Open Interest On Cardano Exceeds $900 Million Amid Crypto Volatility

Cardano (ADA) confirms its momentum with a record open interest of over $900 million, signaling renewed confidence from traders. Despite volatility and regulatory challenges, ADA stands as a major asset in the crypto market, ready to write a new chapter in its history.

In Brief

- Cardano futures’ open interest exceeds $920 million, signifying strong activity on major exchanges.

- ADA trading volume has increased by 58% in 24 hours, surpassing one billion dollars.

- Outlook for ADA is positive with price potential between $0.78 and $1.

Cardano Futures Open Interest Reaches a New Milestone

In a context of marked volatility in the crypto market, Cardano (ADA) is attracting particular attention from investors. The cryptocurrency is under intense scrutiny, balancing controlled price movements and rising volumes. Within this framework, the open interest of ADA Futures has surpassed $920 million, a record highlighting massive commitment from crypto market participants.

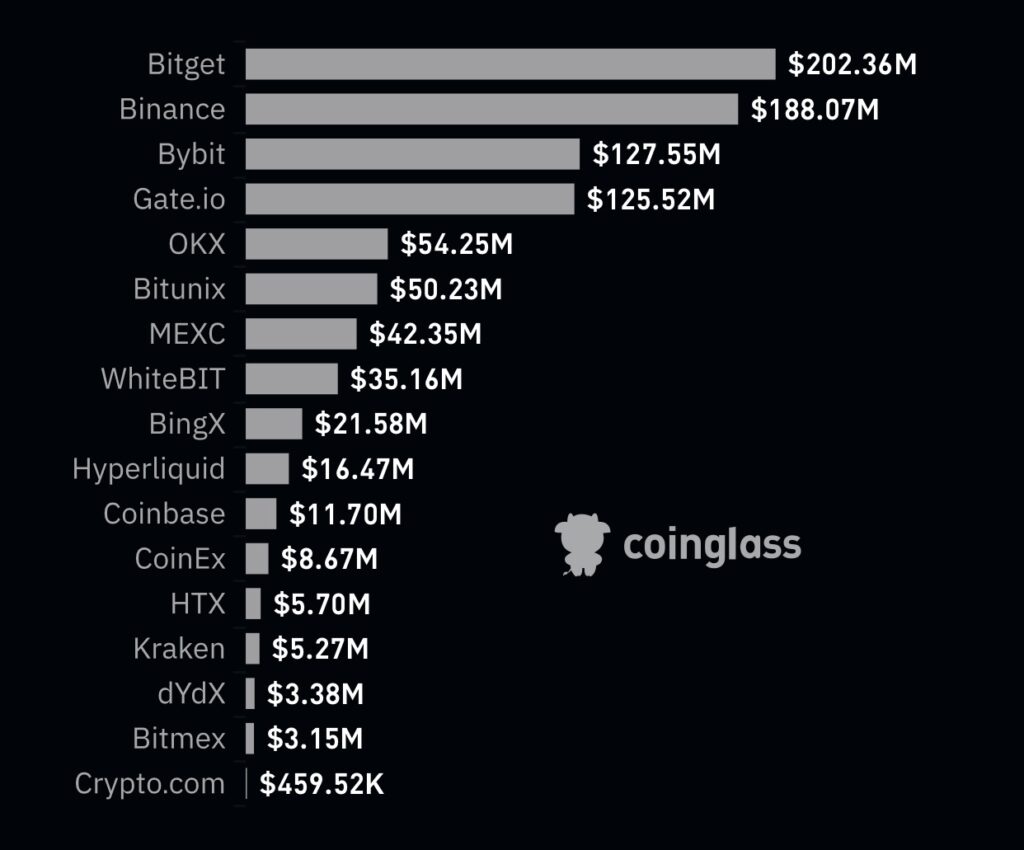

The majority of this futures open interest is concentrated on Bitget, Binance, and Bybit, which dominate ADA Futures positions. Liquidity on these exchanges is strong, which further amplifies potential volatility. Any major fluctuation on these crypto platforms could therefore trigger chain reactions, underlining the crucial importance of monitoring these markets.

Crypto: ADA Trading Volume Surges — A Confidence Indicator

Aside from Futures open interest, ADA’s trading volume also jumped by 58% within 24 hours, exceeding one billion dollars according to Whale Insider.

This surge reflects an intensification of crypto activity and a heightened willingness to speculate and invest around Cardano (ADA). The reasons are multiple:

- This increase signals a renewed confidence despite ongoing crypto market volatility;

- It highlights growing trader interest in ADA as a safe-haven asset and opportunity;

- The dynamic on major platforms fosters a virtuous cycle between liquidity and volume.

This volume peak helps stabilize prices by adding market depth and easing trades. Investors read this signal as tangible proof that Cardano continues to attract and evolve strongly within the crypto ecosystem.

Cardano Faces Regulatory Challenges: SEC Delays ADA ETF Approval

The SEC recently postponed ADA ETF approval indefinitely, unlike other major crypto ETFs whose regulatory decisions have been deferred until this summer. This creates an uncertainty zone that slows more institutional adoption. However, ADA’s resilience amid this complex context shows the robustness of its ecosystem.

Despite this regulatory hurdle, prospects remain favorable for ADA, notably thanks to technical developments and a growing network of partners. Cardano’s ability to navigate these troubled waters grants it enhanced credibility for the future of its crypto.

Future Outlook: What Price for ADA at the End of May?

Following this landmark performance of record open interest and exceptional volume, prospects for ADA remain optimistic. Several scenarios could influence its evolution:

- Continuation of the rise with a possible break above the $0.85 to $0.90 range;

- Consolidation around $0.78 if the crypto market takes a breather after high volatility;

- Potential impact of technical or regulatory announcements that could propel ADA beyond $1.

This range reflects tangible potential in a context that remains uncertain but promising.

The spectacular rise in Cardano’s open interest and volume underscores its increasing appeal. Yet, faced with volatility and regulatory uncertainties, the question remains: will ADA sustain this momentum and establish itself durably among the crypto market leaders? According to Charles Hoskinson, Cardano has reached a major inflection point, reinforcing the significance of this transition.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

The world is evolving and adaptation is the best weapon to survive in this undulating universe. Originally a crypto community manager, I am interested in anything that is directly or indirectly related to blockchain and its derivatives. To share my experience and promote a field that I am passionate about, nothing is better than writing informative and relaxed articles.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.