Solana ETFs capture nearly $200 million in 4 days

The crypto world has just crossed a new milestone with the launch of Solana ETFs by Bitwise and Grayscale. In only four days, these financial products attracted nearly 200 million dollars, revealing a growing appetite for SOL. Analysis of a phenomenon that could redefine the market.

In brief

- Solana ETFs attracted nearly 200 million dollars in just four days, a record for a crypto ETF launch.

- Despite the massive inflow to Solana ETFs, the SOL price shows a 1.5% drop over 24 hours.

- The analysis of SOL’s outlook raises questions: could Solana ETFs stimulate a future rise in SOL?

Successful launch of Solana ETFs: a historic first

On October 28, 2025, Bitwise made history by launching the first ETF providing direct exposure to Solana! An event that immediately captivated the crypto community. Grayscale quickly followed with its own ETF, confirming the enthusiasm around this digital asset.

This dual launch illustrates a clear trend. Financial institutions are beginning to recognize the potential of SOL, long considered a serious alternative to Ethereum. For investors, these ETFs represent an opportunity to access Solana without directly holding crypto. A major step for institutional adoption.

Solana ETF: nearly $200 million inflow in 4 days

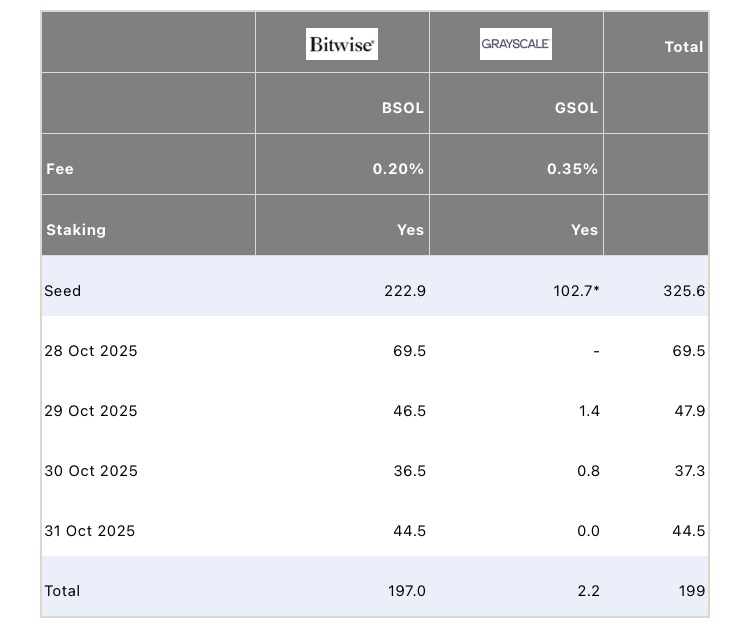

The data speaks for itself. The Bitwise Solana ETF (BSOL) recorded $69.5 million in inflows on its first day! Followed by $46.5 million, $36.5 million, and $44.6 million on the following days. In four days, BSOL accumulated $197 million.

The Grayscale Solana ETF (GSOL) attracted $2.2 million during the same period, with inflows of $1.4 million and $0.8 million on October 29 and 30. Together, these two ETFs reached $199.2 million, a record for products linked to SOL. These figures demonstrate immediate and massive investor confidence.

SOL: a mixed reaction despite the massive ETF inflow

Despite the enthusiasm around the Solana ETFs and the $199.2 million inflows recorded in just four days, SOL shows a slight decrease of 1.5% over the last 24 hours. At $185.73, Solana seems to react cautiously, despite the prevailing optimism around financial products linked to this crypto.

This situation raises questions: why doesn’t SOL immediately benefit from this massive inflow? Several factors may explain this trend:

- On one hand, crypto markets are often subject to high volatility, where expectations and profit-taking can influence prices in the short term;

- On the other hand, institutional investors might adopt a gradual approach, waiting to see how these ETFs perform before investing massively.

It remains to be seen whether this drop is temporary or a sign of a more lasting crypto trend.

Solana ETFs have marked a turning point, attracting hundreds of millions of dollars in just a few days. Solana (SOL) could it become the next star of crypto? One thing is certain, the ecosystem has never been so dynamic.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

The world is evolving and adaptation is the best weapon to survive in this undulating universe. Originally a crypto community manager, I am interested in anything that is directly or indirectly related to blockchain and its derivatives. To share my experience and promote a field that I am passionate about, nothing is better than writing informative and relaxed articles.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.