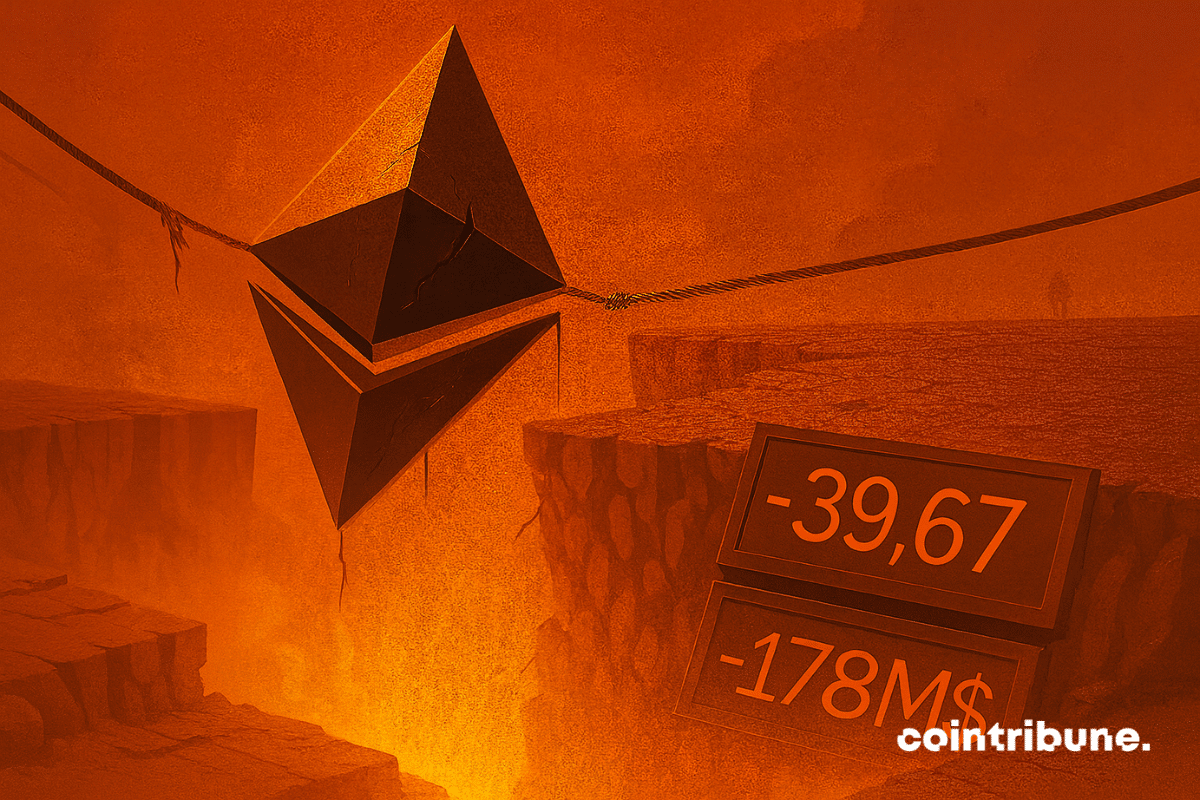

Ethereum is going through a delicate period. Since early October, Trend Research has multiplied massive sales, unloading $455 million worth of ETH on the market. Yet, against all odds, Ethereum holds steady around $4,590. Will this resilience last in the face of growing selling pressure?

Theme Altcoins

A hacker fails his attempt, CZ drops a tweet, and here is a stranger pocketing 2 million with a useless meme. It’s beautiful, modern crypto-poetry…

Shiba Inu (SHIB) investors appear to be back in accumulation mode following an on-chain report of a massive 512 billion SHIB transfer, which has stirred bullish sentiment across the cryptocurrency community. The meme coin, which has struggled for much of the year, is now regaining optimism as long-term holders expand their positions.

The memecoin FLOKI has just reached a historic milestone. By entering the Swedish stock exchange Spotlight Stock Market with its first crypto ETP, the community token finally opens up to traditional financial markets. A symbolic advancement that confirms the rise of digital assets in an increasingly regulated ecosystem.

