Solana Tops Ethereum and Bitcoin in Network Revenue Milestone

Solana stands out in the crypto universe by significantly surpassing all other L1 and L2 blockchains in network revenues. This success is based on several key factors that enhance its attractiveness and relevance. Is Solana on the verge of dethroning Bitcoin and becoming the world’s leading blockchain?

In Brief

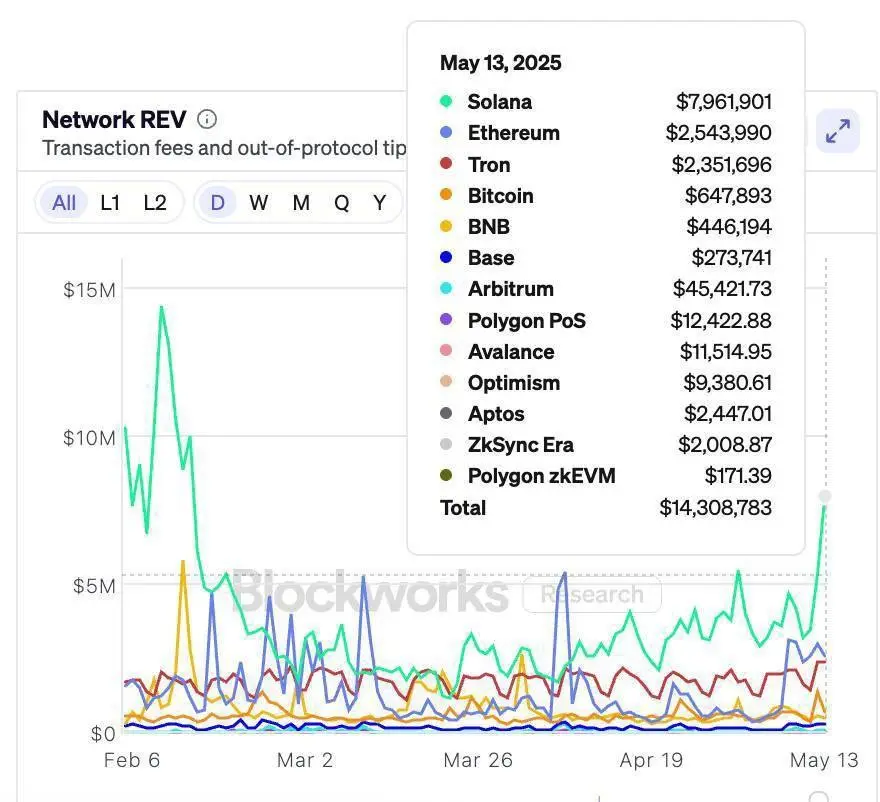

- Solana generates nearly 8 million dollars in network revenue within 24 hours, far surpassing its L1 and L2 competitors.

- Solana: its speed, low fees, and robust architecture attract developers, crypto users, and institutions.

- The arrival of the Solana ETF and anti-inflation measures strengthen its chances to compete sustainably with Bitcoin.

Solana: An Unexpected Leader in Blockchain Revenues

On May 13, 2025, Solana generated nearly 8 million dollars in network revenue within 24 hours, surpassing the combined total of all other major blockchains. Ethereum, Bitcoin, Tron, and even Layer 2 solutions like Base and Arbitrum remain far behind. This unprecedented leadership illustrates a possible shift in the crypto market towards faster and more cost-efficient infrastructures.

This dominance is not just a flash in the pan but is based on a steady and sustained growth of Solana, a sign of increasing adoption both by developers and end users. The blockchain thus sets a new benchmark in terms of profitability and usage.

Technical Strengths That Propel SOL

Solana appeals thanks to solid and differentiating technical features, which enable it to attract a growing volume of activities:

- Transaction fees below 0.01 dollar, making each interaction accessible;

- Finalization of crypto transactions in under one second, ensuring unmatched speed;

- Capacity to process hundreds of thousands of transactions per second without significant congestion;

- An architecture optimized for DeFi applications, stablecoins, and blockchain games.

This unique combination lowers entry barriers and encourages massive adoption of Solana, both for decentralized projects and users seeking high-performance alternatives.

The Regulatory Challenge: The Awaited Solana ETF

The SEC’s postponement of the decision on the Solana ETF until October 2025 does not dampen expectations. This regulated investment vehicle would accelerate institutional adoption, similar to the effect observed with Bitcoin ETFs. The prospect of an ETF offers several advantages:

- Simplified access for traditional investors;

- Increased visibility among major financial institutions;

- A potential massive inflow of capital into the Solana network;

- Regulatory recognition reinforcing the blockchain’s legitimacy.

The approval of this ETF could thus transform SOL into a key player in traditional crypto finance.

Solana demonstrates that technical innovation combined with strategic adoption can disrupt the crypto market. The arrival of the Solana ETF and a recent proposal aimed at protecting the network against inflation could strengthen its position. The question remains whether these advances will allow Solana to dethrone Bitcoin and sustainably redefine leadership in a rapidly evolving sector.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

The world is evolving and adaptation is the best weapon to survive in this undulating universe. Originally a crypto community manager, I am interested in anything that is directly or indirectly related to blockchain and its derivatives. To share my experience and promote a field that I am passionate about, nothing is better than writing informative and relaxed articles.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.