Finance: The savings rate of the French is the highest since 1979. We provide you with all the details in this article!

Finance News

Symbol of a Sino-American tug-of-war, TikTok once again crystallizes the tensions between digital sovereignty and trade war. With 170 million users in the United States, the ByteDance application is facing a third deadline extended by Donald Trump. By extending the deadline for the sale, the president is reviving an explosive file where geopolitical pressure, technological stakes, and legal battles are intertwined. TikTok remains at the heart of a strategic struggle, at the crossroads of economic interests and national security concerns.

While Trump buries the digital dollar, Beijing is setting up its own on all continents. One click, one yuan, and finance trembles. The United States watches... gritting its teeth.

By maintaining its benchmark rates for the fourth consecutive time, the Fed has not simply extended a monetary policy. It has taken a stance in a tense economic and political landscape. Stubborn inflation, weakened growth, barely concealed political pressure... The status quo decided on June 18 resembles a statement of intent. Behind the silence of the numbers, a strategy of resistance is taking shape as the central bank finds itself at the heart of an increasingly unstable balancing act.

Christine Lagarde urges Europe to boost its global role by strengthening trade, economy, and governance—moves that may also open new doors for crypto growth across the region.

Despite some profit-taking, the bullish pressure remains strong. A new high awaits Bitcoin.

While Israeli strikes target sensitive Iranian sites and Tehran responds with missiles on Tel Aviv, the military escalation is redefining balances in the Middle East. However, a strategic absence intrigues: that of the BRICS. A newcomer to the bloc, Iran was counting on solid support against its sworn enemy. Yet neither Moscow, nor Beijing, nor New Delhi are committing. This silence exposes the limits of an alliance that Tehran saw as a counterweight to Western hegemony.

In the turmoil of global commercial reconfigurations, Beijing is advancing its pawns. China announces the complete removal of tariffs on exports from 53 African countries, expanding preferential access to its market. Behind this gesture lies a targeted diplomatic offensive as Washington, under the leadership of Donald Trump, reactivates protectionist levers against the continent. Africa, long peripheral in geo-economic arbitration, is becoming the epicenter of a clash of influences where industrial ambitions, strategic alliances, and narratives of sovereignty intersect.

For the first time, the idea of putting France under the guardianship of the IMF has crossed the gates of Bercy. Long reserved for countries in crisis, this perspective, now acknowledged at the highest level of the state, reveals the extent of the budgetary derailment. An abyssal debt, soaring interest charges, and pressure from rating agencies form an explosive cocktail. The signal is clear: French economic sovereignty is wavering, and international institutions are now scrutinizing Paris with the same severity as struggling economies.

Bukele treats bitcoins like one treats croissants, defiantly challenging the IMF with flair and playing accounting hide-and-seek while promising mountains and wonders to skeptical Salvadorans.

A discreet yet massive shift is redefining the global monetary balances. Indeed, over 90 countries, led by the BRICS, are abandoning the dollar in their international exchanges. In its place, the yuan, the ruble, or the rupee are gradually taking over. This strategic realignment, far from being a mere technical adjustment, challenges the financial order built around the United States since the post-war period. A stated desire for economic sovereignty and a direct challenge to American hegemony over global flows are at the root of this movement.

While Saylor rallies the crowds, a Japanese outsider nibbles on 10,000 bitcoins... through zero-interest bonds. Metaplanet, or how to charm Tokyo with encrypted promises.

The crypto market attracts $1.9 billion in a week. Should we ride the wave or be cautious? Discover the key figures in this article!

June 13, 2025 marks a turning point in the Iran-Israel conflict. Massive Israeli strikes targeted the heart of the Iranian military infrastructure. Iran retaliated later that evening with 300 ballistic missiles, crossing a new threshold in this long-standing war.

Schiff gets carried away, gold soars, bitcoin wavers. What if behind the raging tweets lies a discreet farewell to the digital utopia?

Israeli airstrikes against Iran are disrupting the calculations of the American Federal Reserve (Fed). While Donald Trump is ramping up pressure for monetary easing, central bankers must now contend with a new factor of uncertainty: the geopolitical escalation that is driving oil prices up.

