After the ECB and the Fed, it's the turn of the Chinese central bank to significantly ease its monetary policy. What impact will it have on the stock market and Bitcoin?

Chine

The recent announcement of China's massive economic stimulus plan could propel Bitcoin's price to new historical highs. As Beijing injects colossal liquidity into its economy, analysts anticipate a significant impact on the crypto market, with BTC at the forefront.

Despite a general ban on cryptocurrencies imposed in 2021, China maintains its grip on the Bitcoin mining industry. A recent analysis reveals that the country still controls 55% of the global hash rate, even outpacing the United States.

Cryptocurrency underground trading in China reached $23.7 billion in 2024, despite increasing government crackdowns.

In an increasingly tense global economic context, China has just issued a significant strategic advisory for its electric automotive manufacturers. As the undisputed leader in electric vehicle production, China has made a major strategic decision. Beijing has advised its manufacturers to abandon any intention of investing in India and Turkey, two promising and rapidly growing markets.

When 134 countries play sorcerer's apprentices with CBDCs, it is 98% of the global economy that enters a zone of digital turbulence.

Canada has just added fuel to the fire. The announcement of a 100% customs tariff on electric vehicles (EVs) imported from China, including Tesla models made in Shanghai, by Prime Minister Justin Trudeau is a decisive step in the trade policy of his country. This decision comes amid rising tensions between the world's major economic powers, where each new tariff measure risks causing major upheavals in financial markets and further complicating diplomatic relations.

The internationalization of the yuan is progressing much faster than the figures from the Swift organization suggest. Bitcoin is lying in wait.