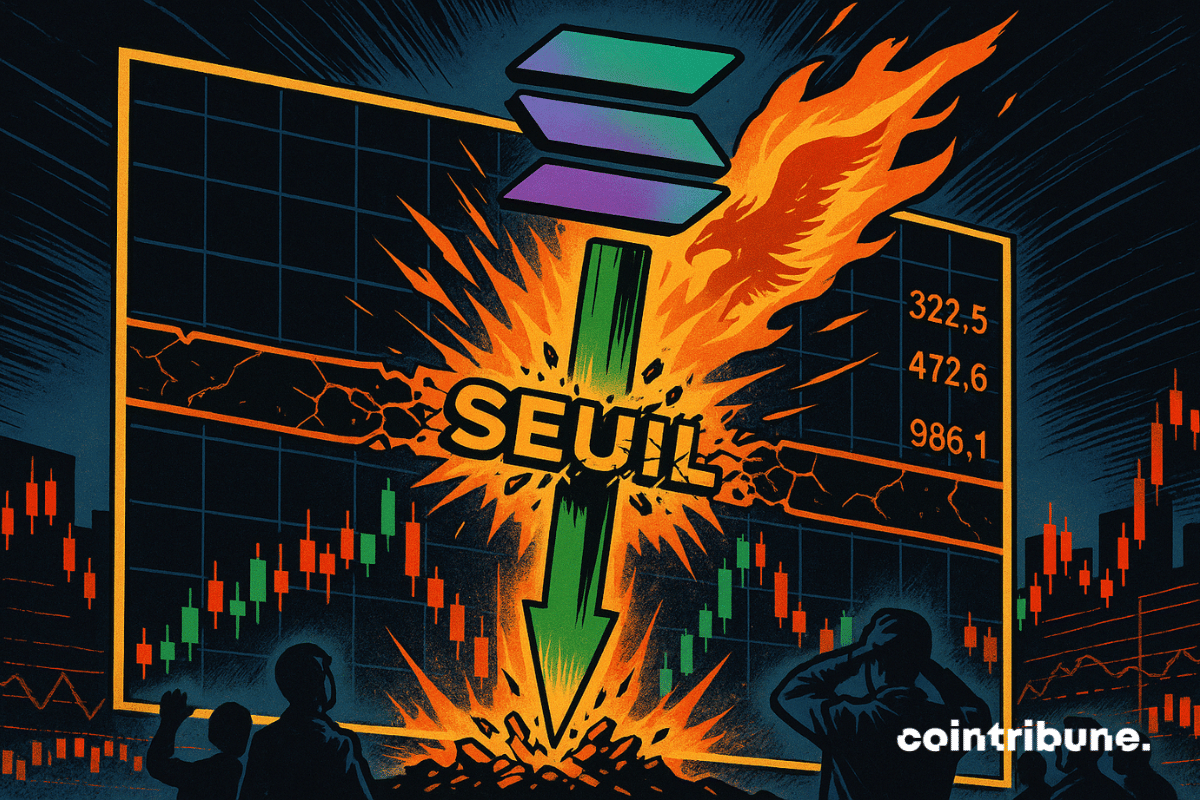

Despite a 19% increase, Solana raises concerns: massive sales and a drop in new crypto addresses undermine the momentum. Details here!

BNB touches the heights while the US government stalls. Record, Kazakh investors and low-cost transactions: Binance fears neither shutdown nor speculation. A crypto that doesn't fall asleep!

Zcash (ZEC) has taken center stage in the crypto market after a parabolic rally sent it to a three-year high. The token has soared on the back of Grayscale’s new Zcash Trust, which has fueled a wave of fresh demand. But while ZEC now leads the market in performance, rising on both daily and weekly charts, on-chain signals warn that the rally may be overheating and vulnerable to a pullback.

A memecoin that collapses, 30 million disappearing, an AI as an excuse... At the Trumps, crypto sometimes smells more like a cover-up operation than a smart contract.

Pi Network, launched in 2019 to democratize mobile mining, gathers millions of users. Yet, its token still has no real value, and its blockchain remains under control. Since the partial opening of its mainnet, the project oscillates between collective fascination and technical warning signs. Centralization, lack of transparency, invasive KYC... despite everything, enthusiasm does not wane. Why does such a controversial project continue to unite people?

