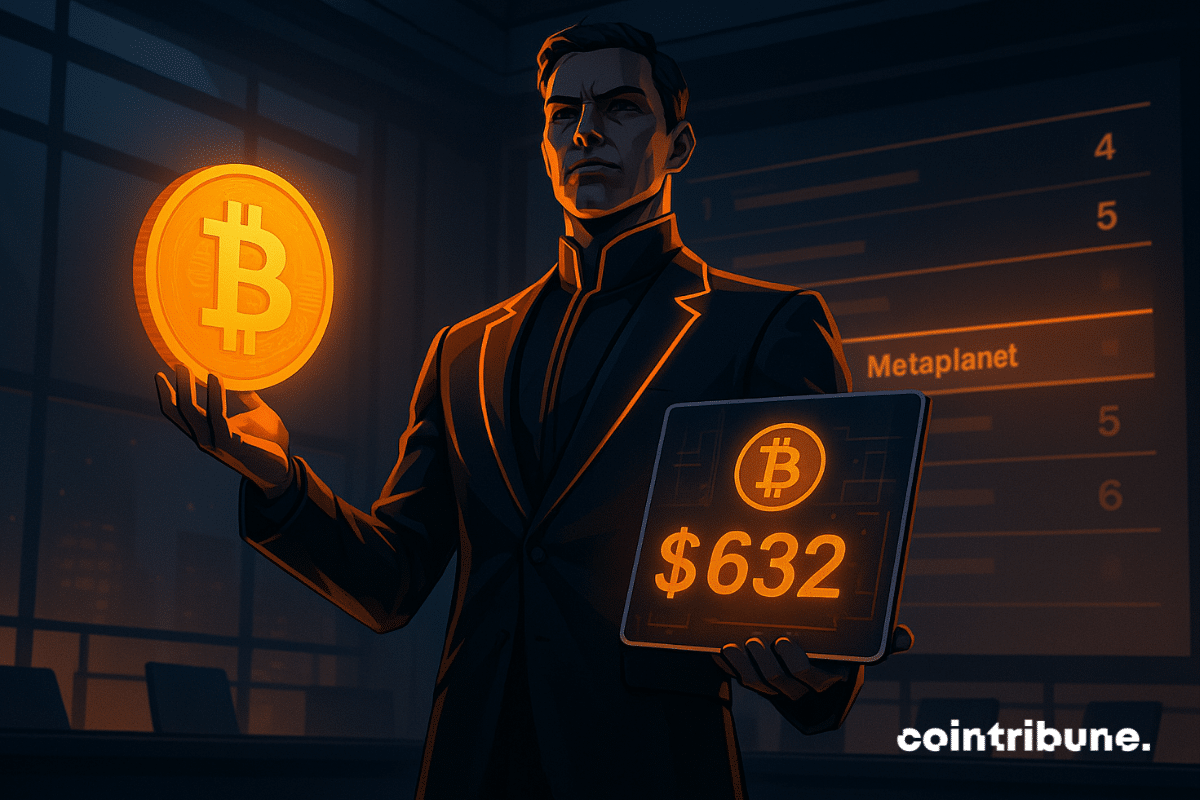

Metaplanet has expanded its Bitcoin holdings to 25,555 BTC with a $632 million purchase, climbing into the top five public company treasuries.

Over the years, Bitcoin has evolved from a peer-to-peer payment system to a sought-after global asset. Regional governments are now looking to the OG crypto as an inflation hedge, and corporate Bitcoin treasuries have emerged as a rising trend. Yet for Tim Draper, venture capitalist and founder of Draper Associates, Bitcoin’s role goes far beyond a store of value. He maintains that the first-born coin will become a cornerstone in the future of finance and even national defense.