The boundary between traditional and decentralized finance continues to erode. This time, it is BlackRock that is shifting the lines. The global asset management giant has connected its tokenized fund BUIDL, backed by US Treasury bonds, to the Uniswap infrastructure. An initiative that goes beyond simple technological experimentation, as it materializes the entry of a major institutional player onto the operational rails of DeFi.

BlackRock

U.S. spot Bitcoin exchange-traded funds (ETFs) showed signs of stabilization on Friday after several days of sustained selling pressure. The rebound was led by BlackRock’s flagship product, even as the broader crypto market continued to experience sharp price volatility. While inflows returned, recent data indicate that investor sentiment remains cautious, with market participants closely monitoring ETF flows for signals on near-term direction.

Bitcoin plunges into the abyss, but BlackRock acts as savior with its ETF, displaying record volumes. Coincidence or strategy? Investors cling, hoping for an unlikely recovery.

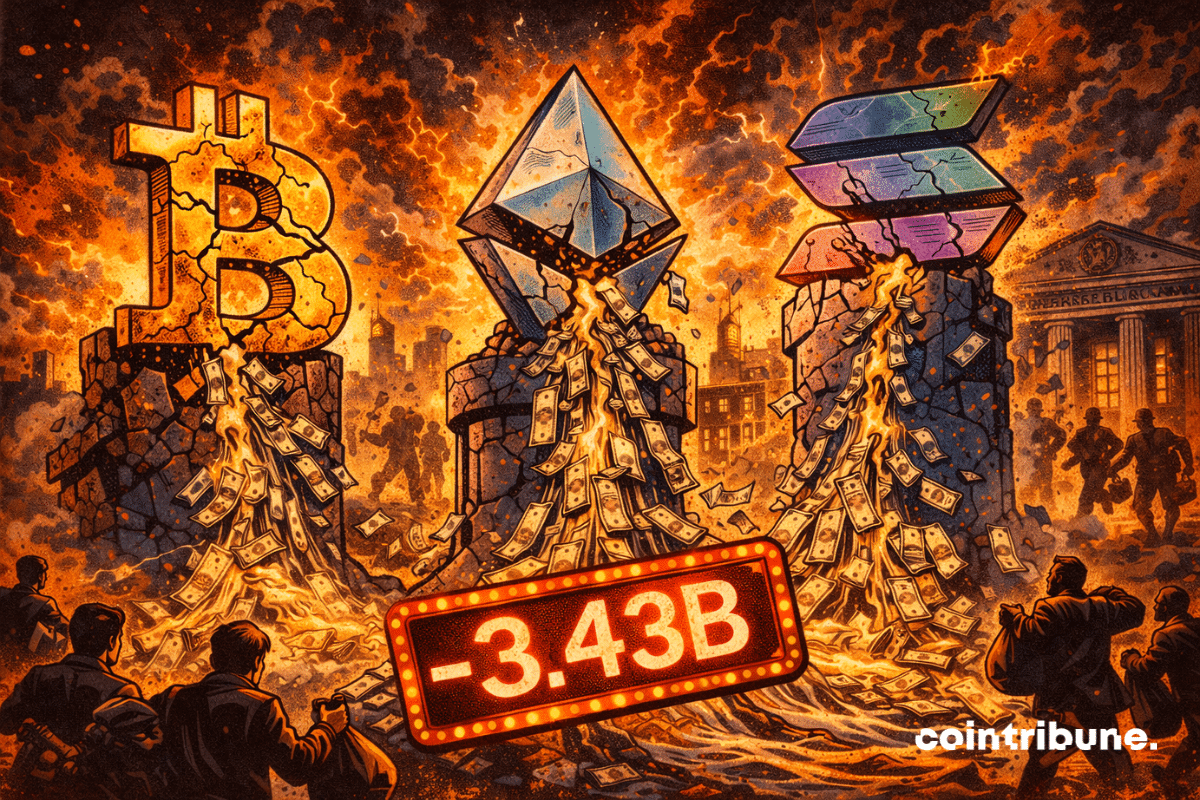

Panic among crypto traders: capital is evaporating, the Fed is frowning, and even bitcoin is coughing. A chill wind is blowing across the blockchain world.

The IBIT ETF records historic losses after Bitcoin's drop. We provide all the details in this article.

Institutions are betting big on Avalanche to tokenize their assets. The network records a spectacular growth of 950% in one year, driven by BlackRock and other financial giants. Yet the AVAX token continues to collapse. How to explain this paradox?

