In the crypto industry, networking plays an increasingly decisive role. Technological advances matter, but human relationships and strategic partnerships often determine the success of a project. TOKEN2049 Singapore 2025 positions itself as the ideal space to create these connections. With 25,000 participants expected, the event will provide a unique environment where investors, entrepreneurs, developers, and decision-makers can meet. The Singapore setting, combined with more than a thousand side events and immersive experiences, will turn every interaction into an opportunity. TOKEN2049 thus promises a rare relational experience that could define the trajectory of many global Web3 players.

Article native advertising

From October 7 to 9, 2025, Madrid becomes the epicenter of blockchain innovation with MERGE Madrid, the must-attend event bringing together over 3,000 participants and 200 speakers from Europe and Latin America. This year, one player is determined to steal the show: Qubic (QUBIC), the blockchain boasting record-breaking performance and a disruptive vision combining artificial intelligence and decentralized computing.

Naoris Protocol, pioneer of decentralized post-quantum cybersecurity infrastructure, announces the appointment of Maria Lobanova as Chief Marketing Officer. This arrival, confirmed in September 2025, comes at a pivotal moment for the project, two months after the successful launch of its $NAORIS token in July 2025.

Cryptocurrency trading requires constant vigilance, responsiveness, and emotional discipline. Bybit EU has just reached a decisive milestone by launching a suite of AI-powered trading bots designed to turn any user into a professional trader, even while sleeping.

The tokenization of real assets (RWA - Real World Assets) represents one of the most promising sectors of the crypto ecosystem in 2025-2026. The integration of recognized assets on the blockchain through RWAs constitutes a significant innovation that is a central narrative of the 2024-2025 crypto season. In this dynamic context, Real Finance (REAL) positions itself as a major player by developing a complete infrastructure to facilitate the integration of real-world assets into the Web3 ecosystem.

In this complete guide, we detail the registration process on Bybit EU, the KYC (Know Your Customer) verification steps, and the exclusive promotional campaigns available in September 2025.

The tickchain Qubic (QUBIC) is making headlines with the launch of an ambitious marketing campaign in partnership with OKX, one of the largest crypto exchanges in the world. This initiative, endowed with an impressive budget, rekindles speculation about a potential listing of QUBIC on top-tier platforms.

The U.S. Securities and Exchange Commission is reviewing a groundbreaking proposal that could reshape how the crypto industry prepares for quantum computing threats. The SEC is reviewing a groundbreaking proposal aimed at preparing Bitcoin and the wider crypto ecosystem for the looming threat of quantum computing, signaling that regulators are taking quantum risks seriously as experts warn "Q-Day" could arrive as early as 2028.

Tokenized real estate takes on a new dimension with RealT, an innovative platform that disrupts traditional rental investment codes. By fractionating American real estate properties into digital tokens on blockchain, this company based in Florida and Delaware opens the doors of international real estate to all investors, regardless of their financial capacity.

