Memecoins live at a strange pace. Everything goes very fast, then nothing. On Solana, Pump.fun has been one of the main accelerators of this dynamic. But when a platform grows, every setting becomes political. Even a simple fee.

Theme Altcoins

Chainlink remains stuck in a micro-range, between $12 and $16, leaving traders waiting for a strong signal. As the crypto market hesitates, opportunities hide in the technical details. Should we anticipate a breakout or a rebound?

Pump.fun has just made crypto history by exceeding 2 billion dollars in daily volume thanks to Solana memecoins. Between rapid opportunities and legal risks, this explosion raises questions: sustainable revolution or bubble ready to burst?

Solana is changing its status. Long perceived as a fast alternative to Ethereum, the blockchain now attracts leading institutional investors. This rise comes as the network consolidates its technical fundamentals. The accumulation of SOL by specialized funds fuels a new dynamic, at the crossroads of real uses and financial flows. At the start of this year, Solana no longer just promises: it establishes itself as a structuring player in the ecosystem.

Iran now offers to sell advanced weapons systems to foreign governments in exchange for cryptos. These include ballistic missiles, armed drones, and warships. Iran aims to bypass Western financial controls and maintain its military exports despite sanctions.

While the crypto industry is multiplying IPOs to gain legitimacy, Ripple opts for a different path. Against all odds, its president Monica Long has dismissed any IPO, despite a valuation of 40 billion dollars and the end of the showdown with the SEC. Thus, contrary to the signals sent to the market, this refusal marks a clear intention: to remain independent in order to better control its growth and governance, while consolidating its status in a rapidly changing regulatory landscape.

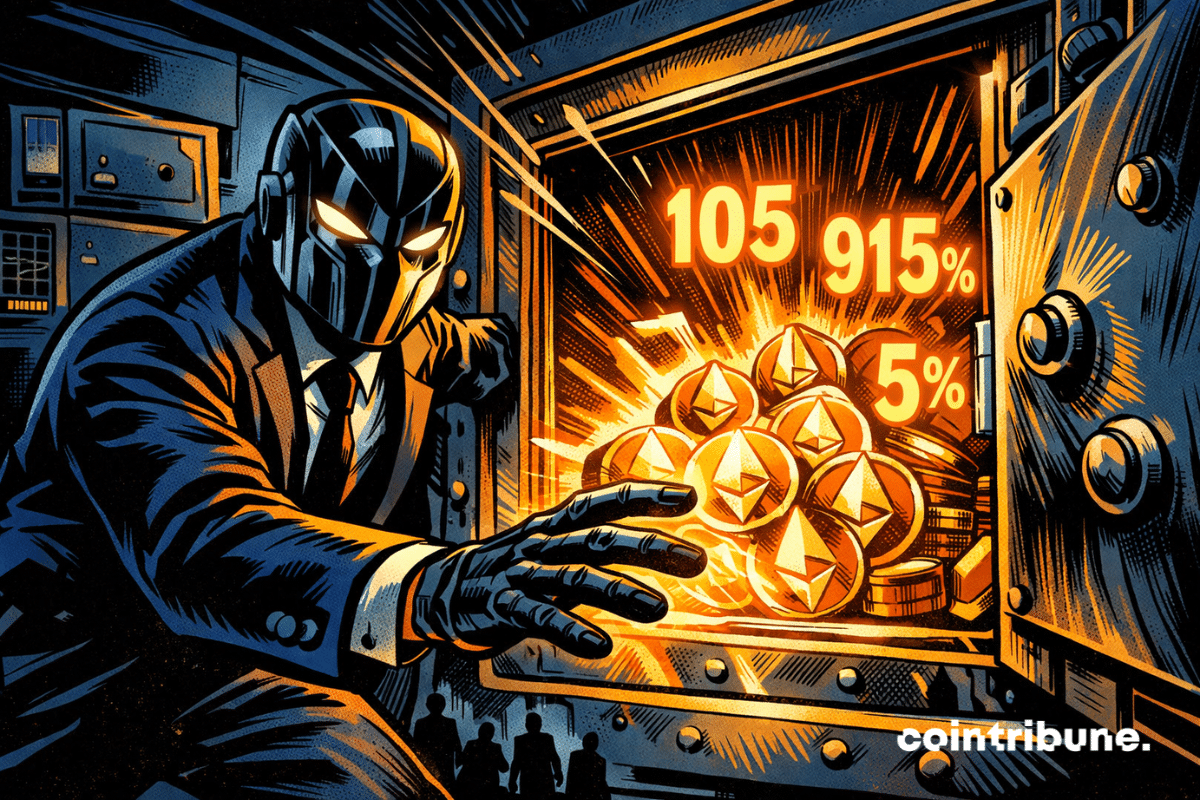

BitMine restarts the race to Ethereum with $105M in cash and an explosive treasury of $915M. All the details here!

