Bitcoin slipped below $105K as concerns over U.S. regional banks grew, with analysts warning of a possible drop toward $98K amid market fear.

Theme Bitcoin (BTC)

Net asset values (NAVs) in digital asset treasuries (DATs) have plunged, signaling the end of what some analysts call the “age of financial magic.” Despite the downturn, market experts believe the correction could create opportunities for informed investors to secure long-term positions in undervalued Bitcoin-linked companies.

The ghost Satoshi watches his bitcoins melt by 20 billion. Still silent, still rich... How long will the king of silence let chaos reign without a word?

When others flee, Saylor whistles the purchase: a teaser, a chart, and there goes bitcoin ready to inflate its treasure. Strategy or poker?

While the crypto market was going through a period of marked instability, a statement from Donald Trump was enough to reverse the trend. By announcing a meeting with Chinese President Xi Jinping on October 31, during the APEC summit in Seoul, the American president triggered an immediate rebound in major cryptos. In a tense climate between the United States and China, this announcement was seen as a sign of easing, briefly rekindling investor optimism.

While traditional markets wobble under macroeconomic uncertainties, the crypto sphere is not spared, especially on the institutional investment vehicle side. This week, US spot Bitcoin ETFs experienced a massive capital outflow, exceeding one billion dollars in net withdrawals, a strong signal that does not go unnoticed by observers.

A recent analysis of blockchain developer activity has revealed a strong influx of new talent across major ecosystems, with Ethereum maintaining its dominance. The report, based on data from Electric Capital, highlights shifting developer trends and growing debates over how blockchain contributions are tracked.

Russia has become Europe’s leading crypto adopter with strong growth in institutional activity and DeFi usage.

Bitcoin reserves on exchange platforms have just fallen to their lowest level in more than six years. This massive, discreet but significant movement comes as the price falls below a key technical threshold. Is this a silent accumulation or a sign of mistrust? The indicator reignites the debate as volatility persists and positions on BTC weaken.

Prediction markets are now betting against bitcoin. On Polymarket, nearly 70% of bettors believe that BTC will fall below 100,000 dollars before the end of this year. A strong signal, as crypto has just undergone a brutal correction. This shift in market sentiment, driven not by analysts but by the investors themselves, raises questions: is the bullish trend already behind us?

Bitcoin ETFs record $536M in withdrawals in 24 hours. Are investors changing course? Complete analysis here!

Cryptos are going through a storm. Bitcoin plunges more than 9%, Ethereum loses 6%, and XRP tumbles 15% within a week. Behind this debacle, a persistent belief divides investors: will the legendary four-year bitcoin cycle seal the market's fate, or is it an outdated relic in the age of institutional adoption?

American regional banks plunge back into turmoil, reviving the specter of systemic instability. As markets react nervously, bitcoin retreats, but some already see it as an early sign. For players in the crypto sector, the asset anticipates a new liquidity crisis and upcoming monetary intervention.

Ripple accelerates while the market slows down. The company is preparing a raise of about $1 billion to accumulate XRP via a SPAC backed by a digital asset treasury structure (DAT). The timing is delicate: liquidations are piling up, Bitcoin falls, and Solana loses ground. However, the strategy is clear: stabilize the supply, speak to the corporate finance world, and expand crypto token usage in payments. Let's review the stakes.

Bitcoin miners are getting a brief reprieve after months of mounting pressure. At block height 919,296, the Bitcoin network recorded its first difficulty drop since June—a 2.73% decrease to 146.72 trillion. The adjustment offers temporary relief after a prolonged period of rising computational demand that pushed many miners to the brink.

Bitcoin may keep breaking records in 2025, but public enthusiasm is dangerously waning. Between falling Google searches and a drop in market sentiment, warning signs are multiplying. Have retail investors definitively turned their backs on the queen of cryptos?

While gold shines like never before, Peter Schiff brings out his anti-bitcoin refrain. What if this time, the crypto undertaker was (somewhat) right? To be continued...

This week, the bitcoin fear and greed index dropped to its lowest level in a year, plunging investors into uncertainty. This sudden decline fuels speculation: should one give in to panic or take advantage of this correction to accumulate at low prices? For Bitwise analysts, this fear phase could actually signal the start of a new accumulation cycle, thus offering a strategic investment opportunity in a volatile market.

On October 16, bitcoin sharply dropped below $108,000, disrupting an already fragile market. Such a sudden fall after a period of stability raises questions about the factors behind this destabilization. This event affects millions of investors and redefines crypto market dynamics.

