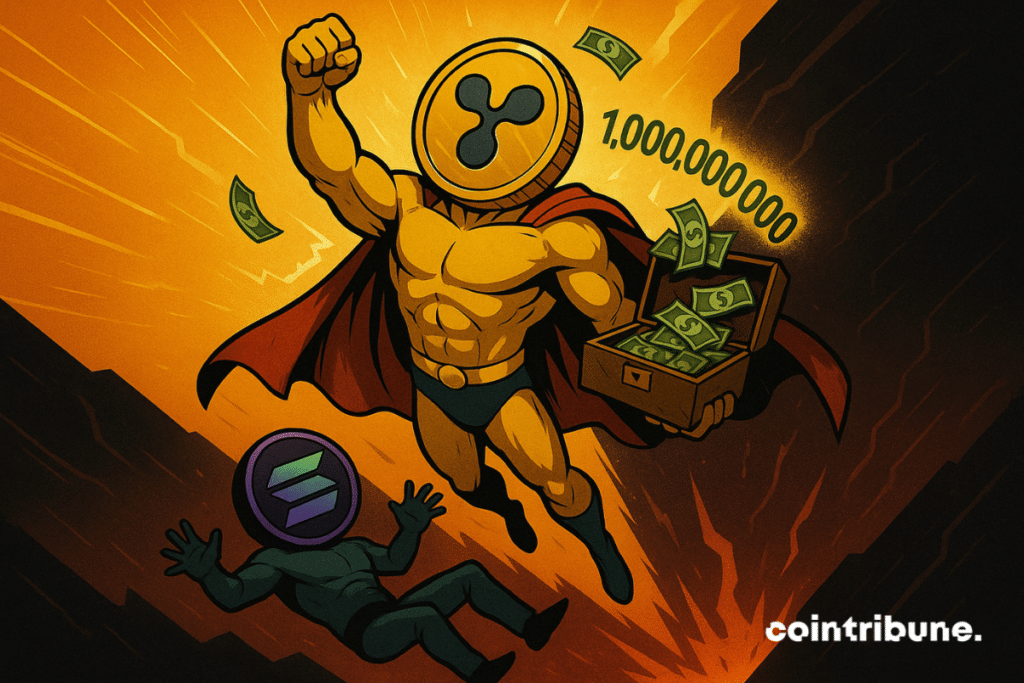

Ripple Raises $1 Billion as Solana Slumps

Ripple accelerates while the market slows down. The company is preparing a raise of about $1 billion to accumulate XRP via a SPAC backed by a digital asset treasury structure (DAT). The timing is delicate: liquidations are piling up, Bitcoin falls, and Solana loses ground. However, the strategy is clear: stabilize the supply, speak to the corporate finance world, and expand crypto token usage in payments. Let’s review the stakes.

In brief

- Ripple is preparing a $1 billion raise via a SPAC to strategically accumulate XRP

- The goal is to stabilize supply, attract financial institutions, and strengthen XRP usage in payments

- Meanwhile, Solana is undergoing a sharp technical correction, with critical support levels threatened

DAT, SPAC and treasury: Ripple’s method to smooth XRP supply

The XRP-oriented DAT draws inspiration from listed accumulators, such as MicroStrategy, known for its bold monetary strategy, or Metaplanet. Even though these players have faced risk aversion, the idea remains the same: accumulate in a disciplined and predictable way. The structure aims to buy XRP in stages, according to explicit treasury rules.

The raise would go through a SPAC, with funds locked in the DAT. Ripple would contribute some of its own tokens according to ongoing discussions. If finalized, the operation would be among the largest related to XRP, whose capitalization was about $138 billion on Friday.

Above all, the company plays the institutional card. Ripple would already hold ~4.7 billion XRP directly (≈ $11 billion) and manages an additional 35.9 billion escrowed, released monthly. The goal: make the supply more transparent for payment and custody actors while reducing volatility linked to flows. At the same time, the $1 billion acquisition of GTreasury opens doors to financial departments testing tokenized deposits and stablecoins.

Febrile crypto market: risky timing, decisive execution

The context allows no mistakes. The US/China trade shock triggered nearly $19 billion in liquidations. Bitcoin lost ~3% on Thursday, altcoins even more. Sentiment is fragile, liquidity selective, and strong hands favor defense.

In this context, an accumulation vehicle reassures if it imposes a credible pace and governance. Investors will read the roadmap: purchase rules, ceilings, transparency, risk metrics. The clearer the mechanism, the more credible the stabilizing effect on the perceived supply of XRP becomes.

Ripple’s bet is twofold: build in a bear market and speak the CFOs’ language. The DAT + GTreasury duo creates a bridge between crypto-treasury and corporate finance. If adoption progresses on payments and custody fronts, the utility premium can compensate for the cyclical risk premium.

Solana: critical supports, technical signals on alert

Meanwhile, Solana is falling. The price trades around $176, down over 6% in 24 hours and 17% over the week. After a peak above $220, the momentum reversed with a series of red candles and a market unable to absorb high-volume sales.

Technically, the $176 zone is crucial. A break would open $168 (recent pullback low), then potentially $150 if market weakness persists. The RSI ≈ 39 flirts with oversold. The 20-day and 100-day moving averages converge, and the price hovers just above the 200-day moving average, a threshold often watched by quantitative managers.

For a credible reversal, $176 must be defended, then the 100-day MA rejoined and $210 reclaimed. Possible catalysts: return of institutional accumulation, positive flows on index products linked to Solana, or macroeconomic easing. Without that, caution dominates: tested supports, high volatility, and unfavorable flows.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Fascinated by Bitcoin since 2017, Evariste has continuously researched the subject. While his initial interest was in trading, he now actively seeks to understand all advances centered on cryptocurrencies. As an editor, he strives to consistently deliver high-quality work that reflects the state of the sector as a whole.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.