Bitcoin is heading into October with traders eyeing its seasonal track record for momentum. Market participants coined the phrase “Uptober” to describe the month’s history of outsized gains, and attention now turns to whether 2025 will continue that trend. After a modest September, investors are weighing past performance against current conditions to judge whether the final quarter could spark another rally.

Bull

While Bitcoin makes headlines, the discreet BNB is climbing quietly. An ATH that tastes of revenge? A crypto that works while others act like stars!

When ETFs fill up like broken pockets and bitcoin breaks through the ceiling, traditional markets wonder: have cryptos become acceptable to the suit-and-tie crowd?

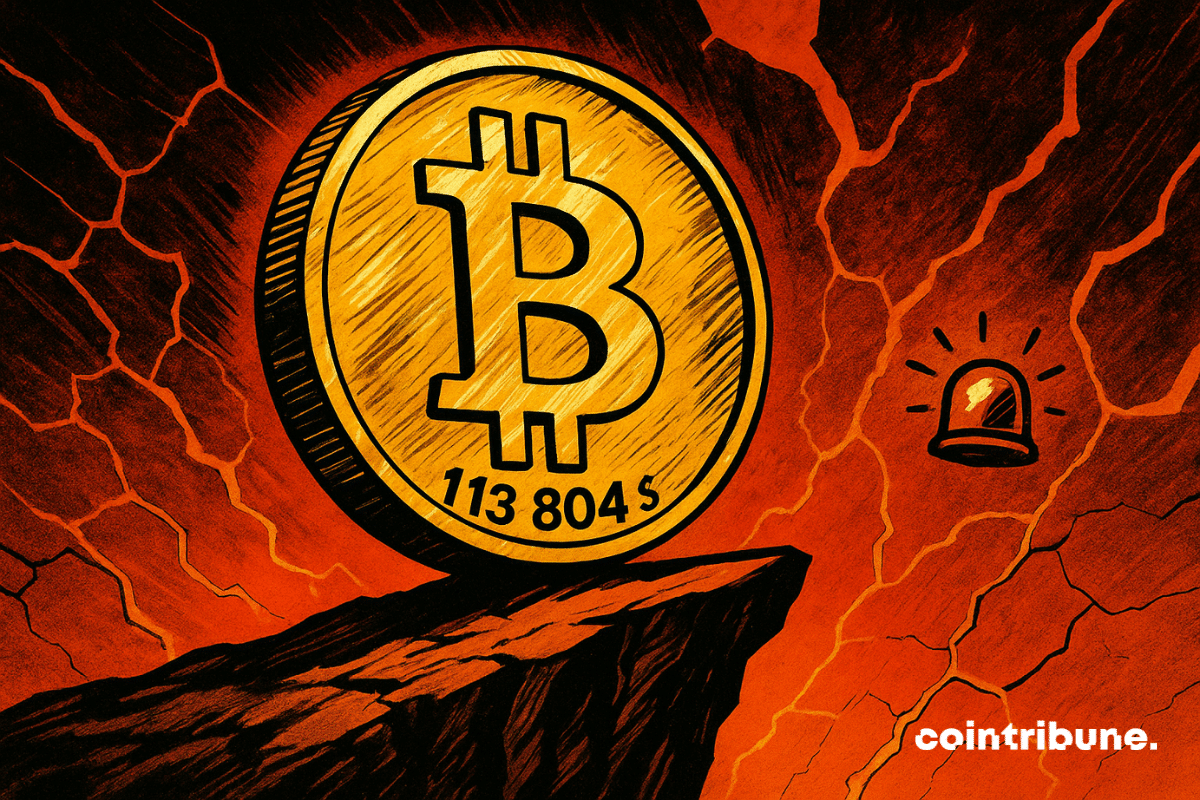

While Trump dreams of tariffs and inflation recedes, Bitcoin rises... but how far? At $113,804, the oracles are stirring and the short-sellers are biting their nails.