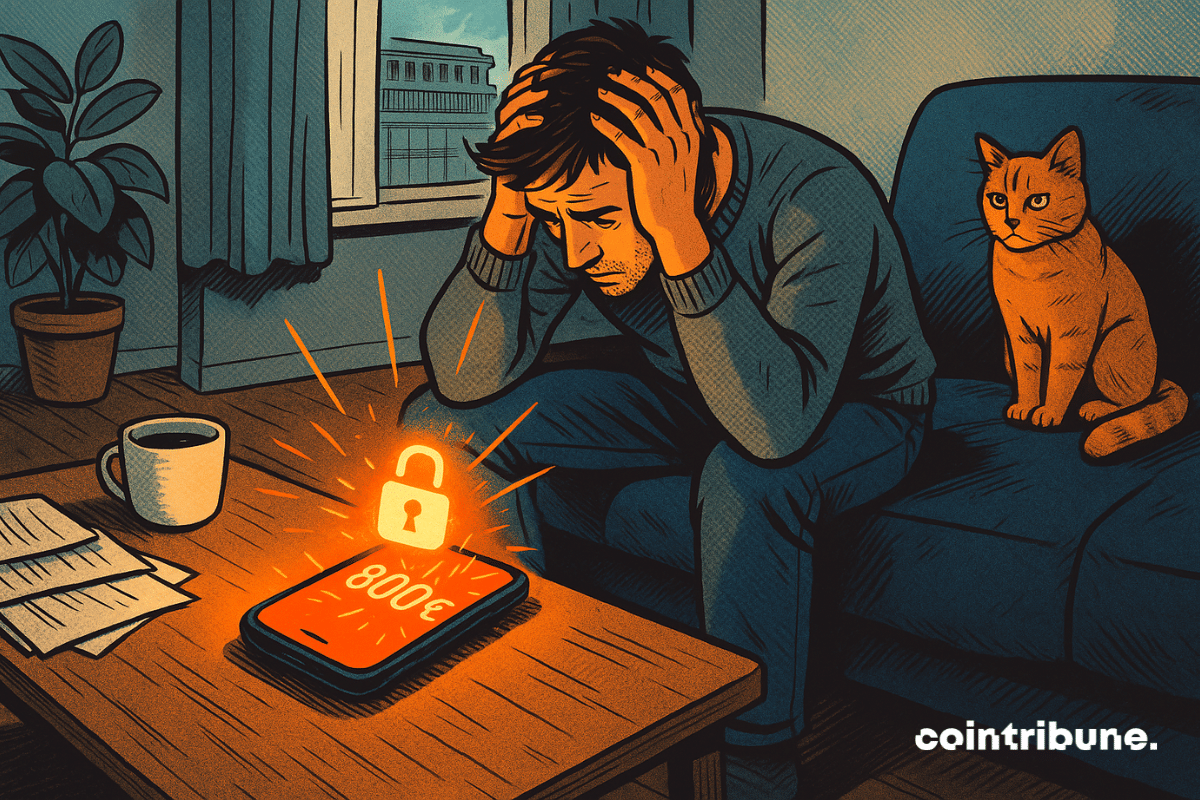

At a time when financial distrust spreads in a click, a TikTok video posted at the end of May has reignited fears of increased state control. It claims that starting from October 2025, any transfer of more than 800 euros between individuals would be blocked for 24 hours for tax verification. Within a few days, the rumor has caused unrest among thousands of French citizens. What does the regulation actually say? And why is this viral announcement completely unfounded?

Donald Trump generated over 600 million dollars in 2024, with a major portion coming from the crypto universe. This figure, drawn from a financial disclosure document signed on June 13, confirms the president's strategic entrenchment in the crypto ecosystem. Between memecoins bearing his name and large-scale DeFi operations, Trump is no longer just observing the market: he is becoming a central player, with major financial and political stakes.

The real estate credit market, long stagnant, is beginning a clear recovery. In two months, the demand for loans has almost doubled, driven by a decrease in rates and a reopening of bank lending. After two years of blockage due to the sharp rise in the cost of money, this turnaround was expected. However, is this improvement sustainable or just a simple catch-up effect? While April marks a turning point, the sector is questioning: are we witnessing the beginning of a cycle or a fragile pause?

Polkadot wants to trade its tokens for bitcoin in the midst of a cryptocurrency storm. A bold maneuver that shakes purists... and makes lurking maximalists smile.

The stock market has its moods, but sometimes, it is mostly its fears. And this Friday, fear prevailed over everything else. An Israeli strike against Iran was enough to cause an immediate shock on global markets, reminding everyone that indices are never completely disconnected from the sound of bombs. In New York, the Dow Jones dropped more than 600 points right at the opening. A brutal collapse that owes nothing to chance, but everything to geopolitics. In this unstable equation, volatility has become the norm again, and the stock market a sounding board for the real world.