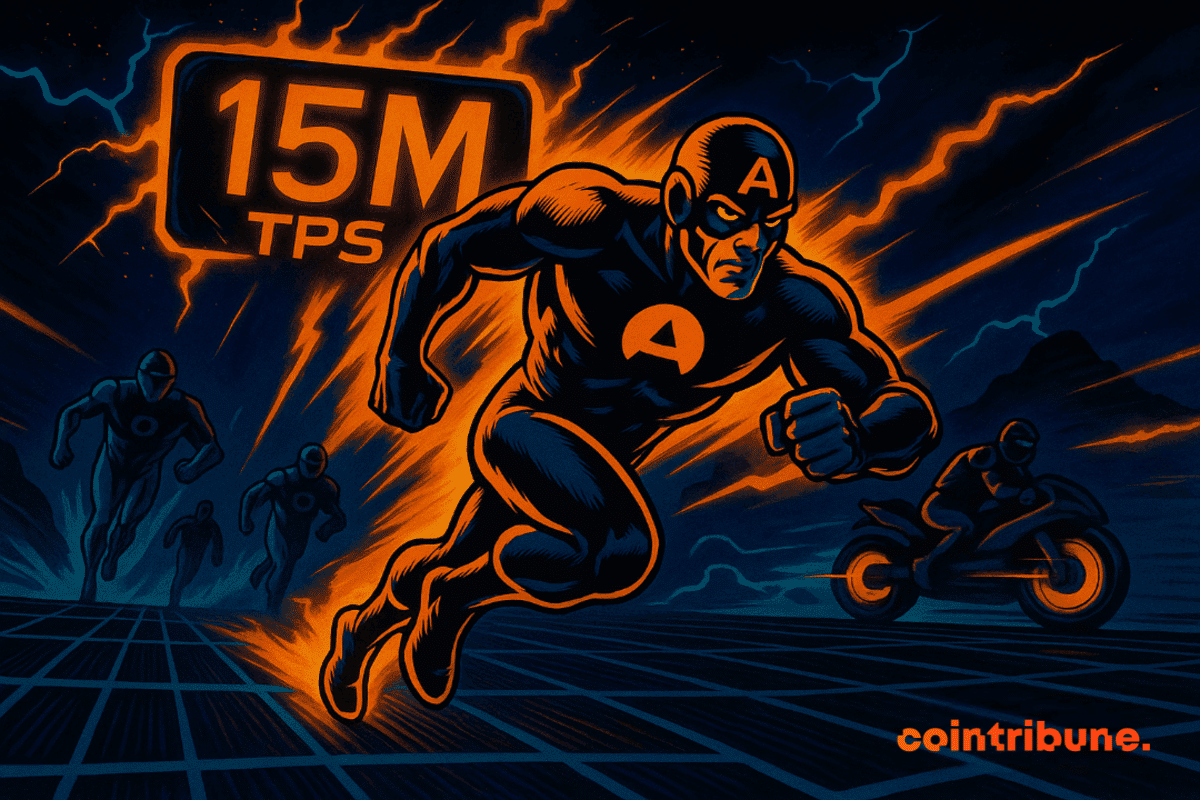

The Qubic blockchain is set to make its mark at Token 2049 Singapore, taking place from October 1-2, 2025. This participation represents a decisive milestone for the protocol that claims the title of "fastest blockchain ever certified" with an impressive throughput of 15.5 million transactions per second (TPS) and after a highly publicized demonstration of its UpoW technology on Monero.

The crypto ecosystem reaches a new milestone with the revolutionary announcement from OKX partnering with Tether to deploy USDT0 on its Layer 2 X Layer network. This major innovation, launched on September 9, 2025, redefines stablecoin interoperability and positions OKX as the essential exchange for the future of decentralized finance.

Real World Assets (RWA) represent one of the most promising evolutions of the crypto ecosystem. By tokenizing traditional physical assets, this sector builds concrete bridges between decentralized finance and the real economy, opening new investment opportunities accessible to all.

The announcement by NIST (National Institute of Standards and Technology) regarding the selection of the HQC algorithm on March 11, 2025, as the fifth official post-quantum cryptography standard resonates as a warning signal for governments worldwide. This decision formalizes what cybersecurity experts have predicted for years: the rise of quantum computers represents a major quantum threat, capable of challenging the current foundations of cryptography and encryption. In this race against technological time, Naoris Protocol emerges as the first decentralized infrastructure able to meet the specific needs of public administrations and critical infrastructures.

The crypto platform Finst officially enters the French market on September 9, 2025, promising to shake up cryptocurrency investing with ultra-competitive rates and a transparent approach. Founded by former DEGIRO executives and regulated by the Dutch Financial Markets Authority (AFM), this Dutch platform aims to democratize access to crypto-assets in France.

The tokenized real-world asset (RWA) market reaches a new milestone with Ondo Finance's groundbreaking announcement: the deployment of over 100 American stocks and ETFs directly on the Ethereum blockchain. This major initiative propels the ONDO token to new heights, flirting with the symbolic 1 dollar mark.nThe enthusiasm around Ondo Finance signifies a silent revolution redefining access to traditional financial markets. By eliminating intermediaries and offering 24/7 trading, tokenization fundamentally transforms how investors interact with traditional assets.nThis evolution is part of a broader movement where blockchain becomes the new standard for democratizing investment, from real estate with players like RealT to listed stocks with Ondo Finance. A breakdown of a sector that could well disrupt traditional finance.n

American crypto exchange Kraken has completed an ambitious tour of France with 21 stops across the country. Stated objective: move beyond major metropolitan areas to meet users in the regions. This unprecedented initiative reveals a deeper strategy for conquering the French market.

