Binance plans to move its primary user protection fund from stablecoins into Bitcoin within the next 30 days, marking a major shift in how the exchange backs emergency safeguards. The transition will convert the Secure Asset Fund for Users (SAFU) entirely into Bitcoin, reflecting what company leadership describes as long-term confidence in Bitcoin’s role in the digital economy. Critics and industry observers warn that increased exposure to Bitcoin’s price volatility could weaken user protections during periods of market stress.

BNB (BNB)

Binance founder Changpeng Zhao (CZ) has issued a stark warning about the future of work as artificial intelligence spreads across industries. He argues that rapid AI adoption will erase millions of jobs worldwide. Against that backdrop, Zhao believes cryptocurrencies can serve as financial protection for those who prepare early.

The crypto ETF dance does not slow down. It changes tune. After Bitcoin and Ethereum, now the market attacks more "political" tokens, more linked to ecosystems, thus more sensitive to regulators' scrutiny. And Grayscale, true to its style, does not timidly knock on the door: it files a dossier and forces the conversation.

On January 14, 2026, BNB Chain activates Fermi, a major update reducing block times to 250 ms. A revolution for transactions and DeFi? Discover the technical details, the impacts for users, and the forecasts for the BNB price. A breakthrough that could change everything in the crypto ecosystem.

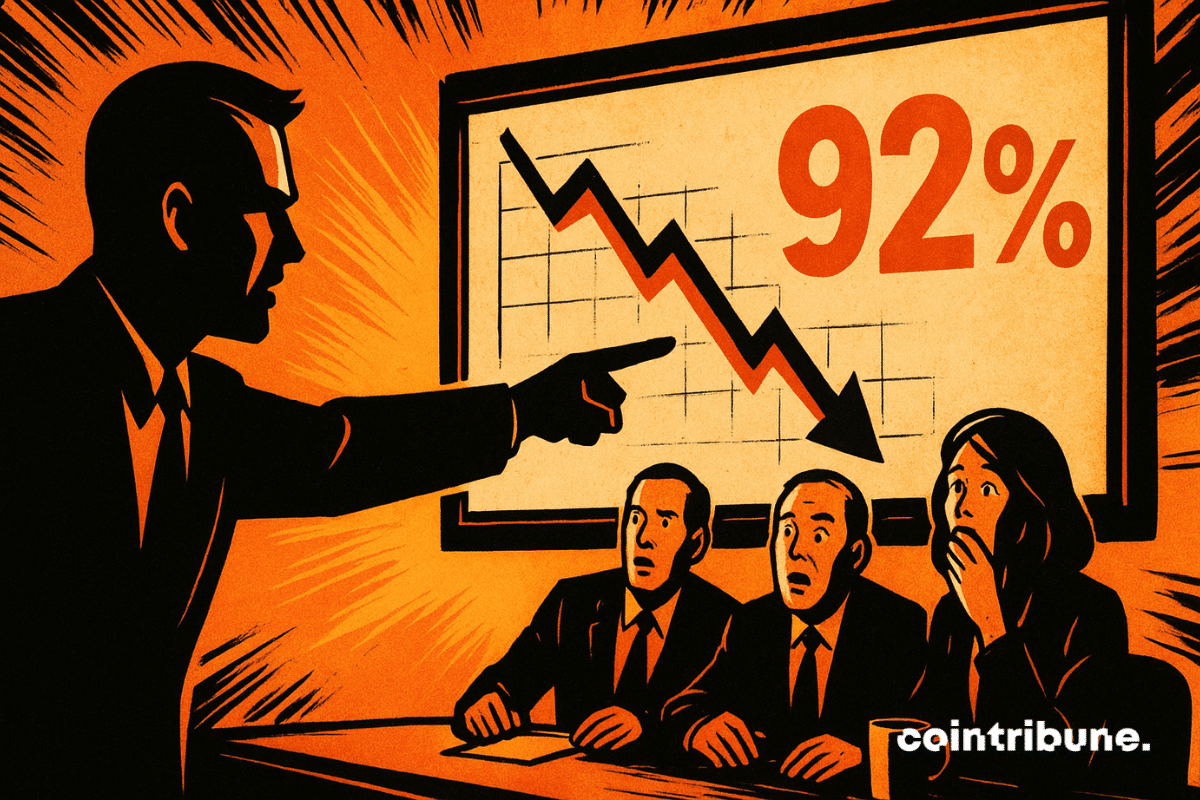

Changpeng Zhao and his investment company YZi Labs come out swinging against the management of CEA Industries, accused of letting the BNC stock price collapse by more than 90%. This offensive marks a turning point for the future of this treasury company dedicated to BNB. Will shareholders follow CZ in this battle to regain control?

While Bitcoin nears the highs, XRP quietly courts Wall Street with its ETFs... What if the real crypto maneuvers are played far from the spotlight? To watch.

Coinbase has deepened its involvement in BNB Chain activity by adding Aster (ASTER) to its listing roadmap. According to market chatter, the exchange’s decision to broaden its coverage is driven primarily by growing interest in BNB Chain–linked assets. Following this recent development, attention has turned to Aster’s market trajectory and the renewed focus from Changpeng “CZ” Zhao.

