S&P 500 Recovers Sharply After Unexpected GDP Contraction

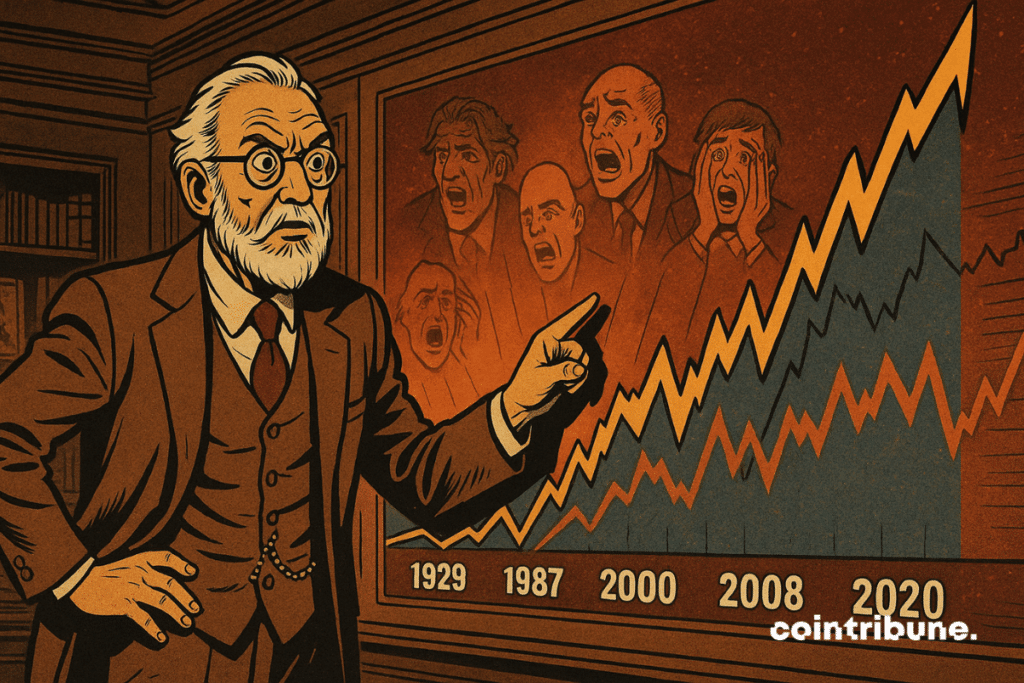

What if markets followed a tempo that escapes economic logic? While the US GDP is declining, the S&P 500 is bouncing back after a sharp drop of nearly 20 %. This unexpected turnaround, fueled by contradictory signals, intrigues even in trading rooms. Indeed, at BNP Paribas, strategists wonder: does this rapid correction fit into a global tradition ? To understand it, they dive back into a century of stock market crash history.

In brief

- The S&P 500 experienced a sharp drop of nearly 20% between February and April 2024, dubbed the “Tariff Crash.”

- BNP Paribas analysts compare this decline to other historical crashes that occurred without a recession.

- Their study, based on 100 years of data, shows that some severe downturns can be temporary and quickly corrected.

- Several positive economic signals, including strong job creation and a rebound in indices, have supported the market’s recovery.

A Crash Without Recession?

Between February 19 and April 8, 2024, the S&P 500 index lost nearly 20 %, falling from 6,144.15 to 4,982.77 points. This downward sequence, which BNP Paribas analysts called the “Tariff Crash”, attracted their attention because of its size, but also its context.

Greg Boutle, Bénédicte Lowe, and Aurélie Dubost write in a note published this Friday :

Recent stock behavior is consistent with previous crashes not related to a recession.

They add: “Crashes that occur without a marked economic slowdown can be significant and volatile, but tend to be relatively short-lived.” By tracing market movements back to the 1920s using Dow Jones data, the authors show that significant drops can occur even without a major macroeconomic shock.

Several conjunctural elements have confirmed this interpretation and supported the rebound observed at the end of the studied period :

- The three main US stock indices posted weekly gains close to 3 %, just two days after the announcement of a GDP contraction in the first quarter (-0.3 %) ;

- Treasury bond yields jumped as investors abruptly reversed their bets on a slowdown ;

- The April employment report showed 177,000 job additions, a figure above expectations, while the unemployment rate remained stable at 4.2 % ;

- Beijing was considering restarting trade talks with the United States, easing tariff-related tensions ;

- Midweek market behavior, notably a spectacular bullish turnaround in the Dow and the S&P 500, highlighted the resilience of stocks despite a deteriorated macroeconomic environment.

A Fragile Rebound and Lingering Uncertainties

While BNP Paribas’s historical analysis tends to mitigate the severity of the “Tariff Crash”, strategists do not overlook the structural vulnerabilities that could plunge markets back into turmoil.

In the same note, they warn of an alternative scenario: “stocks could retest their annual lows if a combination of downward earnings revisions and multiple compression materializes.”

Multiple compression, which means a decline in stock valuations tied to earnings outlooks, could indeed challenge the current rebound, especially if growth deteriorates further. A resurgence of the market thus rests on an unstable balance between hopes for a de-escalation in trade tensions, conjunctural resilience, and corporate earnings momentum.

Moreover, the authors remind us that economic forecasts, even those supported by long-term analyses, can prove to be out of sync with reality. “In 2022, our model projected an S&P 500 around 3,000 and VIX reaching 40 by mid-2023,” they note, before emphasizing that these levels were ultimately never reached.

This observation calls for caution regarding current predictions. Especially since other signals, such as the sharp rise in bond yields observed late last week, indicate the market continues to oscillate between fear of a sudden slowdown and hope for a soft landing. Thus, any macroeconomic surprise or a resurgence of trade tensions could abruptly reverse the current trend.

Ultimately, while the S&P 500’s rebound seems to validate the hypothesis of a crash without recession, the balance remains precarious. The precedent of 2022 reminds us that even the best-constructed scenarios can be contradicted by facts. For investors, the lesson is clear: market resilience should not be interpreted as a free pass. Between encouraging signs and lingering uncertainties, the coming weeks will be decisive in deciding between a simple technical correction and a deeper economic turnaround.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Diplômé de Sciences Po Toulouse et titulaire d'une certification consultant blockchain délivrée par Alyra, j'ai rejoint l'aventure Cointribune en 2019. Convaincu du potentiel de la blockchain pour transformer de nombreux secteurs de l'économie, j'ai pris l'engagement de sensibiliser et d'informer le grand public sur cet écosystème en constante évolution. Mon objectif est de permettre à chacun de mieux comprendre la blockchain et de saisir les opportunités qu'elle offre. Je m'efforce chaque jour de fournir une analyse objective de l'actualité, de décrypter les tendances du marché, de relayer les dernières innovations technologiques et de mettre en perspective les enjeux économiques et sociétaux de cette révolution en marche.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.