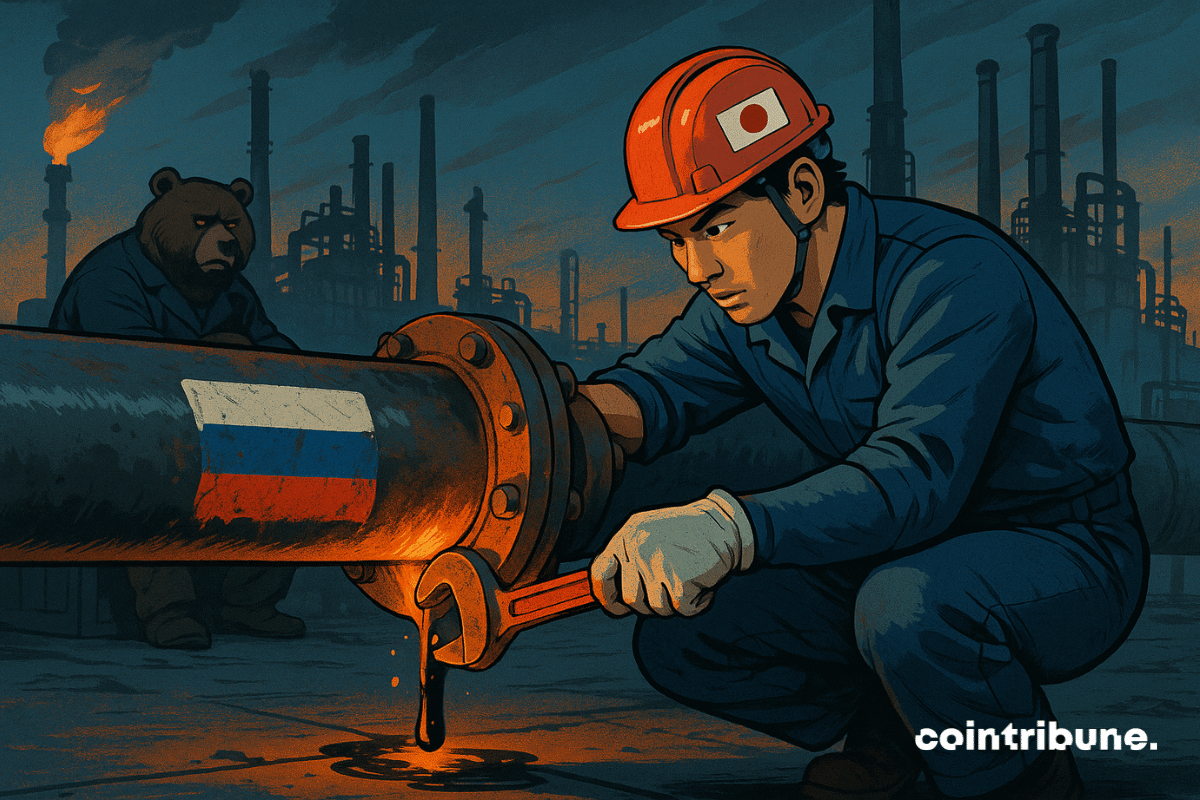

On June 8, 2025, a tanker under American and European sanctions discreetly docked in Japan, delivering Russian crude to a local refinery. This act, far from negligible, reveals a silent fracture in the Western consensus on energy. While the G7 has been trying for two years to isolate Moscow, Tokyo prioritizes its energy security. This episode, both symbolic and strategic, could subtly reshape the lines of a transforming global energy order.

Missiles in the Middle East, markets in turmoil: while the economy catches a cold, some are making a fortune off barrels... and others prefer to flee into solid gold. Guess who is pulling the strings?

Venezuela and Argentina adopt cryptocurrencies. Discover how inflation has driven their adoption in Latin America.

An avalanche of companies are set to make bitcoin their main cash asset and push bitcoin to rapid new highs.

New development in the crypto jungle: the police have apprehended another suspect, while the alleged leader, hiding in Morocco, awaits extradition... The noose is tightening.

In May, cryptos are surging, RWAs are skyrocketing, and Binance declares: "All is well." But behind the numbers, a creeping tokenization is quietly disrupting traditional finance…

In an economic context where every trade tension weighs on global markets, Washington has chosen firmness. On June 11, Howard Lutnick, Secretary of Commerce, ruled out any reduction in tariffs imposed on China. An unambiguous announcement, despite an agreement announced as "concluded" by both capitals. This tariff status quo reinforces uncertainty about global supply chains and sends a clear signal: the time is not for easing, even amid diplomatic dialogue.

The May US inflation shows a deceptive calm: +0.1% for the month, a figure below expectations that immediately boosted risky assets. However, behind this lull lies more enduring tensions, fueled by the renewed offensive of tariff hikes decided by the Trump administration. This seemingly reassuring figure conceals a more unstable reality, where weak signals of a coming inflation resurgence trigger doubts about the robustness of the current economic cycle.

The global economy is set to experience its most sluggish decade since the 1960s. This forecast could reshape the balance of economic power on a global scale. The warning comes from the World Bank, whose latest report, published on June 10, 2025, paints a bleak picture of the near future amidst heightened trade tensions and prolonged political uncertainties.