CAC 40 in difficulty: the real estate crisis in China hampers growth. How does the Paris stock exchange react?

Finance News

Bitcoin is on the brink of a new spectacular surge. Several signals are converging to indicate that the cryptocurrency could soon reach a new historical peak, driven by major economic factors and market developments. The approval of Bitcoin ETFs by regulators, massive accumulation of Bitcoins by large investors ("whales"), and the potential decrease in interest rates by the American Federal Reserve create an explosive cocktail for a potential bull run.

The French deficit is exploding! A parliamentary investigation committee is examining the causes of this slip-up. While France seems to be sinking into an unprecedented spiral of debt, Macron appears to be the sole responsible for this ruin.

Despite some regulatory hiccups, JPMorgan is already set to hit the jackpot in 2025 with Bitcoin, the golden bet of speculators.

On the occasion of the BRICS Business Forum, the nations of this emerging alliance unveiled their brand new cross-border payment system: BRICS Pay. This initiative represents a clear intent to reduce dependence on the US dollar, a currency still predominant in global transactions. As the BRICS seek to emancipate themselves from the financial influence of the United States, the creation of an autonomous payment system could very well redefine the rules of international trade.

Bitcoin is once again at a crossroads. After reaching local peaks in recent weeks, pressure is mounting in the market. In fact, the sudden rise in short positions on Binance, which signals significant bearish sentiment, has triggered a wave of uncertainties among investors. The stakes are high: is this wave of shorts a sign of an imminent correction or a trap set for bearish investors?

And if Apple exchanged its stock buybacks for Bitcoin? Saylor is making a big deal out of it (of apples).

Warren Buffett's recent maneuvers in the financial markets raise concern. David Einhorn, manager of Greenlight Capital, sees it as a worrying signal for the stock market, urging investors to exercise caution.

In 2023, 78% of Russian crude oil exports were directed towards two Asian giants: India and China. A radical redistribution that sharply contrasts with the situation in 2021, when these two nations absorbed only 32% of Russian energy flows. In the face of Western sanctions aimed at strangling its energy sector, Russia is reinventing its trade circuits with its BRICS partners. This strategic realignment towards the Asian axis reflects a major shift in the global energy dynamics, prompting the BRICS bloc to accelerate its efforts to detach from the Western-dominated financial system.

The world of crypto is experiencing a new major advancement. Wecan Group and Banque Delubac & Cie announce a revolutionary strategic partnership. This alliance aims to facilitate the adoption of cryptocurrencies by wealth management advisors (WMAs). Banque Delubac, which celebrates its 100th anniversary this year, is the first French bank registered as a Digital Asset Service Provider (DASP).

A new twist in the Ripple vs. SEC case has shaken the community. In the midst of an ongoing legal battle, the Securities and Exchange Commission (SEC) has filed a last-minute appeal, thus reigniting a lawsuit that could define the future of cryptocurrencies in the United States. Since the historic decision by Judge Analisa Torres in July 2023, the question of whether XRP sales should be considered securities remains at the heart of the debates. The timing and arguments put forward by the SEC in this appeal have caught market players off guard, as well as the XRP community, which views it as a desperate attempt at regulation through repression.

Is Bitcoin poised to reach a new decisive milestone in its tumultuous history? As the flagship cryptocurrency navigates beyond the $65,000 mark, observers predict an imminent surge if the $70,000 threshold is surpassed. This new phase could signify a major shift for the fourth quarter of 2024. The atmosphere of optimism is returning after a period of summer consolidation, and many believe that the "drought period" is now a thing of the past.

Bitcoin ETFs surpass 20 billion. One might have thought it was gold, but no, it's digital!

The ECB lowers its interest rates to 3.25% to stimulate the economy! What does this mean exactly for you?

In a global context marked by economic uncertainties, China is facing unprecedented challenges to maintain its growth. Indeed, for several months, the Asian giant, the world's second-largest economy, has been trying to break the deadlock, particularly through the revival of a deeply crisis-hit real estate sector. The Chinese government has just announced a new series of ambitious measures to stimulate its economy, with particular focus on the real estate market. These initiatives are crucial for China but also for the global economy, given the weight of the Middle Kingdom in trade exchanges and financial stability.

Bitcoin takes a ride on the carousel, hitting $68,000, and triggers an avalanche of greed in the market.

Aptos shows a bullish acceleration since its last dip, rebounding by more than 146% in two months. Let’s examine the future prospects for the APT price. Situation of Aptos (APT) After diving towards $4.36, Aptos rebounded to reach a new peak around $7. The cryptocurrency then established a support zone…

The world of cryptocurrencies, known for its volatility, has once again proven its unpredictable nature. In just 24 hours, over 287 million dollars have been liquidated on the major exchanges. A figure that resonates as a warning for leveraged traders, exposed to sudden and brutal market movements. This new wave of liquidations spares neither Bitcoin nor Ethereum, two pillars of the crypto market, which have seen their valuations severely impacted.

The BRICS summit chaired by Russia is approaching rapidly. Here is everything you need to know before this major geopolitical event.

The cryptocurrency market is on the rise, with Solana rebounding 17% in a week. Let’s examine the upcoming prospects for SOL’s price. Situation of Solana (SOL) After plunging to around $110 following the overall downturn in the crypto market, Solana has rebounded to reach a new peak around $164. Unfortunately,…

The OFCE sounds the alarm: the restrictive budget planned for 2025 is likely to seriously hamper the growth of the French economy and the purchasing power of households. These gloomy prospects, linked to budgetary choices, could affect financial markets, which are already under pressure.

