Cardano shows weakened momentum. Its price remains under pressure after several weeks of decline, and some retail investors are gradually reducing their exposure. However, major ADA holders are strengthening their positions while small wallets decrease theirs. This divergence between the activity of large investors and that of retail frequently appears in the final phase of a bearish trend.

Theme Altcoins

Solana falters. Long presented as one of Ethereum’s most serious competitors, the blockchain today faces a significant decline in its fundamentals: liquidity drop, user disengagement, innovation slowdown. After months of euphoria, the ecosystem shows clear signs of slowdown.

Ethereum is stagnating: whales are accumulating, ETFs are flowing, but the breakout is on strike… Behind the scenes, there is movement, but the chart breakout still boycotts the party.

Memecoins are dead, long live memecoins? While the entire market is burying them, some see... a nap. The crypto circus may not have said its last word.

Sei is making crypto easily accessible by embedding its wallet and payment features directly into Xiaomi smartphones.

JPMorgan, one of the largest American banks, has just completed a historic transaction: a 50 million dollar commercial paper fully managed on the Solana blockchain. Galaxy Digital, Coinbase, and Franklin Templeton participated in this pioneering operation settled in USDC.

While the entire crypto market is showing signs of stabilization at the end of the year, XRP sends an atypical and potentially worrying signal. Its funding rate on perpetual contracts plunged to -20%, a threshold rarely reached even during high volatility periods. This configuration reflects a marked imbalance: short positions dominate while bulls seem to be withdrawing from the game. In a market so sensitive to liquidity and sentiment signals, this anomaly deserves special attention.

Crypto markets have started coughing again. No spectacular crash this time, but a slow loss of breath: crypto trading volumes are declining, prices are correcting, and even spot bitcoin ETFs are turning red. For JPMorgan, the picture is clear: the appetite for risk is fading, and the market stalls just as it was supposed to confirm its strong comeback.

Bitcoin pauses in the balance sheets, but some actors buy more than ever. Here are the numbers worrying analysts.

Shiba Inu is moving through a quiet but steady phase as the broader crypto market works toward a gradual recovery. Price action stays compressed between $0.0000085 and $0.000009, creating a stable zone while traders wait for a clearer shift in sentiment. Even with the calm movement on charts, several ecosystem updates show the project continues to focus on long-term progress.

Dogecoin struggles to convince institutional investors. Despite a strong capitalization and a media-covered launch, crypto-backed ETFs show volumes in free fall. In a sector where Bitcoin and Ethereum concentrate the bulk of flows, the disinterest in DOGE illustrates the limits of assets perceived as too speculative.

What if Ethereum users could lock in the price of their future transactions in advance? This is the bold path opened by Vitalik Buterin. Facing the persistent volatility of network fees, Ethereum's co-founder envisions the creation of gas futures contracts, a hedging mechanism that could revolutionize economic planning on the blockchain.

CoinShares reports $716 million in weekly inflows into its digital asset ETPs, marking the second consecutive week of positive flows. This growth brings assets under management to $180 billion, up 7.9% from their November low. Data show increased investor participation, with significant contributions from the United States, Germany, and Canada.

Ethereum has just reached a historic milestone: 6 million ETH burned, equivalent to $18 billion up in smoke. Yet, against all odds, its supply keeps increasing. How to explain this paradox that defies the logic of the crypto ecosystem?

Ethereum’s network shows record stablecoin activity, $6T in Q4 settlements, low fees, and steady prices above $3,000.

Dogecoin just blew out its twelfth candle. As often with this unlikely project, the celebration looks more like a nod to the Internet than a classic birthday. Born to mock the very serious Bitcoin universe, DOGE has become in twelve years one of the most endearing and sometimes the most baffling emblems of crypto.

While bitcoin is bogged down under the spotlight, fleeing ETFs and traders under Lexomil: the crypto star rediscovers the joys of the plunge, 2022 version, remixed 2025.

XRP is going through a rare moment of tension. While institutional investors continue to pour in via spot ETFs, social sentiment around the asset plunges sharply into extreme fear territory. This striking contrast between capital inflows and market panic feeds uncertainty. At the crossroads of fragile technical signals and a possible rebound, XRP becomes one of the most watched assets in the crypto ecosystem.

Bitcoin Cash has an early year that few observers anticipated. While most L1 blockchains struggle to stand, BCH moves forward confidently, as if the entire market has finally decided to reconsider its place in the crypto landscape. A sharp, almost disorienting rise that contrasts with the lethargy of other major networks.

A record movement of 23 561 billion SHIB in just 24 hours shook the crypto community. Historic anomaly, technical error or manipulation? Dive into the investigation of a phenomenon that defies all logic and questions the experts of Shiba Inu and cryptocurrencies.

Dogecoin remains under pressure but rising on-chain activity and growing investor participation hint at a potential rebound.

The social sentiment around XRP has just dropped to its lowest level since October, according to Santiment data. The crypto is going through what the platform describes as a "fear zone." This emotional downturn contrasts with past movements, where similar phases had preceded a marked rebound. In a tense crypto market, XRP could once again surprise.

