Start of the Binance Coin (BNB) ascension? Technical Analysis of January 17, 2024

The Binance Coin has regained its former resistance around $337. Let’s explore the upcoming outlook for BNB.

Situation of Binance Coin (BNB)

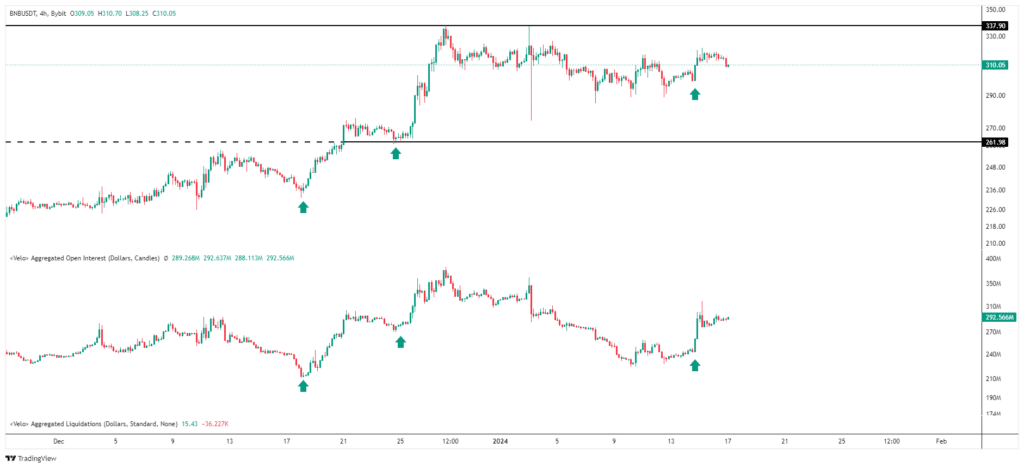

The BNB price ended the year 2023 on a positive note, recording an impressive increase of over 40%. This movement confirms the bullish scenario mentioned in our analysis of December 13th. Indeed, Binance Coin successively broke through the $260-$270 and $300 levels, before reaching the $337 resistance. Since then, the cryptocurrency has entered a consolidation phase, moving within a range commonly understood to be between $290 and $325.

BNB is currently trading around $310. It is positioned well above its 50-day and 200-day moving averages, which have recently formed a crossover and are trending upward. This phenomenon solidifies the idea that the medium and long-term trend of BNB is likely to shift to bullish. As for oscillators, they are above their median thresholds, indicating an ongoing bullish momentum on the price of this cryptocurrency.

Today’s technical analysis was carried out in collaboration with Elie FT, an enthusiastic investor and trader in the cryptocurrency market. Now a trainer at Family Trading, a community of thousands of proprietary traders active since 2017. There you will find live sessions, educational content, and mutual support on financial markets in a professional and warm atmosphere.

Focus on BNB/USD Derivatives

It is noteworthy that the two recent rallies in BNB coincided with an increase in its open interest, suggesting growing interest from buyers. Currently, it seems that this scenario is repeating itself. Indeed, at the beginning of the week, BNB not only bounced off the symbolic $300 level but also saw an increase in its open interest. This behavior reinforces the idea that the $300 price level is an important support for BNB.

Possible Scenarios for Binance Coin (BNB) Price

. If the BNB price moves back above $337, an extension of the bullish trend could be anticipated up to the levels of $380 or even $400. The next resistance to consider, if the bullish movement continues, would be the $500 threshold. At this point, that would represent a rise close to +58%.

. If BNB fails to move back above $337, a retracement to $290 could be considered. The next support level to consider, if the downward trend continues, would be around $260. At this stage, that would represent a decrease close to -20%.

Conclusion

The BNB price has recently shown significant buyer interest, contributing to an increase in its price. Can this positive momentum be attributed to factors such as its launchpad and the Manta Coin? What is certain is that it will be crucial to closely watch the price’s reaction to different key levels to confirm or disprove the current hypotheses. It is also important to remain cautious of potential “fake outs” and market “squeezes” in each scenario. Finally, remember that these analyses are based solely on technical criteria, and cryptocurrency prices can also move rapidly based on other more fundamental factors.

Maximize your Cointribune experience with our 'Read to Earn' program! Earn points for each article you read and gain access to exclusive rewards. Sign up now and start accruing benefits.

Family Trading est une Communauté de traders a compte propre active depuis 2017 offrant Lives, contenus éducatifs et entraides autour des marchés financiers dont celui des cryptomonnaies avec à ses côtés Elie FT, investisseur et trader de passion sur le marché crypto.

The contents and products mentioned on this page are in no way endorsed by Cointribune and should not be construed as its responsibility.

Cointribune strives to provide readers with all relevant information available, but cannot guarantee its accuracy or completeness. Readers are urged to make their own inquiries before taking any action with respect to the company, and to assume full responsibility for their decisions. This article does not constitute investment advice or an offer or invitation to purchase any products or services.

Investing in digital financial assets involves risks.

Read more