In July 2025, a Microsoft vulnerability exposed over 400 public organizations, including the U.S. agency that manages the nuclear arsenal. Hospitals paralyzed, schools ransomed, and a post-quantum deadline now set: 2025 reminds governments that they won't win the cybersecurity race with late patches and centralized architectures. Faced with this reality, one question emerges: how do we build a truly resilient trust infrastructure?

The financial results published on August 14 by Quantum Computing Inc. (QUBT) perfectly illustrate the current dynamics of the quantum sector. With revenues of $61,000 in the second quarter of 2025 and a gross margin of 43%, the Nasdaq-listed company continues its rise since the completion of its photonic chip foundry in Tempe, Arizona, last March. This industrial reality coincides with NIST's selection of the HQC algorithm on March 11, 2025, the fifth official post-quantum cryptography standard, confirming the urgency of the security transition.

REAL positions itself as the first Layer 1 blockchain specialized in the tokenization of real-world assets (RWA), with business validators integrated into the consensus and over 500 million dollars of assets already in preparation. This unique technical approach could revolutionize the institutional adoption of RWAs.

Crypto is good. Crypto + F1 + guaranteed gifts is better. OKX launches a campaign in Europe with McLaren that transforms your first trade (or referring a friend) into a free/complimentary official McLaren F1 Team cap and, for three lucky winners, into a VIP experience at the Netherlands Grand Prix in Zandvoort (August 29–31, 2025). Goal: to give you a tangible and fun reason to try OKX, with an exclusive gift, frictionless with clear rules.

A silent revolution is taking shape. As quantum computing becomes a reality, the very foundations of Web3 begin to tremble. Behind this invisible threat, a solution emerges: Naoris Protocol. A decentralized post-quantum cybersecurity infrastructure, it anticipates vulnerabilities that even nation-states fear. Its founder, David Carvalho, grants us an exclusive interview. An ethical hacker turned cyber strategist, he shares his vision, his technological choices, and his warnings. As the $NAORIS Token Generation Event (TGE) took place on July 31, 2025, a new paradigm is on the horizon..

Chainlink dominates real-world asset tokenization with major partnerships and growing institutional adoption.

An exceptional technical show of force is currently shaking the crypto ecosystem. Qubic now controls 58% of Monero's (XMR) total hashrate during its marathon periods, setting a new record of computational power while simultaneously proving that technical innovation and responsibility can coexist. This remarkable performance illustrates the unique capabilities of the Qubic network and its revolutionary vision of Useful Proof of Work.

The new generation decentralized wallet from Qubic offers users full control over their digital assets with enhanced security

Credefi launches its groundbreaking Platform 3.0 with xCREDI staking at 34% APY and permissionless RWA lending via Brickken.

On April 22, 2025, Qubic performed a public stress test on its live Layer-1 network and reached the incredible score of 15,520,000 transactions per second (TPS). The whole was independently verified in real-time by CertiK, one of the most respected security auditors in the industry.

Deep learning labs showcase models with a trillion parameters and mountains of GPUs, but each new breakthrough always demands more electricity and money. Qubic's Aigarth project raises a provocative question: what if the road to artificial general intelligence (AGI) did not go through ever larger data centers, but through millions of ordinary CPUs working together and evolving by themselves?

Qubic strives to transform its ultra-fast and fee-less Layer 1 into a dynamic economy of dApps, bridges, and DeFi primitives. But code doesn't write itself, and founders can't live on enthusiasm alone. To accelerate innovation, the project launched two distinct funding paths: one for profit-seeking startups, the other for public-interest infrastructure. Think of them as two parallel lanes on the same highway: both lead to Qubic’s mainnet, but each has a different engine, fuel, and technical team.

How an emerging blockchain reinvented mining, outperforms Monero in profitability, and paves the way for decentralized AI, all explained in simple terms for beginners.

Fifteen years ago, Bitcoin introduced Proof-of-Work (PoW): miners burned electricity solving mathematical puzzles; the fastest won new coins and, by extension, secured the ledger. It was brilliant, but the world has changed. Energy prices are rising, regulators monitor carbon footprints as much as blockchains, and AI labs complain about the lack of affordable computing power. In this context, the original PoW feels a bit like burning fuel to run an empty engine. Qubic offers a simple solution: since the electricity bill is already paid, let’s use that energy for tasks useful to society. The Useful Proof-of-Work (uPoW) still protects the chain, but miners earn their living by training AI models and merge-mining Monero with real value, then directly reinject the earnings into the Qubic economy.