In a crypto market marked by wait-and-see, Pi Network struggles to trigger a real recovery. Far from its promising beginnings, the asset now moves between consolidation levels and mixed technical signals. Some indicators show an improvement in flows but without a clear breakthrough of key thresholds. The momentum remains fragile, and the selling pressure latent. Between timid investor support and lack of a strong catalyst, Pi is going through a prolonged phase of uncertainty. The risk of technical deadlock persists.

Theme Altcoins

Dogecoin, the quirkiest crypto on the market, could soon enter institutional portfolios. Bitwise has filed a new spot ETF application with the SEC, removing the last administrative barriers. The green light could come within twenty days… triggering a new rush towards Elon Musk's favorite meme.

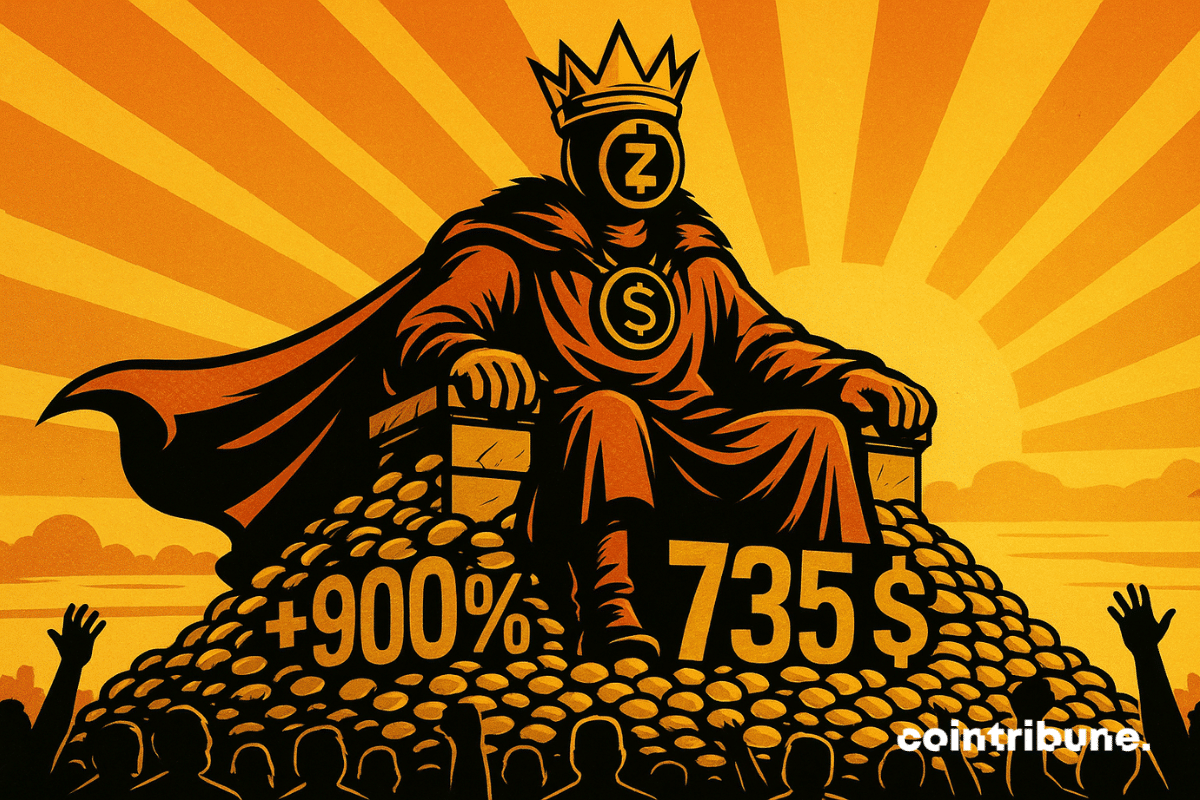

While bitcoin is bogged down in divisive institutional adoption, an old privacy token makes a spectacular comeback. In five weeks, Zcash (ZEC) went from obscurity to a +900% surge, reaching up to 735 dollars this Friday, an unprecedented high in nearly eight years. Stabilized around 666 dollars, the asset still shows a 74% increase over the week. This unexpected rebound shakes the market and revives the debate on crypto privacy.

While the crypto industry regains market confidence thanks to clearer regulation and growing interest from institutional investors, Ripple opts for an unexpected direction. Despite a legal victory against the SEC and a year of exceptional growth, the Californian company forgoes any public offering. A choice that contrasts with the ambitions of other industry players and raises questions about the company’s long-term strategy.

As the crypto market holds its breath, a note from 10x Research reignites the debate. Ethereum is now a good candidate for shorting. According to the firm, betting against ETH could provide effective coverage against the institutional rise of bitcoin. This strategic reading shakes up the hierarchy between the two main assets in the sector.

Shocking ranking in crypto: XRP climbs to the top of altcoins against Dogecoin and Solana. More details in this article.

Forward Industries’ board approved a $1 billion share buyback program, highlighting its position as the largest corporate Solana treasury amid market pressures.

Bitcoin slips, whales abandon, small holders capitulate... what if the famous $92,000 gap became the new stopover? Bearish mood guaranteed.

