Solana shines, Ethereum wobbles: 7,625 new talents for the former, Asia at the top and India shines in a borderless crypto world.

Theme Blockchain

The American elections have always represented a global symbol of democracy and stability. However, in the digital age, they face unprecedented challenges, exacerbated by technological developments and threats to the integrity of electoral processes. Recently, Nevada has been at the center of a major controversy related to accusations of "fake voters" during the 2020 presidential election. Although these accusations were dismissed, they highlighted critical flaws in the electoral certification system. In the face of this crisis of confidence, the state of Nevada made a bold decision by choosing blockchain technology to ensure the security and transparency of its elections. This adoption, hailed as a major advancement, aims to anchor electoral certifications in an immutable ledger, making any attempt at falsification practically impossible.

CCFD-Terre Solidaire is innovating by now accepting donations in cryptocurrencies, combining modernity and solidarity.

The world of cryptos and tokens is constantly evolving, and for those looking to embark on this adventure, the new book by Alexander Rees-Evans, "How to Launch a Token: An Essential Guide for the Uninitiated", is an indispensable resource. This practical guide, published by Springer, offers an in-depth dive into the necessary steps to successfully launch and manage a crypto token.

Eric Trump, son of American president Donald Trump, recently expressed his belief that traditional banking systems are outdated and that crypto and blockchain technologies will soon surpass them. In a recent interview, Eric Trump highlighted that blockchain technology can perform all the functions of modern banking systems, but in a more efficient, faster, and cost-effective manner.

On December 5, 2024, Bitcoin (BTC) crossed the symbolic milestone of $100,000 for the first time. However, analysts believe that this consolidation around this level will not last long. According to Nick Forster, bitcoin remains a "meme asset" with "psychological barriers" that attract attention and generate volatility. Should we expect an imminent drop?

Russian President Vladimir Putin recently signed a major law concerning cryptocurrencies, marking an important step in the regulation of digital assets in Russia. This new legislation officially recognizes cryptos as property and allows their use in foreign commercial payments.

Wecan Chain, a powerful API designed to simplify businesses' integration with blockchain, is now open to the public. Wecan Chain provides an intuitive and reliable gateway to blockchain technologies. Its goal is to democratize access to the benefits of blockchain while masking the technical complexity, thereby enabling businesses of all sizes to transform their data management and business processes.

Discover the investment potential and unique features of ETNY tokens in our detailed analysis.

Discover how Ethernity Cloud applies the circular economy to revolutionize cloud computing.

Discover how Ethernity Cloud is revolutionizing the market with its decentralized rating system.

Discover how Ethernity Cloud ensures continuous availability with a robust and cost-effective infrastructure.

Discover how Ethernity Cloud's decentralized DNS enhances security and privacy on the Internet.

Discover how Ethernity Cloud utilizes cutting-edge technologies for optimal protection of your personal data.

Discover how Ethernity Cloud is revolutionizing cloud computing with enhanced security and decentralized data management.

Memecoin or useful blockchain? Changpeng Zhao insists: it is time for crypto to create real value. The details!

Voracious staking, audacious Dencun: Ethereum teeters on the inflationary precipice. Between vision and chaos, the future is being written under tension.

On November 22, Solana (SOL) reached a new all-time high of $264.31, marking impressive resilience two years after the collapse of FTX! This 11% increase in 24 hours reflects renewed investor confidence in the Solana crypto ecosystem.

Sui, "killer" of Solana? Perhaps, but surely not of failure. A technical pause of two hours... at least.

In crypto, Ethereum is a bit like that talented marathon runner always stuck in its shoelaces at the starting line.

Tectum, the fastest layer 1 blockchain, has launched its Light Node, an innovative tool for the development and management of custom tokens. This solution promises to simplify developers' interactions with the decentralized crypto network, while offering increased efficiency compared to full nodes.

Bitcoin reaches $90,000 and long-term holders are taking profits. However, can BTC really reach $100,000?

The crypto market in Russia will reach 10 trillion rubles by 2026! Here is the element that will change everything.

