Bitcoin shows signs of stabilizing after October’s declines, with seasonal trends and renewed investor interest pointing to a potential year-end rebound.

News

Crypto News

Institutional adoption of digital cash is gaining momentum, marking what BNY Mellon describes as a major structural shift in global finance. The bank projects that the combined market for stablecoins, tokenized deposits, and digital money-market funds (MMFs) could reach $3.6 trillion by 2030. Stablecoins are expected to account for about 41.6% of that total, with tokenized deposits and digital MMFs making up the remainder.

While the small ones sell, the big ones stuff themselves with ETH. A mysterious update named Fusaka might hide a tricky move... or a boon!

Exchange News

Finance News

Bitcoin’s sharp rebound, fueled by optimism over the end of the 40-day U.S. government shutdown, has split traders. While most market watchers welcomed the recovery, aggressive short sellers faced a costly squeeze. High-risk trader James Wynn is at the center of the turmoil after a series of rapid losses pushed him into an even larger short bet.

While the United States struggles to align on crypto regulation, the Senate breaks the deadlock. The Agriculture Committee has just unveiled an ambitious bill aimed at clarifying the roles of regulators, CFTC and SEC, and laying the foundations for a coherent legal framework. Led by Senators Boozman and Booker, the text also addresses key concepts such as DeFi, DAOs, and blockchain. This is a first step towards more readable regulation.

Progress toward ending the U.S. government shutdown is driving market optimism with crypto gains and renewed ETF hopes.