Solana Mobile has confirmed plans to distribute its new ecosystem token, SKR, through an airdrop scheduled for January 20. Distribution will target second-generation Seeker smartphone users and developers building apps for the device. Earlier Saga phone owners will not qualify, marking a shift toward the newer hardware.

Morgan Stanley strengthens its presence in cryptos. The American bank has filed a form with the SEC to create a spot Ethereum ETF, including a staking component. A first at this institutional level, which occurs as market interest in crypto products intensifies.

Ethereum strengthened its DeFi dominance in 2025, locking $99B, lowering fees, rolling out major upgrades, and breaking key price levels.

The Bittensor TAO token soars 10% after the launch of the Grayscale Bittensor Trust (GTAO). Between halving and institutional adoption, this crypto linked to decentralized AI attracts investors. Why could this project revolutionize the market?

Telegram begins 2026 with mixed financial results. The messaging service records 870 million dollars in revenue in the first half of 2025 and targets 2 billion dollars for the year. However, these ambitions come with net losses and an unstable crypto environment. Between economic growth, the fall of Toncoin, and regulatory pressures, the platform is at a strategic crossroads, while an initial public offering is still under consideration.

Altcoins may be positioning for a rebound after months of subdued price performance. Market data indicates that many tokens are trading above key support levels established in October. Analysts say these signals could point to a renewed appetite for risk across the broader cryptocurrency market.

The capitalization of memecoins jumped by more than 23% in early 2026, with a trading volume that almost quadrupled. In short, "hot" money is back, the kind that tests limits. According to data relayed around CoinMarketCap, the sector went from about $38 billion on December 29 to over $47.7 billion a week later, while volumes climbed towards $8.7 billion.

