One whale across many coins:

— StarPlatinum (@StarPlatinumSOL) October 9, 2025

0x73d8bd54f7cf5fab43fe4ef40a62d390644946db

At peak this wallet held about:

– PALU ~38.62%

– 4 ~14.03%

– Binance Life ~22.89%

Same wallet, same week.

If this wallet decides to sell, price dies.

(5/12) pic.twitter.com/Czbr6cADjP

A

A

Panic On BNB Chain : Meme Rush Reshapes Token Landscape

Fri 10 Oct 2025 ▪

5

min read ▪ by

Getting informed

▪

Centralized Exchange (CEX)

Summarize this article with:

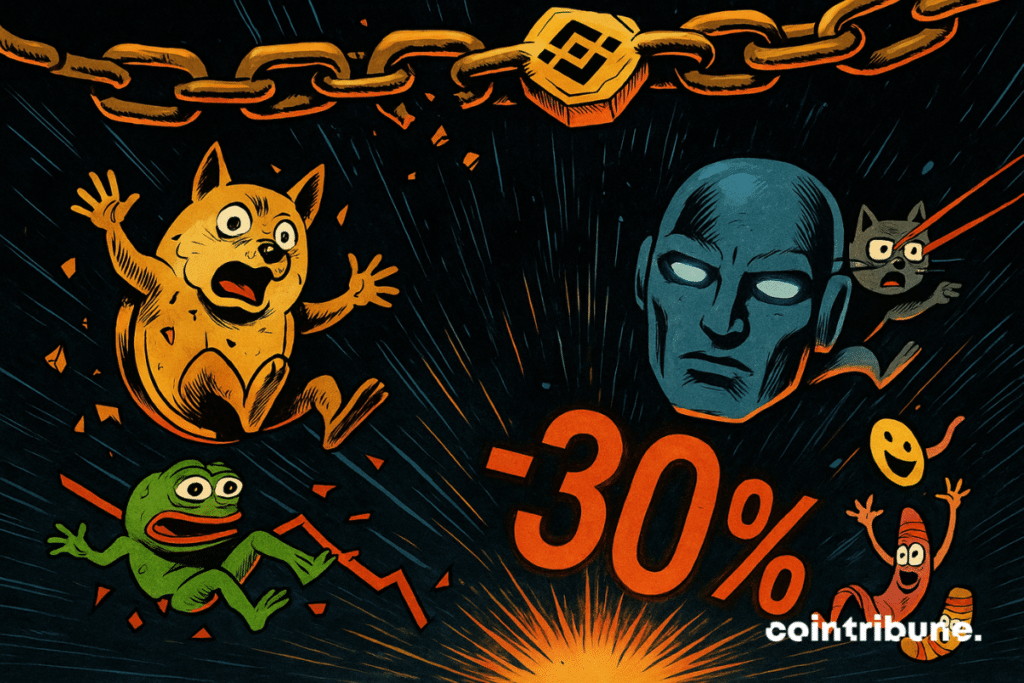

The speculative euphoria that drove memecoins on the BNB Chain was abruptly interrupted. Within a few hours, several popular tokens saw their value plunge by more than 30 %, causing a widespread retreat and cascading liquidations. This sudden correction, occurring amid tension surrounding the launch of Meme Rush by Binance, caught part of the market off guard and rekindled questions about the long-term viability of these volatile assets.

In brief

- Several BNB Chain memecoins dropped more than 30 % in a few hours, causing a panic movement in the market.

- The launch of the Meme Rush platform by Binance triggered a massive capital rotation towards new awaited projects.

- Highly concentrated wallets and artificially inflated volumes accentuated the severity of the crash.

- Suspicion of manipulation, notably around the PALU token, fuels doubts about the integrity of some projects.

The domino effect of Meme Rush launch

While the memecoin craze was igniting the BNB Chain, Binance officially announced on Thursday, October 9, the launch of Meme Rush, a platform dedicated to memecoins, designed in partnership with Four.Meme.

This initiative, reserved for Binance Wallet users, aims to regulate token launches through an egalitarian system, based on KYC requirements and an initial valuation capped at 1 million dollars in “Fully Diluted Valuation”.

Hardly had the announcement been made when several BNB Chain memecoins recorded spectacular losses. Among them, PALU, GIGGLE, 4 and Binance Life all gave up more than 30 % of their value within a day. This reversal took place in a context of pressure on the BNB token, which simultaneously recorded a historic $100 drop, falling below $1,250.

Analysts believe this series of liquidations is partly explained by a capital rotation. In other words, investors would have abandoned memecoin projects already launched on the DEX to position themselves on upcoming opportunities via Meme Rush. This dynamic is based on several elements :

- The announcement of the Meme Rush platform was perceived as a paradigm shift signal, pushing traders to anticipate an influx of new official projects ;

- The launch model with KYC was interpreted as an attempt by Binance to control this space, but this created immediate disengagement from older memecoins ;

- The sharp drop of BNB heightened general nervousness with massive sell-offs ;

- The fear of missing out on Meme Rush’s first projects caused a sudden disinvestment from existing tokens.

This combination of announcements, timing, and strategic repositioning by the crypto exchange Binance acted as a catalyst, triggering a wave of sales that swept a significant part of the BNB Chain memecoin ecosystem.

Concentration, artificial volumes and suspicion of manipulation

Beyond simple anticipation of new tokens, several structural factors played a crucial role in the intensity of the crash. On X, community analysts revealed troubling elements.

User StarPlatinumSOL claims that a single crypto wallet held up to 39 % of the circulating supply of PALU, 23 % of Binance Life and 14 % of the token 4. According to him, this crypto wallet would have made bundled transactions of over $100,000 on several of these memecoins, suggesting the existence of artificially inflated volumes. These practices, incompatible with a healthy market, likely fueled a speculative bubble before accelerating the collapse in prices.

Added to this is a lack of real liquidity on DEXs. In several documented cases, less than 2.5 % of the total token supply was deposited in liquidity pools. A situation which, in an AMM (automated market maker) system, causes extreme price fluctuations as soon as selling volumes increase.

Under these conditions, the very structure of the market becomes unable to absorb orders, which worsens volatility. Another alert point was signaled by Bubblemaps, which noted that a wallet purchased about $100,000 of PALU just before a meme posted by CZ, the former CEO of Binance, showed the project’s logo. This coincidence largely fueled speculation about possible coordinated actions.

If the launch of Meme Rush aimed to restore confidence around memecoins on the BNB Chain which is exploding volumes, the conditions under which this transition takes place are concerning. For the crypto exchange Binance, the challenge will now be to demonstrate that this new platform can truly establish greater transparency and limit opportunistic behavior.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

A

A

Diplômé de Sciences Po Toulouse et titulaire d'une certification consultant blockchain délivrée par Alyra, j'ai rejoint l'aventure Cointribune en 2019. Convaincu du potentiel de la blockchain pour transformer de nombreux secteurs de l'économie, j'ai pris l'engagement de sensibiliser et d'informer le grand public sur cet écosystème en constante évolution. Mon objectif est de permettre à chacun de mieux comprendre la blockchain et de saisir les opportunités qu'elle offre. Je m'efforce chaque jour de fournir une analyse objective de l'actualité, de décrypter les tendances du marché, de relayer les dernières innovations technologiques et de mettre en perspective les enjeux économiques et sociétaux de cette révolution en marche.

DISCLAIMER

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.