Gold and silver prices are rising, while the crypto market is collapsing! Are investors changing direction?

Theme Bitcoin (BTC)

The cryptocurrency market has been booming for some time now. And Bitcoin ETFs are at the heart of this dynamic. Financial giants such as Goldman Sachs and Morgan Stanley are increasingly interested in this new asset class. Discover how these institutions are investing massively in crypto-assets and the implications for the market.

Memecoins in free fall, Shiba Inu grits its teeth to stay afloat. Not the time to stumble!

The crypto market, known for its legendary volatility, has struck again. In a matter of hours, Bitcoin and Ethereum, the two largest cryptocurrencies in the market, saw their prices drop sharply, leading to a wave of liquidations that exceeded $175 million.

As digital markets continue to mature, a complex dynamic is beginning to emerge and disrupt traditional trading models: liquidity fragmentation. This phenomenon, far from anecdotal, could well redefine the rules of the game on major crypto exchange platforms, accentuating price disparities and increasing volatility.

In a market as unpredictable as that of cryptocurrencies, every fluctuation in economic indicators can trigger shocks of formidable magnitude. While some see Bitcoin as a safe haven against economic uncertainty, the reality of August 2024 once again demonstrates that this asset class remains profoundly sensitive to the headwinds of the global economy. In recent hours, the crypto market has been hit hard by a series of economic and institutional developments that have precipitated a brutal drop in prices.

The year 2024 will have been marked by notable fluctuations in the crypto market, but this has not dampened the enthusiasm of institutional investors for Bitcoin ETFs. Despite a 14.5% decrease in the asset's value during the second quarter, major financial players have shown remarkable resilience.