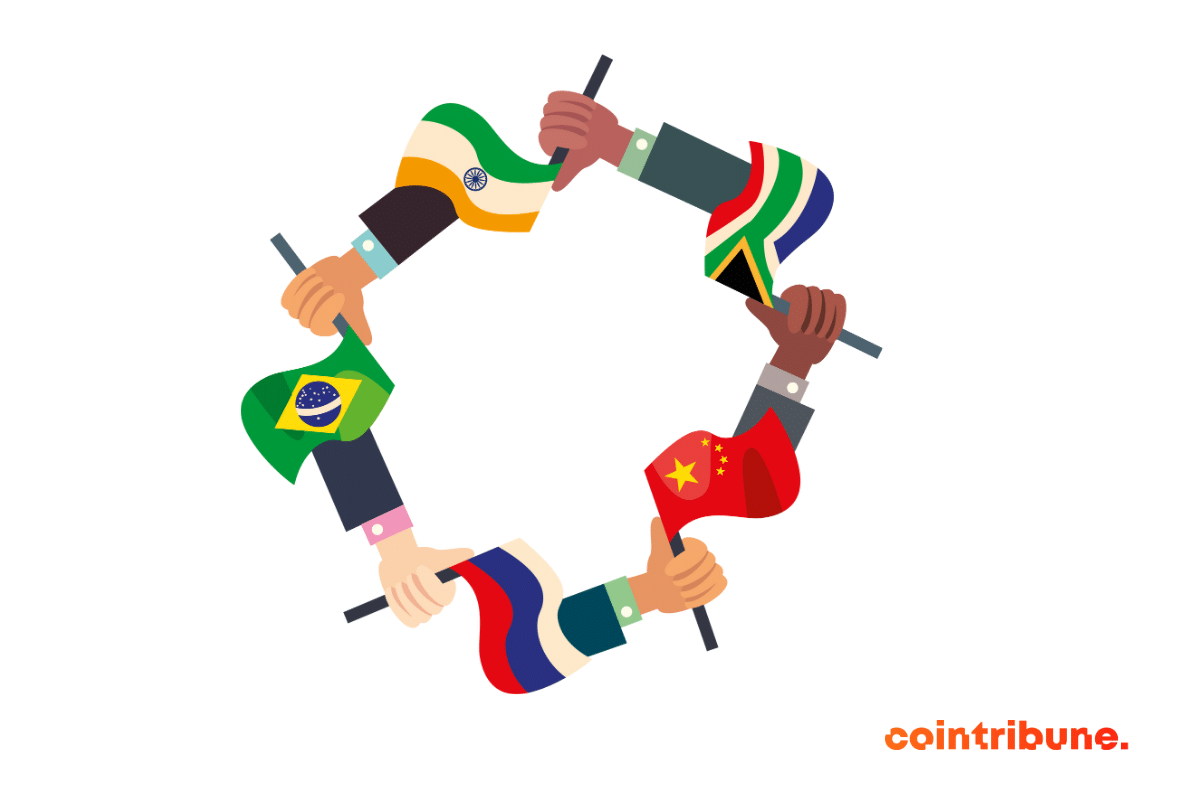

The international monetary system is in turmoil. The BRICS are exploring various avenues with varying degrees of success.

Discover how Fortune 500 companies are adopting blockchain and why the United States risks falling behind?

The Chinese central bank has significantly slowed down its gold purchases in recent months. Is this the beginning of a strategic shift? What about bitcoin?

Beijing and Bangkok will de-dollarize their trade by promoting their national currencies. With CBDCs? What about Bitcoin?

Infrastructures, real estate, AI… Beijing is expanding the tentacles of its finance in Europe, to consolidate its economic dominance!

The Wall Street Journal reports that the United States is preparing to cut Chinese banks off from the dollar. This financial bombshell would be a boon for bitcoin.

Stock market turmoil: Tesla reduces its global workforce by over 10%, with main impact in the United States and China.

The monetary influence of BRICS is increasing day by day. The latest news reports that the Chinese currency, the yuan, has surpassed the dollar as the most used currency in Russia. This change aligns with the alliance's desire to reduce their dependence on the American currency.

ETF Bitcoin are coming to China, to Hong Kong. Reuters suggests they could arrive as soon as next week.

During her visit to China, US Treasury Secretary Janet Yellen sounded the alarm about the massive subsidies granted by Beijing to its industry. These aids could destabilize the global economy by leading to production overcapacity.

The SEC's approval of Bitcoin ETFs could unlock things in Asia. It is rumored that Hong Kong will give the green light before June.

Chinese finance starts 2024 on fragile footing, with an uneven recovery despite efforts deployed!

A killer bill for the American bitcoin industry has made its way to the US Congress. Are we on the brink of a new exodus?

Nexity's CEO reveals the challenges facing an unprecedented crisis, involving a quick adaptation to turn the situation around.

Striking contrast: stagnant Chinese market, booming Indian market. High valuation of India raises concerns.

The most important emerging nations are abandoning the dollar. The next international reserve currency will be Bitcoin.

Cryptocurrencies in China: despite the ban, the threat of money laundering is growing, prompting crucial legislative revisions.

The Chinese economy, facing uncertainties, is turning to cryptocurrencies despite the bans. The digital future is being written.

China finds itself at the heart of an economic storm of rare intensity. Indeed, the Middle Kingdom has seen no less than $6 trillion evaporate in two years, a staggering figure that prompts questions about the drastic measures taken in response. Among these, the ban on short selling is seen as a radical decision. Get ready for a journey into the heart of finance, where economic dragons battle against headwinds with armor made of greenbacks and sharp regulatory swords.

The BRICS do not skimp on the implementation of their strategy to escape the economic domination of the US dollar. The alliance's monetary projects are attracting attention, especially the massive funds they are injecting to acquire significant amounts of gold.

The American bank JP Morgan believes that the Chinese yuan could take over the crown of hegemony in the financial markets from the dollar. In 2023, the currency of the Middle Kingdom has continued to gain importance. This situation benefits the BRICS, of which China is one of the most influential members.

Iran has recently called on the BRICS to establish a common currency to replace the dollar. This challenge to the dollar by Iran, but also increasingly by Saudi Arabia, explains why the Americans want to put an end to the Iranian regime. The end of the petrodollar would no longer allow the United States to finance its monstrous deficits through other countries.