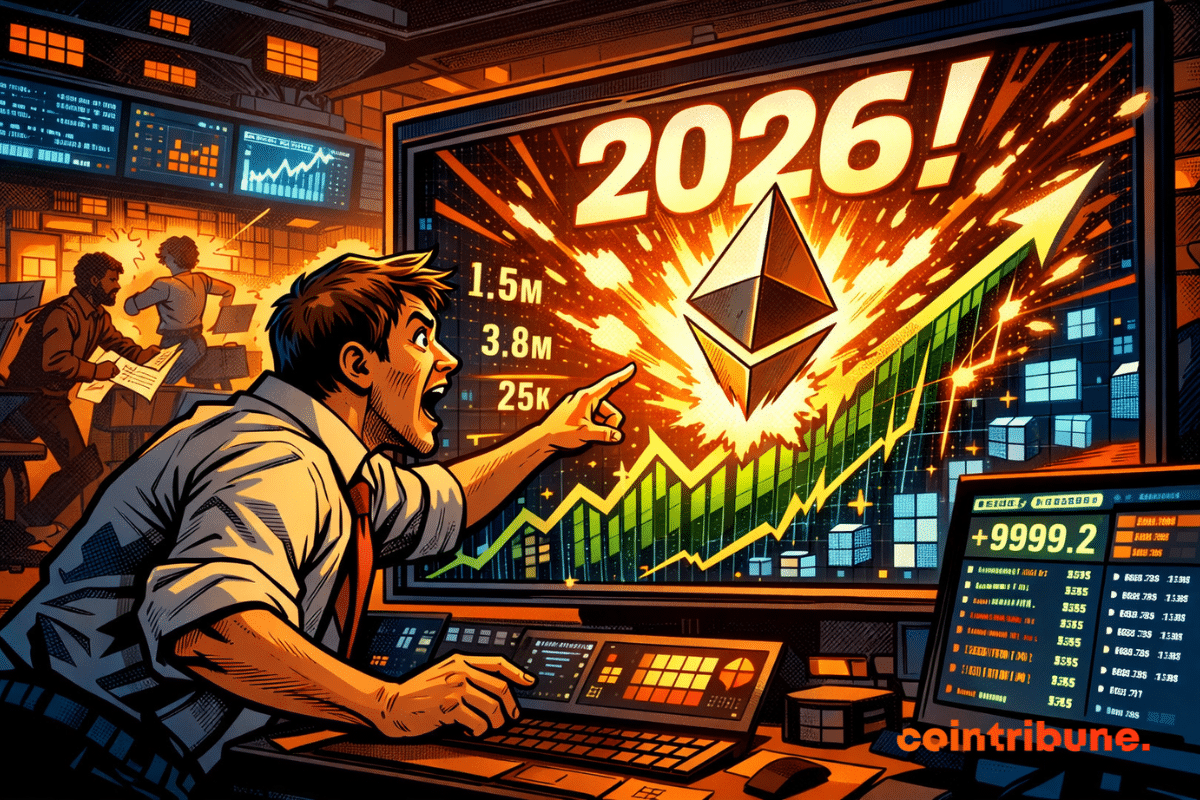

At the end of 2025, Ethereum didn't just finish the year well. It accelerated, then it broke the crypto counter. On December 29, 2025, the network validated 2.23 million transactions in a single day. A historic peak, supported by numbers.

In 2026, cryptocurrencies are the subject of rare optimism on social networks, according to Santiment. However, traditional indicators remain cautious. Why this gap? Between social euphoria and market reality, discover what this unexpected signal hides for the crypto market.

BitMine stock jumped 14% after an announcement described as "spectacular" by its chairman, Tom Lee. Indeed, the company is seeking shareholder approval to significantly increase the number of authorized shares. This strategic move comes as BitMine strengthens its position on Ethereum, of which it holds 3.41% of the circulating supply. In a market where crypto treasuries are growing, this initiative marks a key step for one of the largest institutional holders of ETH.

Crypto markets are showing a notable shift, with major altcoins recording solid gains. Bitcoin’s share of the overall market has weakened and is now nearing 59%. Capital rotation toward higher-beta assets has followed, renewing discussion around a potential altcoin-led phase.

While bitcoin remains above $89,000 at the start of 2026, many analysts claim that whales are beginning a powerful accumulation movement. A signal perceived by some as the prelude to a new bull run. However, behind this optimistic reading, on-chain data tells a very different story. Far from a massive return of large holders, the current market dynamic seems driven by other actors, much more discreet… and probably more decisive for what comes next.

For the first time in over 400 days, a major technical support for XRP has broken. Under pressure below 2 dollars, Ripple's crypto operates in a critical zone. The market is holding its breath, as the bullish structure falters, and what follows depends on the next moves.

Despite a 46% drop in three months, Solana tops the crypto trends at the start of this year, according to Santiment data. This accumulation is supported by large wallets, while the majority of investors remain hesitant after an unstable 2025. Such a discreet but structured movement calls for attention. Is it a simple opportunistic bet or an early reversal signal?

Bitmine and Fundstrat head of research Tom Lee rehashed debates across crypto markets after forecasting a sharp rise in Ethereum’s price. Speaking at Binance Blockchain Week, Lee stated that Ether could reach $62,000 in the coming months as blockchain adoption enters a new phase. His remarks also reaffirmed his long-held bullish view on Bitcoin.

Shiba Inu (SHIB) is under renewed pressure as its market position weakens. Once ranked among the top 15 cryptocurrencies, SHIB now sits near the lower end of the top 40 by market capitalization. Recent price movement and fading interest have raised questions about whether the token can recover in the next market cycle.

Crypto veteran and BitMEX co-founder Arthur Hayes has adjusted his portfolio, selling a significant amount of Ether and reallocating funds into decentralized finance projects. The move comes as Ethereum faces weak price momentum while network activity continues to grow steadily. Hayes’ actions have drawn mixed reactions across the crypto community, particularly as DeFi tokens remain under pressure.

The supply of XRP on exchange platforms has fallen to its lowest level in eight years. This liquidity contraction coincides with a massive disengagement of short-term investors and a retreat to custody solutions. Thus, the prospect of a rally in 2026 reemerges, without a clear consensus.