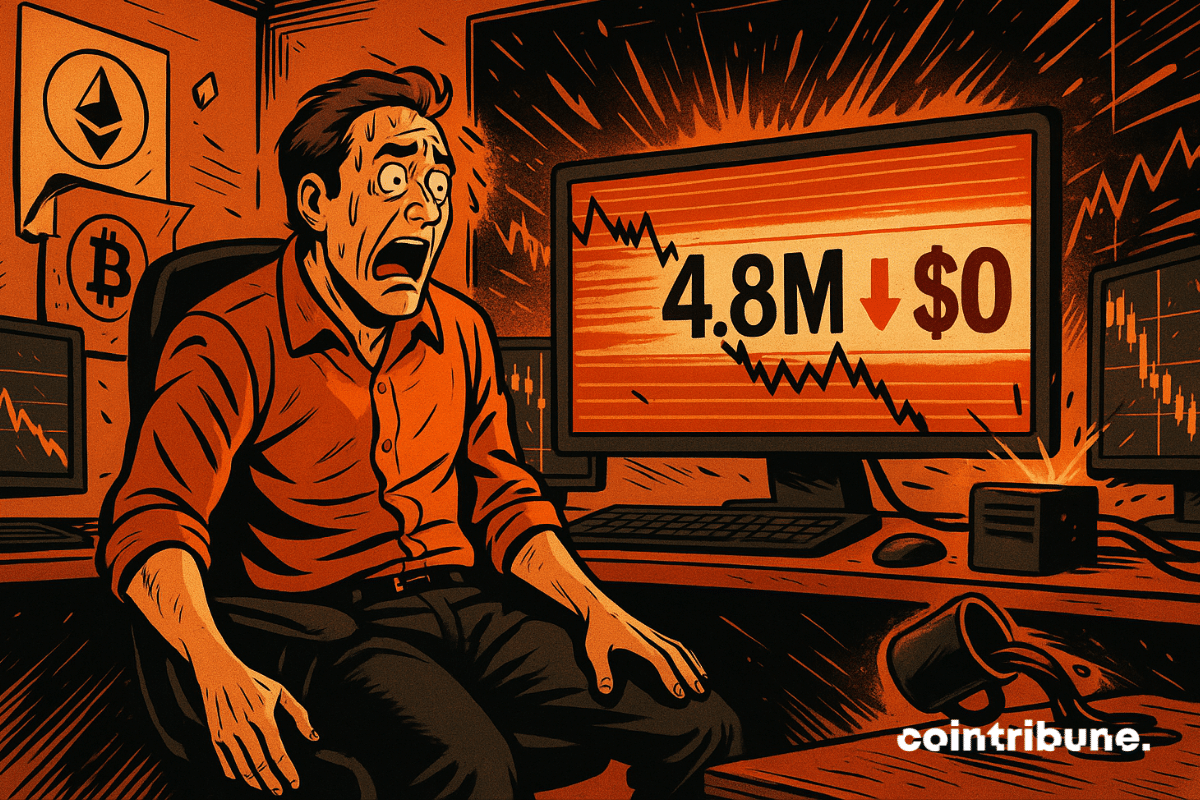

James Wynn lost $4.8 million in high-leverage crypto trades, continuing a pattern of risky bets that have made him a cautionary figure in the market.

In Q3 2025, bitcoin makes a big impact: 172 companies now hold 1.02 million, or 4.87% of the total supply. Why are these giants betting heavily on this crypto? Strategies, risks, and opportunities.

Donald Trump declared that the United States is in a trade war with China. This statement, made in Washington, marks an escalation of economic tensions. In the aftermath, the markets wavered. Bitcoin, particularly sensitive to geopolitical shocks, plunged. This declaration comes as the administration targets Chinese technological imports, directly threatening the mining industry. The American trade offensive now takes a strategic turn with immediate repercussions on the crypto ecosystem.

Bitcoin dropped as it approached its all-time high. In a few hours, the market erased several billion dollars, revealing once again its extreme volatility. Despite this marked correction, several analysts maintain a bullish scenario, estimating that this pullback does not call into question the underlying trend.

While the market is bleeding, Bitget releases a report: crypto investors still want to load up. 2025, a year of gains... or shocks?

Eric Adams, the self-proclaimed "Bitcoin Mayor" of New York, has just created the very first American municipal office dedicated to digital assets and blockchain. A bold move marking his exit before the scheduled January change of guard.

Faced with persistent inflation, geopolitical tensions, and unchecked money creation, investors are seeking solid refuges. Gold and bitcoin, long seen as opposites, now move in tandem. One is a millennial pillar, the other a digital outsider, but their curves converge at a historic level, reigniting the debate on bitcoin's role as digital gold.

As the global race for artificial intelligence accelerates, Elon Musk returns to the crypto spotlight. In a message published on X, the Tesla CEO presents bitcoin as a bulwark against the inflationary drift of fiat currencies, stating that it is "based on energy" and therefore immune to state manipulation. This stance puts the flagship asset back at the heart of international monetary debates.

U.S. Bitcoin and Ethereum ETFs saw a combined $755 million withdrawn as investors pulled back following a volatile weekend and rising market fear.

Crypto phishing explodes in 2025, even targeting official accounts like BNB Chain. Faced with this growing threat, SEAL deploys a solution: a transparent and tamper-proof reporting system. How could this innovation change the game for your digital assets?

After one of the steepest selloffs in crypto history, digital assets have begun to recover. A renewed wave of buying has lifted both memecoins and major tokens, driven by easing tensions between the U.S. and China and a rebound in overall market sentiment.