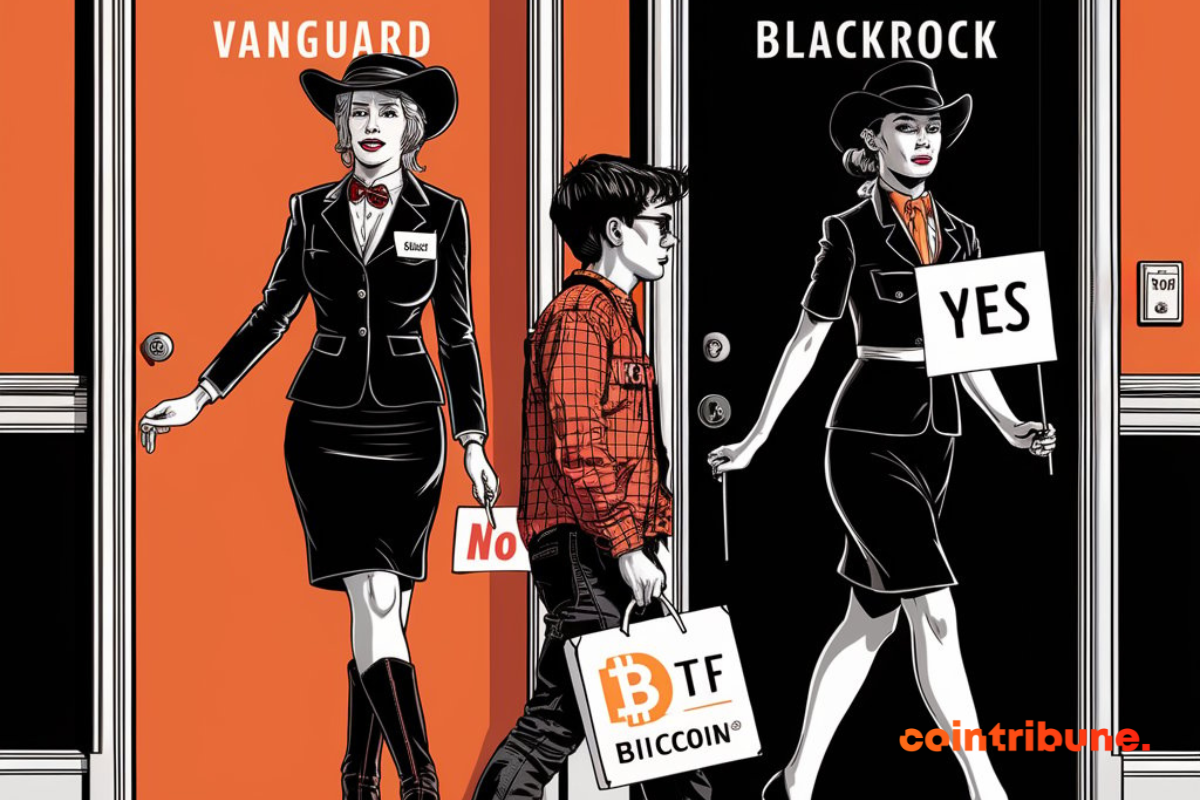

Vanguard on the crypto touch: "We do not copy BlackRock, nor their Bitcoin ETFs." There, it's said!

The crypto market is buzzing following the transfer of 10,000 bitcoins by the US government. This transaction, valued at nearly $594 million, raises questions about Washington's crypto strategy and its potential impact on the market.

While Bitcoin lags behind, stablecoins could well wake it up. But beware, nothing is ever certain.

Discover how CPI data influences the price of Bitcoin and investors' strategies in this volatile market.

Mt. Gox wakes up cryptos with a 2 billion bitcoin test. It smells risky.

Bitcoin shows its resilience with a quick recovery after a sharp fall! This, despite the persistent volatility in the crypto market.

While Bitcoin experienced a sharp drop on the first Monday of the month, it managed to rebound by more than 27% in the following days. Let's analyze together the future prospects of the BTC price.

A historic investment of $1.6 billion to develop El Salvador's "Bitcoin City"!

Amid revolutionary announcements, technological advancements, and regulatory turbulence, the crypto ecosystem continues to prove that it is both a territory of limitless innovations and a battleground of regulatory and economic challenges. Here is a summary of the most significant news from the past week regarding Bitcoin, Ethereum, Binance, Solana, and Ripple.

Bitcoin is collapsing, ETFs are following. Investors are desperately looking for signs of recovery in this financial turmoil.

With $60,000 found, Bitcoin doesn't seem ready to stop. Optimists are already talking about $300,000. Do you believe in it?

In this month of August, where market volatility in cryptocurrencies is at its peak, there are still over 20 days left to identify and seize the best investment opportunities. While some assets are stabilizing, others are showing signs of potential rebound. This article examines five cryptocurrencies to watch closely, analyzing recent developments and prospects that could turn this month into a key period for savvy investors.

The crypto market is in turmoil. Today, a $2.5 billion expiration of Bitcoin and Ethereum options is set to violently shake the markets after an already eventful week. This major event could redefine current trends and influence investors' decisions. Let's dive into this impending storm and analyze its possible repercussions for the crypto universe.

Bitcoin shows a nice increase of 6% in the last 24 hours and is leading the way in the crypto market recovery!

The cryptocurrency market, often unpredictable, has just experienced a new shock with a significant drop in Bitcoin. While some see this decline as a rare opportunity, others believe that it would not be wise to bet on such a volatile currency.

The Dow Jones and Nasdaq plunge, VIX climbs. Tourism and technology sectors in total disarray.

Poutine has just signed a historic bill for crypto mining in Russia. We tell you everything in this article.

Hackers launch an attack on the Olympics: ransom demanded in cryptocurrency. The Grand Palais and other tourist sites threatened.

Michael Saylor currently holds 1 billion dollars in Bitcoin! This has sparked strong reactions in the crypto community.

As the price of Bitcoin experiences a significant drop, data reveals a surprising trend: the number of addresses holding more than 0.1 BTC is nearing a new all-time high, indicating persistent confidence among small investors.

The International Monetary Fund (IMF) and El Salvador are moving towards an agreement to mitigate the risks associated with the adoption of Bitcoin as legal tender. These talks, focused on strengthening public finances and financial stability, could lead to a program supported by the IMF.

The cryptocurrency market is down 25%: here are the trends and outlook for crypto investors!

Markets have fallen historically in recent days. Are we heading towards a new descent into hell, or will the Fed lower its rates and launch a new stock market boom?