Only $719M of Bitcoin Faces Quantum Risk, CoinShares Research Shows

Digital asset manager CoinShares has played down concerns that quantum computers could pose a near-term threat to Bitcoin, arguing that only a small portion of coins are realistically exposed to such attacks. While fears around quantum technology have fueled market anxiety in recent months, the firm says current risks remain largely theoretical and far from actionable.

In brief

- CoinShares estimates just 10,230 BTC have exposed public keys that could be targeted by future quantum attacks.

- Most potentially vulnerable Bitcoin is concentrated in large wallets, limiting the risk of systemic market disruption.

- Wallets holding under 100 BTC would take centuries to crack, even under optimistic quantum computing assumptions.

- Experts remain split on quantum risks, with some calling threats distant and others urging early upgrades.

Only a Fraction of Bitcoin Is Vulnerable to Quantum Attacks, CoinShares Says

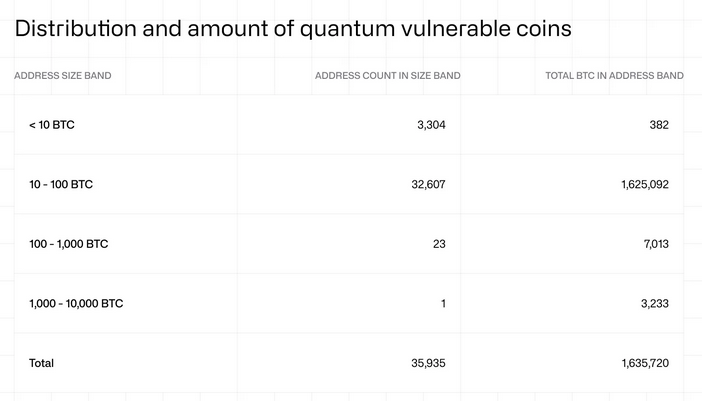

In a post published Friday, CoinShares’ Bitcoin research lead, Christopher Bendiksen, said just 10,230 BTC out of roughly 1.63 million BTC are held in wallet addresses with publicly visible cryptographic keys that could, in theory, be targeted by a quantum computer. At current prices, that amount is worth about $719 million—a figure Bendiksen noted could resemble the size of a routine market trade rather than a systemic shock.

Most of the potentially exposed Bitcoin sits in larger wallets. Around 7,000 BTC are stored in addresses holding between 100 and 1,000 BTC, while about 3,230 BTC are held in wallets with balances ranging from 1,000 to 10,000 BTC. Bendiksen argued that even if such holdings were compromised, the broader market impact would likely be limited.

By contrast, roughly 1.62 million BTC are held in wallets with balances below 100 BTC. According to Bendiksen, attacking these wallets would be impractical even under extremely optimistic assumptions about future quantum progress, with each address taking centuries to crack.

Key points behind CoinShares’ assessment include:

- Only a small share of Bitcoin sits in wallets with exposed public keys.

- Most vulnerable coins are concentrated in a limited number of large addresses.

- Smaller wallets would require unrealistic time and resources to attack.

- Core network rules remain untouched by quantum methods.

Bendiksen explained that quantum-related risks stem from algorithms such as Shor’s, which could theoretically break Bitcoin’s elliptic-curve signatures, and Grover’s, which could weaken SHA-256 hashing. However, he stressed that neither method could alter Bitcoin’s fixed 21 million supply cap or bypass proof-of-work, two pillars of the network’s design.

Quantum Fears Spark Debate Over Bitcoin’s $1.4 Trillion Security Model

Concerns about quantum computing have become a recurring source of fear, uncertainty, and doubt, with critics warning that any breach in cryptography could endanger networks securing about $1.4 trillion in value. Coins considered at risk are mainly unspent transaction outputs, or UTXOs, many of which date back to Bitcoin’s early “Satoshi era,” when address reuse was more common.

Debate continues within the Bitcoin community over whether a quantum-resistant hard fork should be pursued now or delayed. Figures such as Strategy executive chairman Michael Saylor and Blockstream CEO Adam Back argue that quantum threats are overstated and decades away.

Bendiksen aligns with that view, noting that meaningful attacks would require millions of fault-tolerant qubits—far beyond the roughly 105 qubits achieved by Google’s latest system, Willow.

Taking a cautious stance, Capriole Investments founder Charles Edwards has described quantum computing as a possible existential risk. He called for upgrades sooner rather than later. The founder argued that resolving the issue could even lead to a higher valuation for Bitcoin. At the same time, some researchers pointed to post-quantum signatures as a potential path forward.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

James Godstime is a crypto journalist and market analyst with over three years of experience in crypto, Web3, and finance. He simplifies complex and technical ideas to engage readers. Outside of work, he enjoys football and tennis, which he follows passionately.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.