No one bets on a campfire when the rain is falling. Yet, NFTs continue to crackle, even in the downpour. While trading volumes shrink quarter after quarter, sales are holding firm: $2.82 billion collected in the first half of 2025. Fewer dollars per transaction, but more hands are reaching out. The market is no longer frantic; it breathes differently, calmer, denser. And that might be the best news crypto has had in months.

Although Bitcoin is shaking up the markets and gradually establishing itself as a pillar of modern finance, it remains curiously discreet in the columns of major traditional media. In the second quarter of 2025, while crypto reached a new historical peak, its media presence was revealed to be meager. This absence is all the more striking as it does not reflect either the intensity of its adoption or the economic upheavals it brings about. The latest report from the Perception firm presents a clear observation: Bitcoin is unsettling, and some prefer not to talk about it!

The world of French tech is reaching a new milestone. Sequans, a specialist in IoT semiconductors, chooses Bitcoin to strengthen its financial strategy. A rare, bold decision that carries significant meaning in the current economic context.

When Changpeng Zhao, aka CZ, takes to the pen — or rather his keyboard — the crypto ecosystem listens carefully. On June 7, 2025, the former head of Binance struck again with a tweet that was both provocative, ironic, and full of meaning, merging the echoes of Winston Churchill's speeches with his own philosophy of "HODL." The result: a powerful message that encapsulates the mindset of millions of crypto investors around the world.

There are stories that one buries with lawsuits, maximum security prisons, and forgotten headlines. Then there is bitcoin, this red thread that one never really cuts. In June 2025, a transaction of 300 BTC, equivalent to 31 million dollars, lands in the wallet of Ross Ulbricht, creator of Silk Road, the legendary black market of the darknet. The catch? This windfall comes from a wallet linked to AlphaBay, its notoriously infamous successor. The past has not said its last word. It returns... in encrypted form.

Bitcoin is walking a tightrope between bulls and bears. If $110,000 gives way, it's champagne; otherwise, the options expire, along with the illusions.

Bitcoin has once again shaken up the market. By surpassing the $105,000 mark, the iconic crypto has returned to levels it hasn't seen since January. This surge, accompanied by a rise in the major altcoins, reignites speculation: is it just a technical rebound or the start of a new bullish cycle? In a rapidly changing geopolitical context, as investors regain their appetite for risk, signals are multiplying... but their interpretation remains uncertain.

At the tumultuous intersection of spirituality and speculation, a cryptocurrency named LUCE defies conventions. As the Vatican mourns the death of Pope Francis, this meme token, inspired by the mascot of the Holy Year 2025, emerges as a modern paradox. Between prayers and algorithms, the crypto community stirs, turning a sacred event into a financial playground. How could a simple cartoon trigger such a profane frenzy?

Bitcoin, often compared to a digital gold rush, is taking a decisive step. Imagine: 79 companies now hold nearly 700,000 BTC, equivalent to a treasure estimated at 57 billion dollars. These figures reflect not just an accumulation of assets, but a profound shift in investment strategies. Far from fleeting speculation, Bitcoin is establishing itself as a key piece in the reserves of economic giants. A silent but explosive revolution.

Bitcoin ruthlessly crushes the hopes of Ether. The ETH/BTC ratio has just hit its lowest level in five years, at 0.02193. A staggering drop of 39% in one year. For the first time since a halving, Ether is bending under the weight of its elder. What is behind this historic reversal? Between being a safe haven in the face of macroeconomic turbulence and the repositioning of investors, Bitcoin consolidates its status as a safe-haven asset. A deep dive into the mechanics of an unequal duel.

The storm is rumbling in the crypto market. This Saturday, the charts display an alarming red: bitcoin plunges below $84,000, Ethereum wavers around $1,880, and XRP crashes by 5%. A brutal correction, but not entirely unpredictable. Behind these numbers lie complex dynamics, where on-chain data and macroeconomic factors intertwine. Analysis.