In just a few days, Ripple's crypto has crossed several key technical thresholds, awakening expectations of a bullish rally as early as this October. In a context where indicators align and regulatory deadlines approach, attention turns to an asset long relegated to the background. What if XRP became the trigger for the next bullish movement?

Solana’s faster unstaking process could give it an advantage over Ethereum for investors and funds considering staking ETFs

The XPL token from Plasma is going through a turbulent period. After a sharp drop in its price and a wave of rumors targeting its team, CEO Paul Faecks stepped forward to defend the project and try to reassure investors.

At just 19 years old, Barron Trump already displays a fortune that surpasses that of his own mother. His secret? An early entry into the crypto world and a strategic role within World Liberty Financial. But how could such a young man accumulate such wealth in so little time?

Memecoins attract, but the profits escape those who buy them. According to a report by Galaxy Research, these tokens, booming on Solana, primarily benefit platforms and trading bots. Far from the community image they project, they feed a fast market where retail investors, often losers, serve a well-oiled industrial mechanism.

While Ethereum staggers, Wall Street joins the crypto party: ETFs galore, billions lurking, and a network that makes less noise, but more waves.

After 13 years at Ripple, CTO David Schwartz is stepping down. He joins the board but remains influential in the crypto world. Details here!

When crypto goes up, he goes down. @qwatio, a relentless speculator, burns millions on XRP… and could well blow up at the next green candle. What are we waiting for to stop him?

What if technology is no longer enough? Despite its technical lead, Ethereum falters, not on its foundations, but on its narrative. This is the troubling finding of "Project Mirror," a study commissioned by the Ethereum Foundation, which reveals a deep unease: without a clear vision or mobilizing narrative, the network loses momentum, attractiveness, and coherence. Behind the promises of Web3, a perception crisis is settling in.

Kazakhstan launches the Alem Crypto Fund to build a government-backed digital asset reserve, starting with BNB.

The crypto market finds bullish momentum again. Some altcoins benefit from massive short covering. Details in this article!

CME’s XRP futures have seen billions traded in just months as both institutional and retail traders show strong interest despite a stable price range.

James Wynn, the man who flirted with billions in crypto, now bets on ASTER… An airdrop, a 3x leverage, and a lot of boldness: hold-up or hara-kiri?

As euphoria fades more and more in the crypto market, Pi Network, already controversial, has just brushed a new historic low. Officially, the global context is to blame. However, technical signals paint an even darker picture: absence of rebound, low volume, indicators in the red. Doubt is setting in. Is Pi Network losing control of its trajectory?

What if October became Solana's month? Several spot ETFs with staking could be approved by the SEC within two weeks. A decision that could trigger a new institutional momentum and reshape the crypto landscape. But will this regulatory recognition be enough to propel SOL to a status comparable to Bitcoin and Ethereum?

Has Trump found the cure for plummeting cryptos? WLFI buys back its tokens burned with the financial blowtorch. A hastily botched operation or a finely tuned strategy? To be seen.

Solana records a historic high: 71.8 million SOL are engaged in futures contracts. This peak in open interest could suggest a rise in strength. However, the crypto drops 18% in one week, marking one of the worst market performances. This discrepancy between bullish speculation and price collapse raises questions: is the market fueled by excessive leverage?

Vitalik Buterin considers the Fusaka upgrade and its PeerDAS technology as a decisive turning point for the future of Ethereum. By revolutionizing blockchain data management, this innovation could well solve the complex equation between scalability and decentralization.

Ethereum falls below $4,000. Liquidations, ETFs outflows, but record accumulation behind the scenes. Complete analysis of the reversal.

BNB Chain seems ready to write a new chapter in its history. With ultra-low gas fees at 0.05 Gwei, a record perpetual volume of $51.3 billion, and massive developer adoption, Binance's ecosystem is putting all the odds in its favor to reach new heights and compete with Ethereum Layer 2 and Solana.

He posts a "gm" from his cell, the FTT token soars... and traders applaud! Who said crypto wasn't an open-air theater?