The Ethereum Foundation changes the game: no more random grants, instead an ultra-targeted strategy to boost innovation. Wishlist, RFPs and impacts on ETH... Decoding a revolution that could redefine the future of crypto and make prices explode.

XRP has just experienced a historic boom: a 100% explosion of new users in just a few days. Transaction records, rising volumes and price under pressure — what's behind this sudden frenzy around Ripple's crypto (XRP)? Dive into the analysis of the numbers and stakes.

Long overshadowed by regulatory constraints and the rise of centralized platforms, Zcash makes an unexpected comeback to the forefront of the crypto scene. Driven by a spectacular rise in its price and growing adoption of its privacy features, the project regains momentum. At a time when demand for private transactions is exploding, Electric Coin Company unveils an ambitious roadmap to assert Zcash's central role in the ecosystem.

Solana ETFs have just achieved a historic feat: nearly 200 million dollars raised in only four days. Yet, the price of SOL drops by 1.5%. A paradox that raises questions: will these new financial products finally propel the Solana crypto to new heights?

Crypto explosion: Zcash emerges from an 8-year bearish cycle and climbs to the top. We tell you more in this article.

While institutional interest in cryptos is rising again, the decisions of major players capture all the attention. This November 1st, Ripple plans to unlock 1 billion XRP, which is more than 2.4 billion dollars at the current price, from its escrow accounts, as part of a mechanism established in 2017 to regulate the supply. A regular operation, but one that, in the current climate, raises questions about liquidity strategies and market balance.

The crypto derivatives market has just reached a strategic milestone. XRP and Solana surpass 3 billion dollars of open interest on the CME, a threshold until now reserved for heavyweights such as Bitcoin and Ethereum. This rapid rise propels these two tokens to the frontline of institutional financial products, marking a silent but decisive repositioning in the crypto hierarchy.

In 2025, crypto breaks all records: entrepreneurs become billionaires in a few months thanks to spectacular fundraising and bold secondary sales. But behind these express fortunes hide major risks and burning questions. Who will withstand the test of time? Dive into the behind-the-scenes of this digital gold rush.

While Wall Street discovers the joys of staking, Solana infiltrates ETFs. Attractive yield, full crypto, and Bitwise outpaces the giants. Yum.

Coinbase, the well-groomed crypto exchange, is cooking up a Base token. JPMorgan sees billions in it. Should we worry when banks applaud tokens they do not control?

While the crypto market shows signs of recovery, BitMine Immersion Technologies stands out with a $321 million Ethereum purchase. This operation places the company, listed on the NYSE, at the top of public ETH treasuries. At the helm, Tom Lee, co-founder of Fundstrat, orchestrates this bold bet in a climate of renewed risk-taking in the markets. This strong signal could redefine the balance of power between Bitcoin and Ethereum.

REX Shares’ XRP ETF XRPR surpasses $100 million AUM as institutional interest in the cryptocurrency continues to grow.

Solana (SOL) hovered near $191.95 on October 25 after briefly testing $195 earlier in the day. The token has shown resilience amid shifting market momentum, with traders watching to see if it can turn the $192–$195 range into a new support zone.

XRP has gained momentum with three days of price growth, a $26.9 billion surge in CME futures, and rising institutional interest.

Cardano has just crossed 115 million on-chain transactions. Remittix, for its part, opens its testing phase for a wallet designed for cross-border payments. Two distinct pieces of information, but indicative of a common trend: the growth of concrete uses in an ecosystem long dominated by speculation. Far from theoretical promises, these projects illustrate a shift towards measurable, functional, and user-oriented applications.

October often rhymes with "Uptober", the month where bitcoin ignites the markets with spectacular increases. However, this year, the scenario turns to disappointment. After a promising start, the queen of cryptos gets stuck in an unexpected bearish dynamic, reviving fears of a possible "red October". A first since 2018, which tests investors' confidence and questions the market's solidity in the face of an increasingly tense global economic context.

A Ripple co-founder quietly sold $764 million worth of XRP over seven years. The operation, although legal and transparent, reignites tensions within the community. As crypto struggles to keep pace with its competitors, this revelation reopens the debate on the impact of internal sales on the token's performance.

Stuck in a symmetrical triangle since mid-September, Solana's price reflects a war of attrition between buyers and sellers. Neither side gives up. But technical and on-chain signals converge: this stalemate is coming to an end. The next breakout could well decide SOL's fate for the coming weeks.

Aave steps up a gear. Its decentralized autonomous organization (DAO) has just unveiled an ambitious buyback program that could redefine its treasury management. The initiative would transform occasional buybacks into a permanent policy, funded by the protocol's growing revenues. But will this strategy be enough to sustainably support the token against fierce competition in DeFi?

Ethereum’s latest rally has once again lost momentum, with the cryptocurrency struggling to stay above the $4,000 mark. With weak demand and declining spot ETF inflows weighing on sentiment, analysts warn that Ether (ETH) could face a deeper correction toward $3,100 if buyers fail to regain control.

The Kadena Organization will no longer maintain its blockchain, causing KDA token to crash nearly 60% as the network shifts to community control.

Solana Mobile turns the page on its first crypto smartphone. The Saga, launched in 2023, will no longer receive updates or security patches. Only two years after its market arrival, the device is abandoned. An early obsolescence that contrasts with the standards of Apple and Google.