The halving, once the war drum of the bull market, has fallen silent. In the silence, Bitcoin seeks a new rhythm in a crypto market that dances differently.

The bitcoin market enters a pivotal day with the expiration of $16.5 billion in options, a record that could shape its short-term trajectory. While the $90,000 mark seemed within reach, an unexpected pullback has weakened bullish positions, providing sellers with a strategic opportunity. In this battle between buyers and sellers, the outcome will depend on price movements in the coming hours, with potential impacts far beyond this single expiration. The market holds its breath, ready to tilt one way or the other.

In the arena of cryptos, Solana plays the gladiators. Despite a turbulent sea, it withstands, shines, and aims for a peak that could very well shake the skeptics.

As cryptocurrencies reshape the boundaries of finance, the United States takes a historic step. The Bitcoin Act of 2025, submitted to the House of Representatives, proposes to create a strategic reserve of one million BTC over two decades. A bold maneuver, blending financial innovation and geopolitical vision. Far from being a simple accumulation of digital assets, this project embodies a strategic realignment in the face of digital gold. Explanations.

Yesterday, surrounded by four gray walls and the clinking of bars, Sam Bankman-Fried blew out his 33 candles. A celebration far from the golden trappings of his FTX days, but under the spotlight of a scandal that still shakes the crypto world. Sentenced to 25 years in prison, the former golden boy of cryptocurrencies provides, from his cell, a version of his story where innocence and political calculation intertwine.

The consolidation phase of Bitcoin seems to be coming to an end. While recent fluctuations have not disrupted retail demand, the enthusiasm of retail investors remains palpable. Several signals indicate that a trend reversal could be imminent, offering new bullish prospects.

While Bitcoin and Ethereum have paved the way for ETFs, it is now Solana that is set to write a new chapter. The SEC has just ignited an unexpected fuse: the agency has started the countdown for the approval of a Solana ETF. A decision that reeks of gunpowder, as it contrasts sharply with its hostile past. But behind this turnaround lie issues far deeper than just a simple regulatory green light.

The cryptocurrency market has recently witnessed extreme volatility, marked by a significant drop in Bitcoin (BTC) followed by an equally spectacular rebound. This sequence of events led to massive liquidations, reaching $1.18 billion! Leaving many investors perplexed and worried.

Bitcoin, this cryptocurrency with growing popularity, intrigues as much as it divides. For Jamie Dimon, CEO of JPMorgan, this digital currency has no place. His criticisms have echoed for years in the financial sector. Yet, his viewpoint raises questions: why is he so harsh, and what does his argument really rest upon?

Cryptos continue to captivate the attention of the financial world, but the true players in this market often lurk in the shadows: the whales. These investors with colossal resources influence trends and open new paths. This time, it is in the realm of AI-based tokens that an anonymous whale has struck hard, raking in 11.5 million dollars in less than three weeks.

Chartism is a graphical analysis technique of financial markets. Widely used in crypto trading, it is an essential decision-making tool. Will this digital currency rise or fall? When is the right time to buy or sell? Let’s discover everything there is to know about this analysis method in the crypto market.

It's $100,000 or nothing! A deadline of $13.6 billion could catapult Bitcoin into uncharted territories.

The year 2024 could become a key milestone in the history of bitcoin, with projections placing this famous cryptocurrency beyond $80,000. As November quickly approaches, analysts and experts see clear signs of an imminent explosion in macroeconomic indicators and graphic trends. What are the underlying causes, and what should we…

When Bitcoin rises, traders tremble: the golden beast ascends, but the shadow of the bears is never far away.

Innovations in artificial intelligence continue to astonish, but not all serve noble intentions. This October, the cybersecurity company Cato Networks reveals an AI tool named ProKYC, designed to bypass KYC (Know Your Customer) security measures in cryptocurrency exchanges. This tool opens the door to new forms of fraud, at the…