Solana Extends DEX Dominance in July with 56% Surge in Trading Volumes

Solana continues to dominate the decentralized exchange (DEX) ecosystem, outpacing other veteran networks such as Ethereum. Platforms such as Jupiter are also witnessing active engagement, with four new private AMMs debuting on the network. This trend follows the recent emergence of token launchpads, which have helped drive overall trading activities.

In Brief

- Solana DEX volumes hit $124.2 billion in July, maintaining a 10-month lead over Ethereum’s $87.1B.

- Newcomers like Humidifi and Tessera saw billions in trades despite lacking front-end interfaces.

- Raydium led Solana’s DEX market share at 32.2%, with Meteora posting the largest growth at 145.9%.

- Direct DEX trades surged to $65.9B, overtaking aggregator flows for the first time this year.

Solana Extends DEX Dominance in July as New Platforms Drive Trading Boom

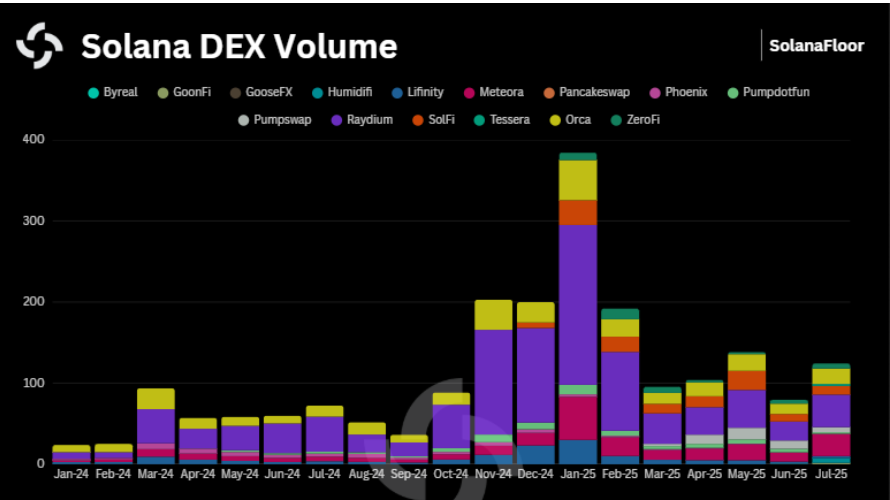

Following a June downtrend, DEX volumes on the Solana network posted a strong comeback in July. Notably, this trend aligns with the rise in new market players and an increase in trading volume.

As per on-chain data from Dune, trading volume on Solana DEX touched $124.2 billion in July—up 56% from the previous month. Ethereum, its DEX counterpart, posted a volume of $87.1 billion during the same period, lagging Solana by 42%. Interestingly, Solana has held this lead for ten consecutive months, dating back to October 2024.

In the past two months, four new DEXs debuted on the Solana network, all of which have hit notable trading figures. With a trading volume exceeding $6 billion, Humidifi topped the new-DEX leaderboard.

Tessera came second with $2.5 billion. Both platforms outpaced other leading networks, including Lifinity and Phoenix. For now, the new debutants run on Jupiter without any front-end interfaces.

Raydium Leads Solana DEX Market as Meteora Posts Biggest Growth in July

Raydium maintained sector dominance, touching 32.2% of Solana’s DEX volume in July. In second place, Meteora tapped 21.8% of the market share, followed by Orca with 15.2%.

Looking at multi-month growth, Meteora took the largest leap, reaching 145.9%. Raydium wasn’t left out of this growth, posting a month-over-month surge of 72%. Orca hit a 48.4% surge, while ZeroF and SolFi posted a 32% and 14.5% increase, respectively.

On the flip side, DEX launchpad and Pump.fun, and Pumpswap each dropped by 57.8% and 39.3%. Much of Pump.fun’s decline is attributed to its market control being usurped by Letsbonk.fun. In turn, this affected token launches and trading activity on the launchpad.

Direct DEX Trades Surpass Aggregator Flows

One notable trend in the past month is the growing preference for direct trades over aggregator-focused order flow. For context, aggregator order flows are trading activities—especially from retail traders—which are routed through order aggregators rather than directly to exchanges or market makers.

Earlier this year, trades conducted through aggregators were twice as many as those made directly on DEXs. Direct trades grew steadily with time, almost equalling aggregated trades in June. By July, direct DEX trades had completely flipped aggregator-based trades, with figures standing at $65.9 billion and $7.5 billion, respectively.

Solana Dominates July Trading with Strong Momentum

Solana (SOL) stood out as the most traded asset in July, recording over $58.4 billion in trades—a 92.7% growth from the month before. Fiat-pegged assets came second with $29.7 billion, while memecoins raked in $26.2 billion in trades. The remarkable surge experienced by memecoins was primarily driven by the eventful market tussle between Pump.fun and LetsBonk.fun.

At the time of writing, SOL is exchanging hands at $201, following an over 20% month-to-date uptick.

Here are Solana’s other notable on-chain trends, as per CoinCodex:

- Solana (SOL) is trading with bullish momentum, with the Fear and Greed Index standing at 73.

- SOL is up 39% over the past year, showing solid long-term growth.

- It has outperformed 53% of the top 100 cryptocurrencies in the last 12 months.

- Plus, SOL is trading above its 200-day simple moving average, reinforcing its bullish trend.

- It has posted 18 green days in the past 30 days.

- Solana is currently hovering near its cycle high of $205.73, suggesting strong market confidence.

Solana’s impressive run in July underscores the growing relevance of the decentralized exchange ecosystem, particularly as an affordable and fast blockchain network. Besides, the various trading options position the network as one of the top blockchains for decentralized trading.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

James Godstime is a crypto journalist and market analyst with over three years of experience in crypto, Web3, and finance. He simplifies complex and technical ideas to engage readers. Outside of work, he enjoys football and tennis, which he follows passionately.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.