While the market watches the price of crypto, another indicator emerges. Ethereum recorded a record 8.7 million smart contracts deployed in the fourth quarter, according to Token Terminal. This peak in activity, reached despite a price drop, confirms the strength of network usage. Far from cyclical effects, the on-chain dynamics outline a discreet but structuring underlying trend.

Cardano founder Charles Hoskinson has said he will no longer address questions about the Genesis ADA audit, stating that the matter is settled following the release of the full audit report. The comments come as debate resurfaces within the Cardano community over transparency and governance tied to early ADA allocations.

As the crypto market closes a year under high tension, XRP takes a sharp turn. After riding a wave of optimism fueled by institutional flows and regulatory hopes, Ripple's asset faces increasing selling pressure. The reversal is clear, technical signals turn red, and investor sentiment flips. This downturn could well mark a new chapter in the trajectory of one of the most watched tokens on the market.

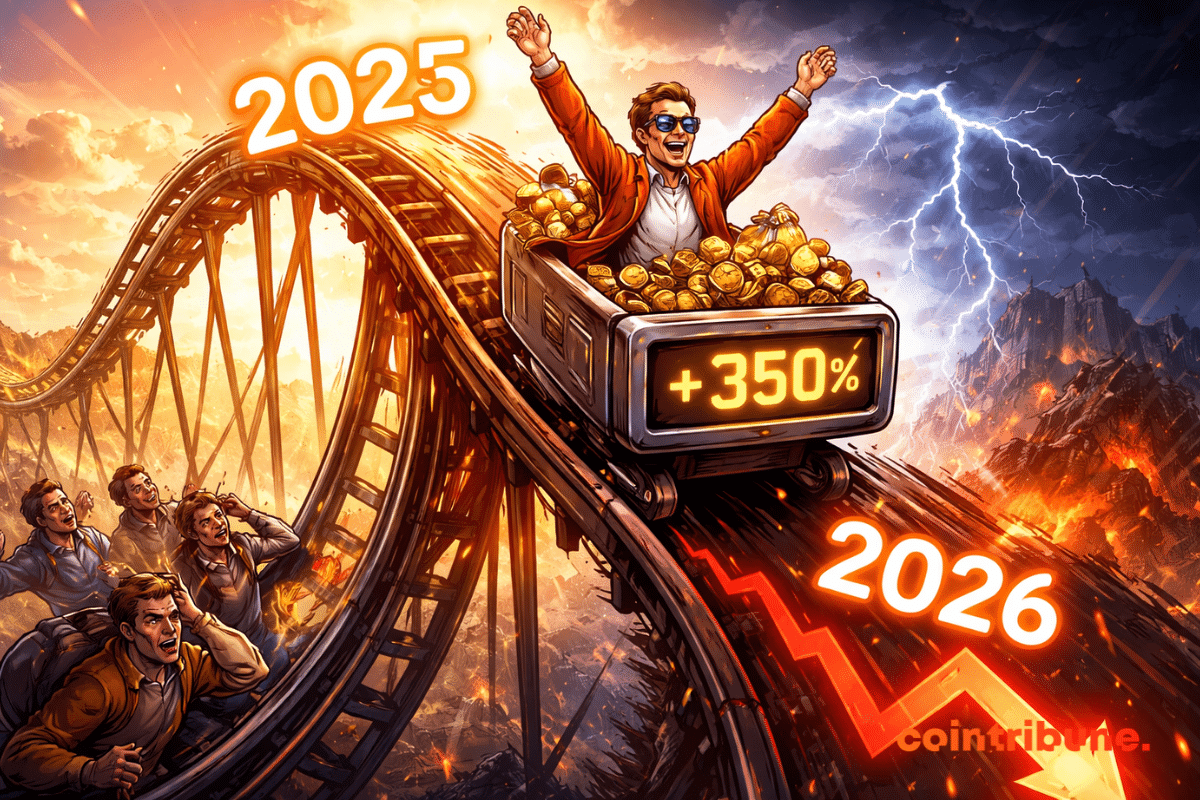

Bitcoin wavers as the New Year's Eve approaches: whales, options, silver ratios... What if 2026 rhymes with hangover in the crypto jungle? Holy tree!

We've seen louder trends pass by. But rarely such a corporate trend. In 2025, the CTAs, those companies that put Bitcoin or other crypto-assets at the heart of their treasury, multiplied at an almost suspicious speed. And already, some leaders in the sector are talking about 2026 as a narrow corridor where many will not pass.