People News

Tech News

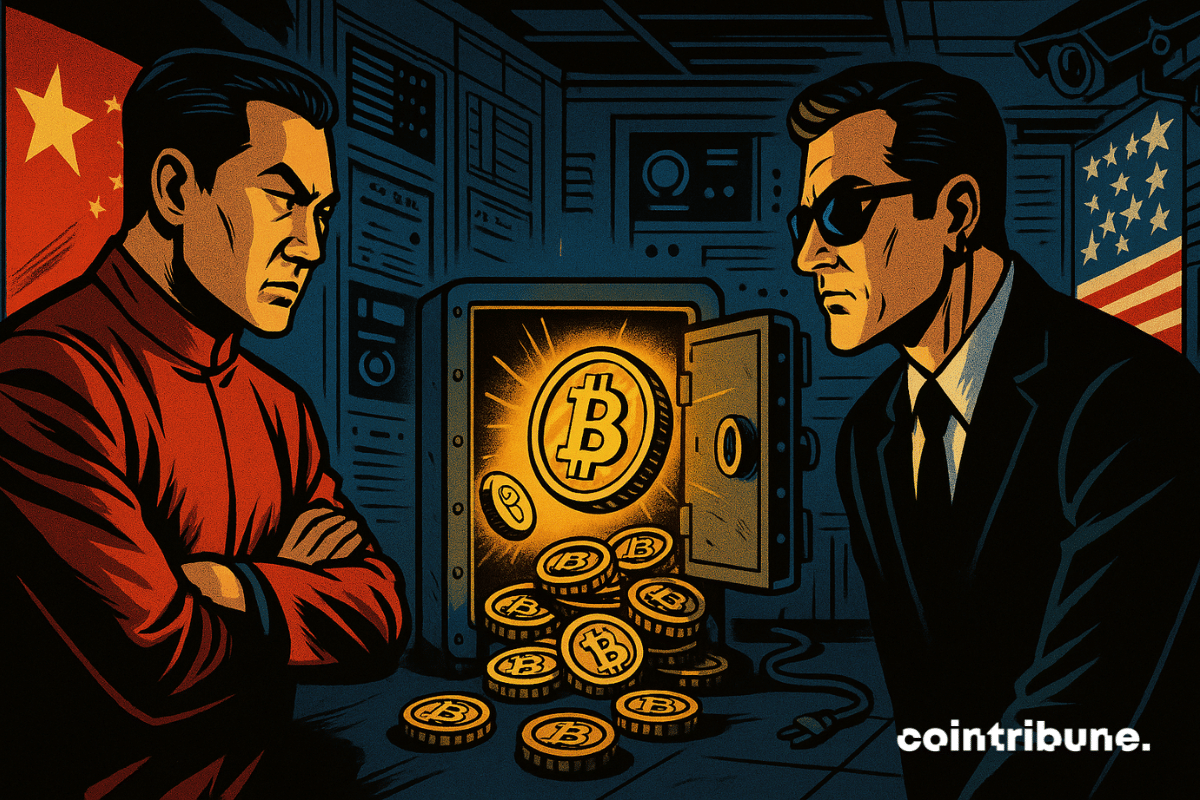

As states tighten their control over cryptos, an old bitcoin theft resurfaces amid a geopolitical rivalry. LuBian, a Chinese mining pool, reportedly lost more than 127,000 BTC in 2020. Remaining discreet for years, the case suddenly resurfaces as Beijing now accuses the United States of having seized these funds, now valued at over 14 billion dollars, through an intelligence operation. The suspicion of a state confiscation reignites tensions between two superpowers.

While Wall Street panics over the AI bubble, Softbank sells everything, invests everywhere... and hits the jackpot! But how long will the billion-dollar machine run without bugs?

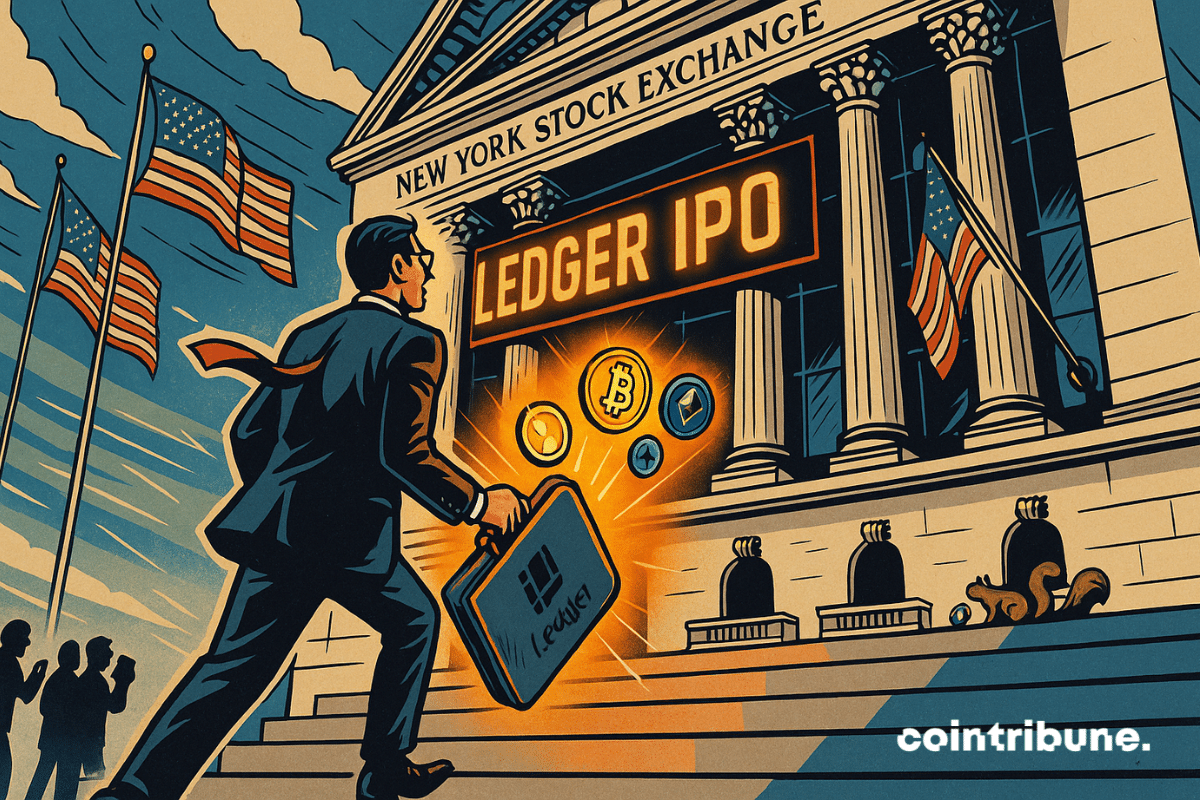

Facing a historic wave of cyberattacks shaking the crypto ecosystem, a French company captures global attention. Ledger, a pioneer of physical wallets, records rapid growth as individuals and institutions seek safe havens. Driven by this explosive demand, the company now plans a stock market debut in New York, a strategic decision embraced, described by its CEO as the new epicenter of crypto capital.