According to a study by the FINRA Investor Education Foundation, enthusiasm for cryptos has cooled. Indeed, only 26% of investors still plan to buy cryptos, compared to 33% in 2021. However, 27% still hold them, an unchanged level. There is less desire to buy more, but not necessarily a massive exit.

When a company named Strategy becomes the compass of bitcoin, even JPMorgan takes out its calculator. Bull run or crash? The answer lies between MSCI, reserves, and a few well-placed billions.

Supported by record inflows into spot ETFs and favorable technical setup, Ethereum quietly outperforms bitcoin. As flows shift and retail interest rises again, a turning point is happening. Is the trend changing permanently?

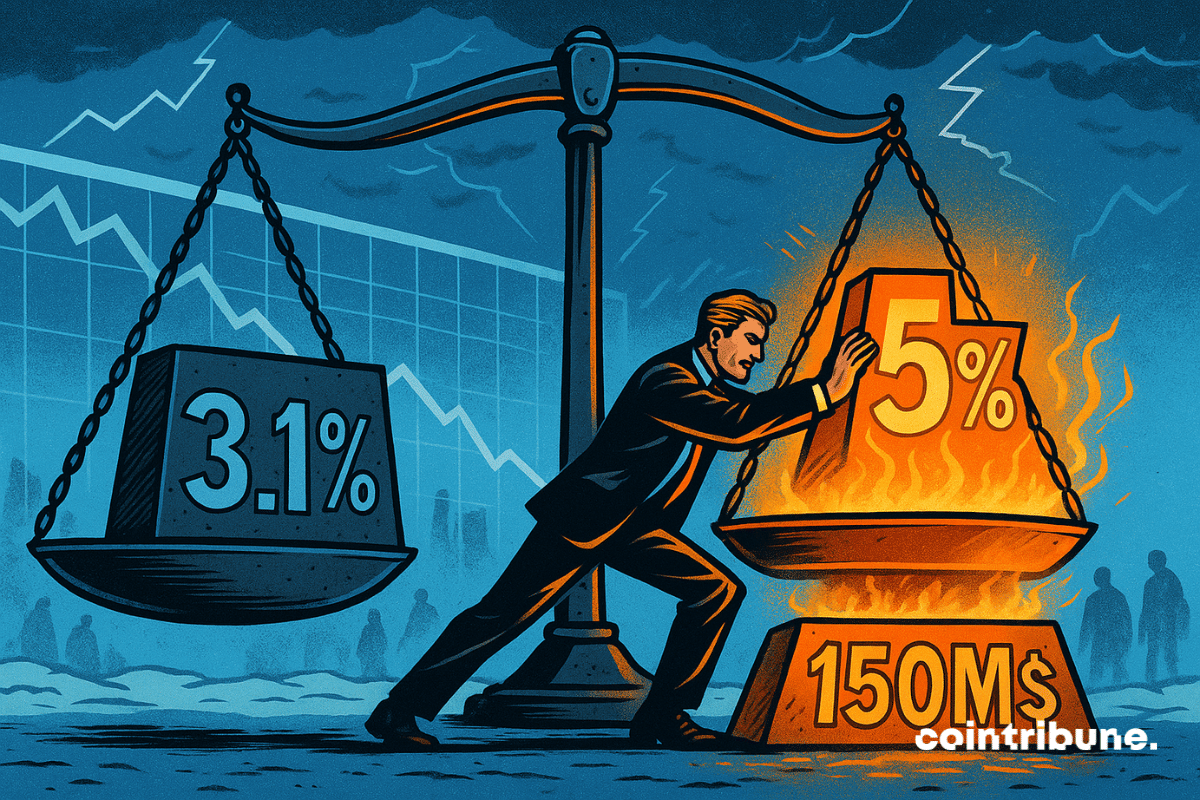

While the small holders sell, BitMine stuffs itself with ether: $150 million at once, aiming for 5%. Soon, Ethereum will be to Tom Lee what Twitter is to Musk.

When Ethereum no longer inspires companies, BitMine feasts, the small ones die... and the crypto market wonders: is it a pause or the end of recess?

While many eyes remain fixed on Bitcoin and Ether, Solana is currently playing a much subtler game. The SOL crypto still holds above the 120 dollar area, but this level is not just a technical support: it is supported by a real shift in liquidity and on-chain supply. However, trader-side demand remains surprisingly timid. And as long as this gap persists, Solana's structural advantage is not fully reflected in the price.

Shiba Inu’s Shibarium network is set for a major evolution with Zama’s 2026 privacy upgrade. Fully homomorphic encryption could bring private transactions, confidential smart contracts and stronger security after the 2025 exploit.

Despite a cautious atmosphere in the crypto market, one asset captures the attention of institutional investors: XRP. Long weighed down by its regulatory troubles, the altcoin has triggered a spectacular resurgence of interest since the launch of several spot ETFs in the United States. Capital inflows continue at an unprecedented pace, revealing a possible turning point in the token's trajectory. Should this be seen as the signal of a new bullish cycle, driven both by traditional finance and encouraging technical signals?