Strategy stops massive BTC buying: Should we worry?

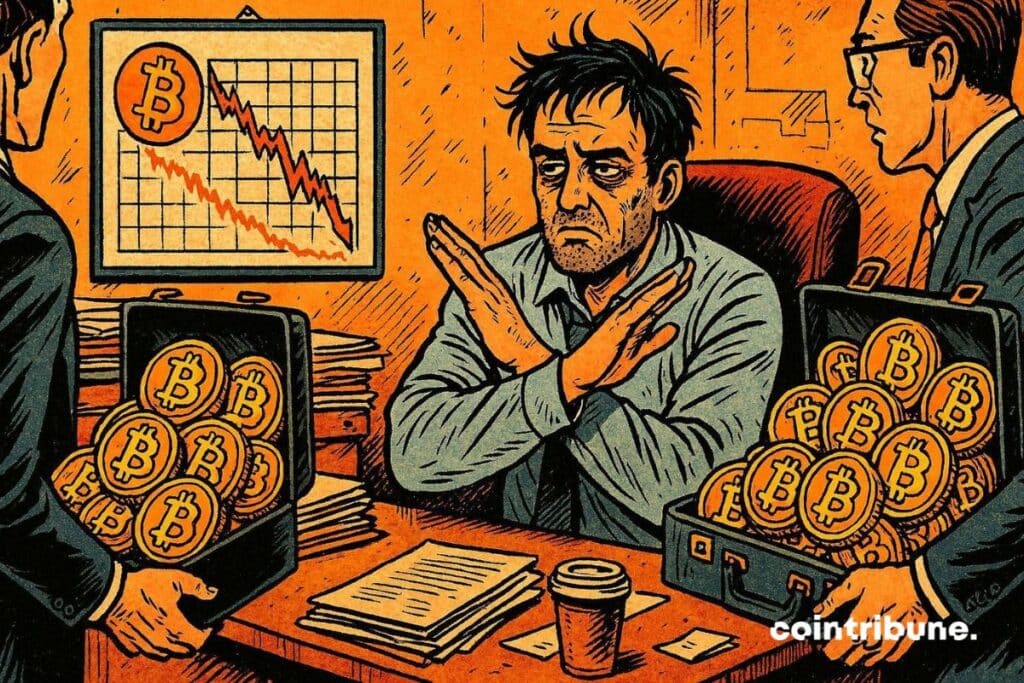

Since 2020, Strategy embodied absolute trust in bitcoin, accumulating thousands of BTC each month. However, in December 2025, the giant seems to mark a sudden pause. Purchases collapse, cash reserves swell, and questions arise: does this turnaround announce a prolonged crypto winter or just caution in the face of uncertainty?

In brief

- Strategy drastically reduced its Bitcoin purchases, dropping from 134,000 BTC in 2024 to only 130 BTC in December 2025.

- Strategy’s last significant bitcoin purchase raised its reserves to 649,870 BTC, but the CEO mentions a possible sale under conditions.

- Strategy’s slowing bitcoin purchases raise questions: risk of a drop or buying opportunity before a rebound?

Strategy suddenly slows its massive bitcoin purchases: Why?

The numbers speak for themselves: Strategy has decreased its monthly bitcoin purchases from 134,000 BTC in November 2024 to only 130 BTC at the end of November 2025. According to CryptoQuant, this vertiginous drop reflects a shift toward a conservative strategy focused on liquidity. The last significant purchase made on November 17, 2025, was 8,178 BTC for 835.5 million dollars! Bringing its reserves to 650,000 BTC, with a total cost of about 48.38 billion dollars.

CryptoQuant interprets this slowdown as preparation for a bear market. The monthly purchase chart confirms this trend: after a peak in 2024, the curve collapses, revealing almost no accumulation at the end of the year. This change comes after bitcoin’s largest drawdown in 2025, in a context marked by the end of the “BTC proxy trade” and increased pressure on crypto treasury companies.

Selling BTC? The Strategy CEO sets a condition that worries markets

Recently, the CEO of Strategy mentioned an unexpected possibility: selling part of the bitcoin reserves under a specific condition. A statement that sowed doubt among investors used to seeing the company as an unconditional BTC pillar. According to CryptoQuant, this caution is explained by several factors:

- The need to preserve liquidity in an uncertain market;

- Pressure from shareholders;

- An unfavorable macroeconomic environment.

Strategy’s last massive purchase in November 2025 might seem contradictory with this new approach. Yet, it might rather be an opportunity seized at an attractive price before a potential prolonged decline. Speculations abound: does Strategy anticipate a major correction, or is it simply trying to reassure its investors?

Bitcoin at a turning point: immediate rise or risk of fall?

A burning question for investors: if Strategy, the historic leader in bitcoin accumulation, slows its purchases, should we expect a rise or a fall of BTC? Two scenarios clash. On one side, a surprise rise remains possible if institutional players take advantage of low prices to buy discreetly, creating scarcity effects. On the other, a risk of fall persists: weakened demand might lead to a deep correction, especially if other companies follow Strategy’s example.

The indicators to watch are many: whale behavior, Bitcoin ETF reactions, and regulatory developments. One thing is certain, the market is at a tipping point. The coming months will be decisive to determine if Strategy was right preparing for a crypto winter, or if its caution was excessive. For investors, doubt settles in: should they follow this trend or bet on a rebound?

Strategy is not turning its back on bitcoin, but its change of course reflects uncertainties of a market in full mutation. Between opportunities and risks, one thing is sure: 2026 promises to be decisive. And you, would you be ready to buy BTC in this context, or are you waiting for a more marked drop before investing?

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

The world is evolving and adaptation is the best weapon to survive in this undulating universe. Originally a crypto community manager, I am interested in anything that is directly or indirectly related to blockchain and its derivatives. To share my experience and promote a field that I am passionate about, nothing is better than writing informative and relaxed articles.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.