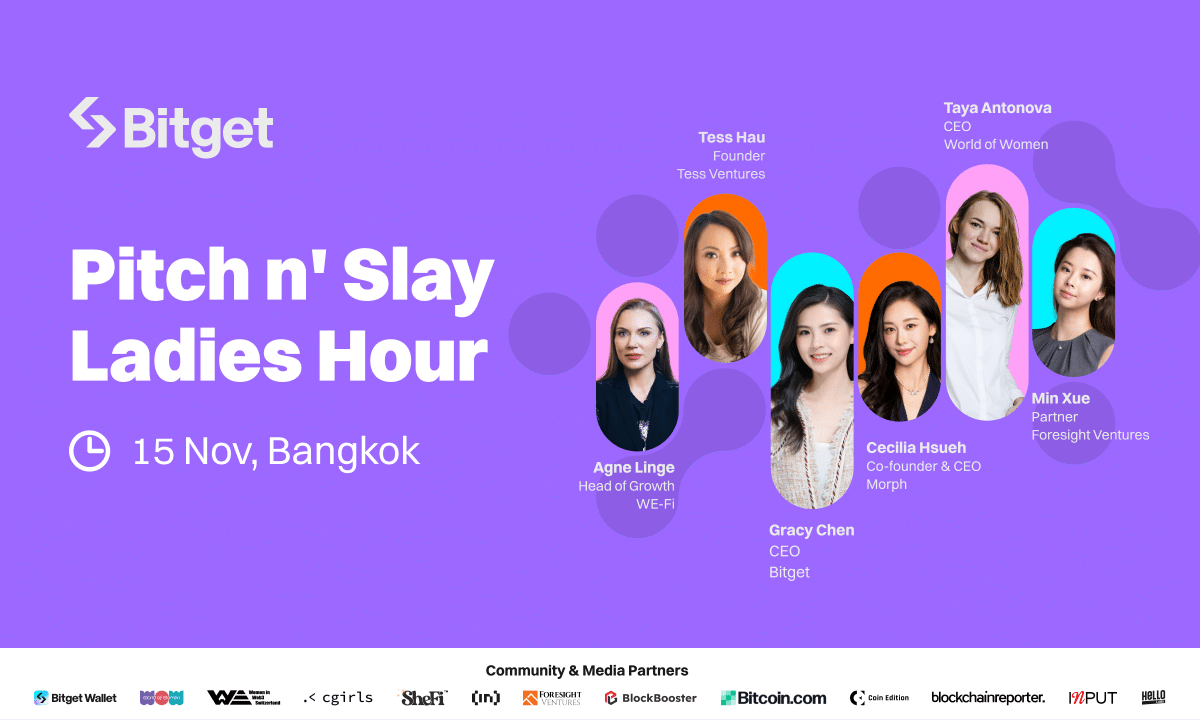

Bitget, the leading cryptocurrency exchange and Web3 company, proudly announces its upcoming “Pitch n' Slay” event at DevCon Bangkok on November 15, 2024, as part of its Blockchain4Her initiative. This exclusive event will empower female founders in Web3 by providing essential resources such as funding, mentorship, media exposure and a global platform to amplify their innovative projects.

If you have just started to explore the world of Bitcoin, you have surely come across various technical terms that are difficult to understand. Today, we will discuss Proof of Work, the consensus mechanism that ensures the security of Bitcoin. But you are probably wondering: How does it work? Discover in this guide all the inner workings of the most widely used validation mechanism in cryptographic systems.

The entire technology surrounding the Bitcoin ecosystem continues to fascinate us. Every element and feature is important for ensuring the proper functioning, security, and decentralization of the network. This is the case with the hashrate, which is a measure of the total computational power required by the Bitcoin network to validate new blocks. The hashrate is essential for the Bitcoin mining process. But what exactly is it? How does it work? And above all, what is it used for?

Victim of its success, the Bitcoin network faces congestion problems: cryptocurrency transactions take longer to be validated and fees are higher. It is in this context that Segwit came into being, bearing the improvement proposal number BIP141. This is a soft fork of Bitcoin that helps to address the scalability of the network. In addition to improving the performance of the ecosystem, this upgrade has also brought better security to transactions. But how does Segwit actually improve the BTC blockchain? We explain everything in this comprehensive guide.

The Bitcoin blockchain is a distributed ledger technology that underpins the first and most iconic cryptocurrency: Bitcoin. Since its creation in 2009, it has sparked global interest, challenging our conception of money and transactions. With its growth, debates have intensified around its environmental impact and its ability to scale without compromising its principles of decentralization. This article reveals the mechanisms of the Bitcoin blockchain, clarifying its complex functioning and practical implications for users and society as a whole.

Bitcoin, with its decentralized architecture, has revolutionized the world of blockchain. However, its operation relies on considerable electricity consumption, raising questions about the sustainability of this system. This article explores the energy mechanisms of Bitcoin and examines the factors influencing its electricity consumption. It assesses the environmental consequences of Bitcoin's energy consumption and discusses potential solutions for a greener future.

Bitcoin Diamond (BCD) is one of the major blockchain projects that emerged following a hard fork of Bitcoin (BTC). It was designed with the aim of overcoming certain challenges faced by its predecessor. In this article, we will examine the history, functionality, and potential benefits of BCD. Finally, we will explore how Bitcoin Diamond could evolve and develop in the future within an increasingly competitive cryptocurrency market.