An unexpected move by Tesla, one of the largest publicly traded holders of Bitcoin, is making headlines. On October 15, 2024, Elon Musk and his company transferred nearly $770 million in Bitcoin to new addresses, an action that could signal a significant upheaval in the crypto market. This operation, which comes after more than two years of inactivity, fuels numerous speculations regarding Tesla's intentions regarding its crypto holdings.

As gold rises slowly, Bitcoin makes spectacular leaps. Investors, meanwhile, are already electrified.

As the global economy continues to recover from successive crises, a new announcement from the IMF reveals a mixed trend: global public debt will reach 100 trillion dollars by the end of 2024. This staggering amount, equivalent to 93% of global GDP, represents a critical point in the budgetary management of states. The world now finds itself at a crossroads where managing this colossal debt has become more crucial than ever.

The funding rate for Bitcoin futures has reached a multi-month high. Amid the volatility, this indicator could well reflect a renewed sense of confidence and signal a bullish trend in the short and medium term. As a result, investors are now closely watching every movement, in a context where Bitcoin has broken the $65,000 mark.

Wecan continues to evolve and strengthen its ecosystem. In 2024, the partnership with WIZE, a Swiss leader in wealth management software, marks a crucial step in simplifying compliance processes for asset managers and banks. This collaboration illustrates Wecan's commitment to building a digital environment that addresses the contemporary challenges of the financial industry.

After a difficult start to the month, Bitcoin rebounds with a rise of over 5% at the beginning of this week. Let’s examine the upcoming prospects for BTC’s performance. Bitcoin (BTC) Performance Situation After briefly falling below $60,000, Bitcoin attracted buying interest that allowed it to rebound and break through…

This case is just one piece of the vast puzzle of economic sanctions against Russia, but it highlights the difficulty of tracking and seizing assets acquired through sophisticated financial arrangements. As French justice intensifies its efforts, international pressure for greater financial transparency is mounting. The next steps in this investigation, and those to come, could redefine the tools for combating transnational financial crime. Thus, the implications for Russian oligarchs and their networks in Europe are immense, and such actions could inspire other jurisdictions to act.

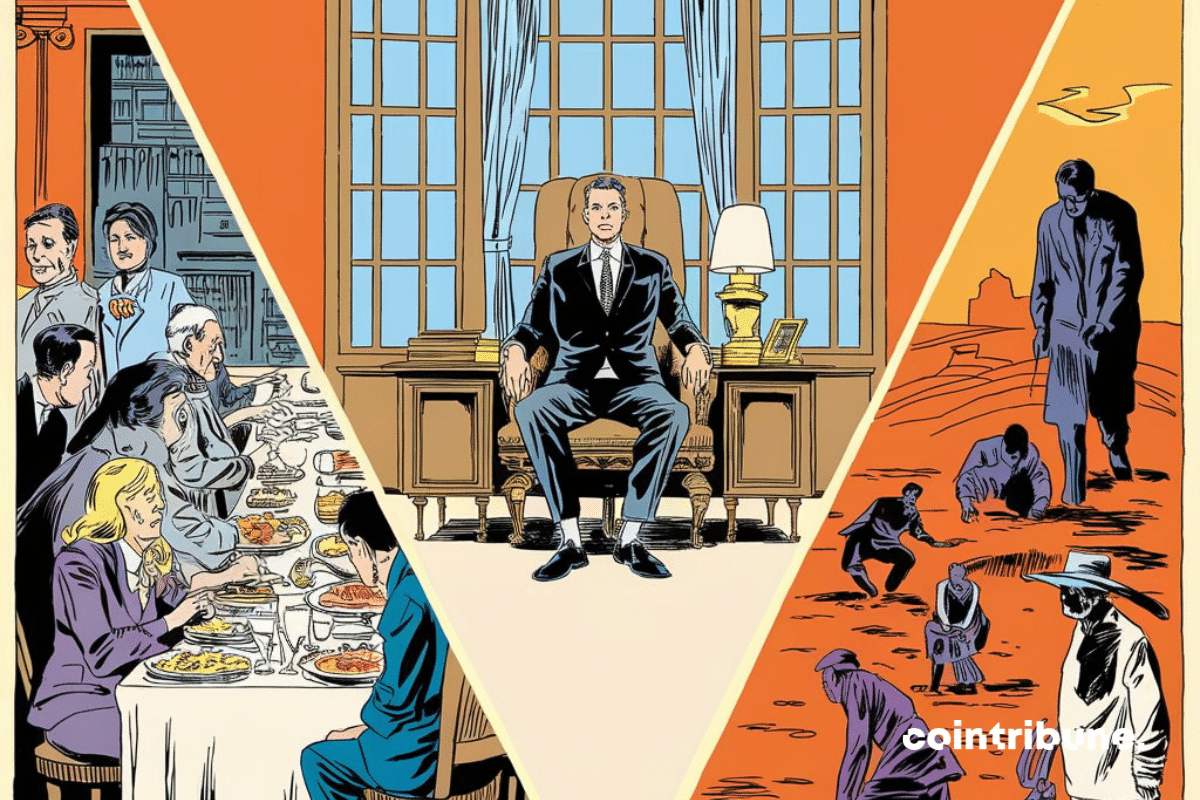

The 2024 Nobels sound the alarm: economic inequalities would be the rotten fruits of our failing institutions.

The Taiwan Strait is once again boiling, and tensions between China and Taiwan are reaching a critical threshold. At the beginning of this week, Beijing intensified its show of military force by deploying fighter jets and warships all around the island, in what is described as a direct warning to Taiwanese "separatists." This surge in tension comes in a context where relations between Beijing and Taipei have continued to deteriorate since Lai Ching-te came to power in 2024, raising fears of an escalation with unpredictable consequences.