BlackRock’s 2026 Thematic Outlook positions Ethereum as core financial infrastructure rather than a speculative asset. The report frames the network as a potential “toll road” for tokenized assets—capturing value through issuance, settlement, and transaction fees as real-world assets move onchain. For investors, the central question is whether growth in tokenization activity can translate into durable economic demand for ETH.

A stablecoin backed by BlackRock, a crypto ecosystem in superapp mode… what if Jupiter was preparing the discreet invasion of the dollar into our decentralized wallets?

BlackRock’s BUIDL fund has delivered $100M in dividends and grown beyond $2B, marking a milestone in tokenized money market funds.

Bitcoin plunges, IBIT takes off, and BlackRock cashes in. A contrarian strategy turning an ETF into a billion-dollar magnet. Skeptics laugh, but the numbers respond.

BlackRock transfers 2,196 BTC to Coinbase Prime. A decision that could shake the Bitcoin market. Details here!

BlackRock discovers Ethereum staking and joins the yield banquet. But who is really dining at the table? The investor, the institution... or the tax authorities watching?

Larry Fink, CEO of BlackRock, acknowledged a change of stance on bitcoin. Long critical of cryptos, he now says he has revised his strategy. At the DealBook Summit organized by the New York Times, he mentioned a notable evolution in his perception of the asset. A symbolic shift, which also reflects the gradual adjustment of the institutional view on cryptos.

BlackRock argues that tokenization is becoming a defining trend in global finance, with real-world asset adoption surging and the industry entering a new phase of digital transformation.

The second largest American bank officially opens its doors to Bitcoin. Bank of America now recommends its wealthy clients allocate between 1% and 4% of their wealth in crypto. A strategic shift marking a decisive step in institutional adoption.

Heavy withdrawals hit BlackRock’s flagship Bitcoin ETF in November, but company executives say the activity reflects normal market behavior, not a shift in long-term sentiment. Momentum from earlier in the year continues to guide the firm’s outlook, supported by the strong demand that once pushed IBIT toward a major milestone.

The crypto market rebounds: ETFs fill up, BlackRock frowns, Solana hesitates. What if whales knew the weather before everyone else?

Flash crashes, digital dominos and states lying in wait: the IMF sees tokenization less as a revolution than as an explosive cocktail ready to blow up finance... but hush, it's bubbling.

After months of tension, BTC finally crosses $90,000, offering unexpected relief to BlackRock Bitcoin ETF holders. How does this historic rebound redefine the crypto investment landscape? Dive into the analysis of a turnaround that changes everything for institutional and retail investors.

The global cybersecurity market is projected to reach $345 billion by 2026, yet traditional security models continue to fail spectacularly. The recent Balancer protocol incident, which saw $128 million drained in under 30 minutes through a mathematical rounding error, exemplifies a fundamental problem: centralized security architectures create single points of catastrophic failure. As quantum computing advances threaten to render current encryption obsolete within the decade, a new economic model for digital security is emerging, one where trust itself becomes a tradeable, measurable commodity.

Bitcoin as a global payment rail? For BlackRock, this is clearly not the core issue. For now, clients of the world’s largest asset manager mainly play the digital gold card, not the everyday currency one.

Uptober fizzled out, November bleeds: $3.79 billion gone, Bitcoin stumbles, Solana rejoices… What if the BlackRock giant just pressed where it hurts?

Bitcoin ETFs are attracting capital again: simple rebound or bearish trap? We deliver the details in this article.

BlackRock takes a staking cure for its Ethereum: a developing ETF that promises yield for large portfolios. Crypto, meanwhile, continues to trot towards Wall Street.

BlackRock’s BUIDL Token Gains Institutional Traction as Binance Expands Support

Harvard made major moves in its investment portfolio by sharply increasing its Bitcoin and gold ETF holdings.

A former BlackRock executive has just thrown a wrench in the works. For him, Ethereum will not be just another blockchain. This network will actually become the digital backbone of all global finance. A bold vision as crypto has just lost a key support at 3,600 dollars.

Bitcoin explodes in ETFs with $524M in 24h: simple rebound or massive return of institutions? Complete analysis here!

Bitcoin was supposed to take off after the US budget chaos. Result? ETFs on strike, Solana showing off... and investors biting their nails, eyes fixed on December.

Growing attention to the long-delayed Fort Knox audit has reignited debate between gold and Bitcoin. Binance founder Changpeng Zhao (CZ) has once again joined the discussion, questioning gold’s verifiability while responding to long-time critic Peter Schiff. Rising interest in tokenized gold and continued market uncertainty have added fresh momentum to the conversation.