Aster, a decentralized perpetuals exchange, surged over the weekend after Binance founder Changpeng “CZ” Zhao revealed a personal investment of more than $2 million in its native token. His entry into the project reignited market excitement, drawing investors back to the fast-growing DeFi platform and reaffirming his lasting influence over digital-asset markets.

Donald Trump granted a pardon to Changpeng Zhao, former CEO of Binance, reigniting debates on the links between political power and the crypto industry. In a context of increased regulation, this act raises questions about the growing influence of platforms in the public sphere. The decision, confirmed by the White House, triggered an immediate market reaction and revived tensions around conflicts of interest between the political sphere and financial technologies.

BNB, Binance's flagship crypto, finally makes its debut on two of the largest American platforms: Coinbase and Robinhood. Long excluded from the mainstream US markets, often for compliance reasons, the asset crosses a major strategic threshold. Now listed on platforms accessible to millions of investors, BNB gains formal recognition that contrasts with its past as an asset confined to the Binance ecosystem. This shift says a lot about the evolution of the American crypto market and the gradual normalization of certain long-controversial assets.

The BNB crypto just plunged 15% in a few days, triggering panic and speculation. Between technical divergences, community backlash, and Binance's 400 million fund, a burning question arises: is this a simple correction or the start of a collapse?

Coinbase is preparing to list BNB, the flagship token of its historic rival Binance. Such an unexpected gesture contrasts with past tensions between the two giants. In a climate of enhanced regulation and strategic repositioning, this decision could mark a turning point in the power dynamics of the sector. Calculated opportunism or signal of appeasement? This rapprochement intrigues as much as it raises questions.

In addition to the $283 million distributed on Monday, Binance offers an additional 400 million dollars to support crypto traders after the recent crash. A marketing move or a desperate maneuver to restore investor confidence after the fiasco?

After one of the steepest selloffs in crypto history, digital assets have begun to recover. A renewed wave of buying has lifted both memecoins and major tokens, driven by easing tensions between the U.S. and China and a rebound in overall market sentiment.

As the crypto market collapses, BNB hits a record at $1,370. Discover all the details in this article!

BNB’s latest rally has pushed the token to new highs, sparking strong reactions from market leaders and investors. With growing adoption across DeFi, gaming, and on-chain trading, analysts view the rise as more than just a price move—it signals deepening network strength and credibility.

The crypto market is recovering after last Friday's flash crash. Ethereum, BNB and Dogecoin fueled this spectacular rebound, while companies like BitMine took the opportunity to strengthen their positions. Can bitcoin still aim for 200,000 dollars this year?

The speculative euphoria driving memecoins on the BNB Chain was abruptly interrupted. Within a few hours, several popular tokens saw their value plunge by more than 30%, causing a widespread retreat and cascading liquidations. This sudden correction, which occurred amid tension surrounding the launch of Meme Rush by Binance, caught part of the market off guard and rekindled questions about the long-term viability of these volatile assets.

YZi Labs announced a $1B fund to support developers building projects on the BNB Chain, aiming to foster innovation and growth.

On the BNB Chain, a few days were enough to turn modest bets into lightning-fast fortunes. Driven by meme coins launched in a chain and propelled by social virality, a new speculative wave is shaking the ecosystem. Between dizzying returns and community excitement, the episode reveals both the excesses and the attractiveness of a network that has become the favorite playground of traders.

BNB has just shaken up the crypto market hierarchy. By surpassing XRP, Binance's native token settles in third place worldwide, just behind Bitcoin and Ethereum. This rapid progression intrigues as much as it impresses. While the figures confirm a strong momentum, this rise raises questions about its legitimacy and sustainability.

BNB touches the heights while the US government stalls. Record, Kazakh investors and low-cost transactions: Binance fears neither shutdown nor speculation. A crypto that doesn't fall asleep!

BNB Chain has restored control of its official X account after a phishing attack briefly misled users with fake reward links. Although limited in scale, the breach is the latest reminder of the growing threat of scams targeting crypto communities. Losses were contained, but the event comes amid a broader rise in phishing-related thefts across the industry.

Kazakhstan launches the Alem Crypto Fund to build a government-backed digital asset reserve, starting with BNB.

BNB Chain seems ready to write a new chapter in its history. With ultra-low gas fees at 0.05 Gwei, a record perpetual volume of $51.3 billion, and massive developer adoption, Binance's ecosystem is putting all the odds in its favor to reach new heights and compete with Ethereum Layer 2 and Solana.

Usually September bleeds, this time bitcoin smiles: +8%. But behind the miracle, the Fed pulls the strings and the crypto ecosystem holds its breath.

On September 13, Binance Coin (BNB) crossed a symbolic threshold by briefly surpassing the market capitalization of the Swiss bank UBS. Such an event illustrates the rising power of cryptos against traditional financial institutions. Changpeng Zhao, co-founder of Binance, immediately reacted, calling on banks to "adopt BNB". As the crypto reaches a new all-time high, this statement revives the debate about the integration of native tokens in banking strategies in the era of decentralized finance.

BNB surged to $909 following Binance’s collaboration with Franklin Templeton, as analysts anticipate further gains and strong market momentum.

A BNB whale fell victim to a $13.5 million phishing attack on Venus Protocol. The platform paused operations, but the stolen funds were later recovered.

B Strategy is launching a $1 billion BNB treasury to actively grow the Binance ecosystem, leveraging U.S. listing and Asia-Pacific support.